Financial crises are characterised by discontinuous breaks in market pricing the timing of which by definition must be unanticipated - if people see them coming, then the markets arbitrage them away.

I have explained that long term yields are options or short-term yields. A normal yield curve is such that these long-term yields get their fair value. However because these options are complicated to arbitrage, banks are structural lenders (it is their job after all) and of Quantitative Easing, which aggravated this inversion, recently, on Wednesday 25th, August these low long-term yields became unsustainable.

Even a Pig can Get Fed Up, Eventually!

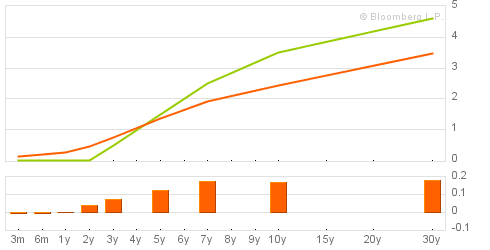

and the expected yield curve on Sept. 17th (green).

In fact the green yield curve is not exactly normal. I expect

that a switch from long-term assets toward liquidity will make

short-term yields go below their normal configuration.

But what they perceive as newly abundant liquidity can readily disappear. Any onset of increased investor caution elevates risk premiums and, as a consequence, lowers asset values and promotes the liquidation of the debt that supported higher asset prices. This is the reason that history has not dealt kindly with the aftermath of protracted periods of low risk premiums.

Although these yield curves can stay for an extended time below the normal yield curve [undervalued], and sometime extremely so. But once the process of normalization has started it can revert to its normal configuration quick as for any arbitrage. [It is the reason that a restrictive monetary policy is almost impossible to implement smoothly and while ineffective at the start of its implementation it generally ends with a rout of bonds and the stock market (1987).]

Note: that increase in bond yields is not caused by any macro economic event but only by the fair valuation of an option. It is very probable that with dismal economic figures we still witness that yield increase.Our day-by-day experiences with the effectiveness of flexible markets as they adjust to, and correct, imbalances can readily lead us to the conclusion that once markets are purged of rigidities, macroeconomic disturbances will become a historical relic.

However, the penchant of humans for quirky, often irrational, behaviour gets in the way of this conclusion. A discontinuity in valuation judgement, often the cause or consequence of a building and bursting of a bubble, can occasionally destabilize even the most liquid and flexible of markets. I do not have much to add on this issue except to reiterate our need to better understand it.

With 11 trading days to go we would need on average to gain 10 basis points on the Yield of 10 Years US treasury Notes and 10.5 basis points on the 30 Years US Treasury Bonds.

Technical Analysis:

After the Hammer we had on Wednesday 25th, August expect a dowmfall

This will have very dramatic consequences.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).