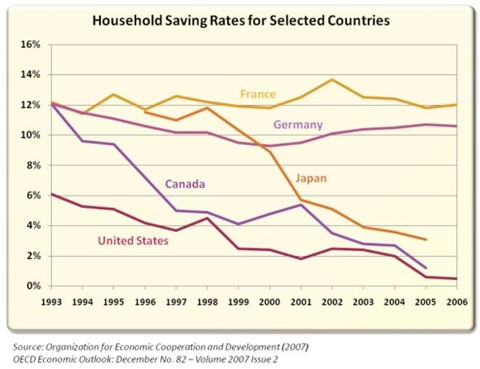

The U.S. is the country in the developed world with the lowest savings rate. Canada and Japan are trying to keep pace. Germany and France have social programs which allow for more savings. We may come in last in savings, but no other country in the world can spend like us. Our motto is live for today, the government will bail me out in the future.

click to enlarge images

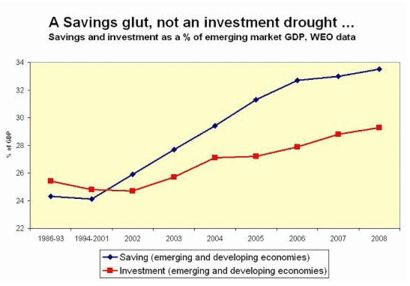

We have outsourced our savings to the emerging economies, along with our manufacturing jobs. The Chinese are saving the money we’ve paid them for flat screen TVs and the Middle Eastern countries are saving the money we’ve paid them for oil. You need savings in order to increase investment. The emerging markets are making the vast majority of the investments in the world. While the U.S. endlessly debates drilling and construction of nuclear plants (none built in U.S. since 1987) and oil refineries (none built in U.S. since 1977), China brought four oil refineries online in 2008 and plans to build 30 nuclear reactors in the next twelve years. The Asian Century has begun, but the U.S. has tried to keep up by using debt. It will not work. If anything, this has accelerated the shift of power to Asia.

Source: Creditwritedowns.com

The last thing that anyone thought would result while watching the Twin Towers collapse on September 11, 2001 was the greatest housing boom in the history of the world. When a country goes to war, it usually asks its citizens to sacrifice.

“I have nothing to offer but blood, toil, tears, and sweat. We have before us an ordeal of the most grievous kind. We have before us many, many months of struggle and suffering.” (Winston Churchill – May 13, 1940)

In the true spirit of Winston Churchill, President Bush could have paraphrased Churchill by saying: I have nothing to offer but tax cuts, tax rebates, 0% auto financing, and no-doc mortgages. Americans grieved for a few weeks and then did their patriotic part by buying everything they could get their hands on. As Alan Greenspan denies causing the housing crisis today, his words from November 2002 come back to haunt him, “our extraordinary housing boom…financed by very large increases in mortgage debt, cannot continue indefinitely into the future.” After making this statement, he proceeded to slash the discount rate to 1% in June 2003 and left it at that level for a year. This began the positive feedback loop:

1. The Federal government cut taxes and sent rebates to all Americans.

2. The Federal Reserve cut interest rates to 1%.

3. Government officials urged Americans to spend in order to defeat terrorism.

4. Alan Greenspan told people that adjustable rate mortgages were a good thing.

5. Congress and President Bush believed that everyone should own a home and pressured lenders to provide mortgages to low income people.

Next Page 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).