The Invisible Hand of Irrational Exuberance.

FOR IMMEDIATE RELEASE

Diagnostic and Prognostic:

Fiscal Policy:

Also called Keynesian stimulus has found its limit as people and financial markets become wary of further deficits and, more importantly, powerful vested interests oppose it.

Monetary Policy:

That also has reached its limit with short-term interest rates close to zero in every developed economy. Central banks will find it difficult to decrease it lower than what they call the zero lower limity. The so called 'quantitative easing', which have pumped trillions of liquidity that can't find their way into real investment. If they were we would witness some sort of inflation which we don't. It raises the question: What several trillion dollars more will do that 2 trillion dollars didn't do. Will people accept another round of these obviously unjust measures? The last non conventional monetary policy tool, devaluation of the currency, has also already been exhausted.

What can yhey do the Japanese couldn't during the last decade, which is now 17 years old, when faced with a milder local collapse of the economy?

How could we know how effective is the monetary policy? The Federal Reserve System decided on March 23, 2006, 9 month before Goldman Sachs decided to pull back from Mortgage Bond Securities market, to terminate the publication of the single most important measure of the effectiveness of its actions: the M3 measure of money supply or the quantity of liquidity it injects that gets transformed into long-term investments.

Symptoms:

Long-term yields go down as they have since 1981. At some point they will be so low as not to reward the investor for interest-rate risk. Sooner or later he will prefer cash at 0% interest rate rather than any lon-term investment: it is the crash.

Long-term trend of the Yields of US Treasury Bonds:

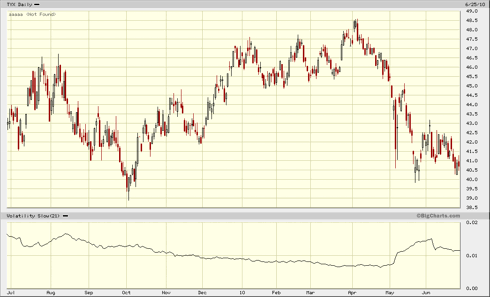

Short-term trend of the Yields of US Treasury Bonds:

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).