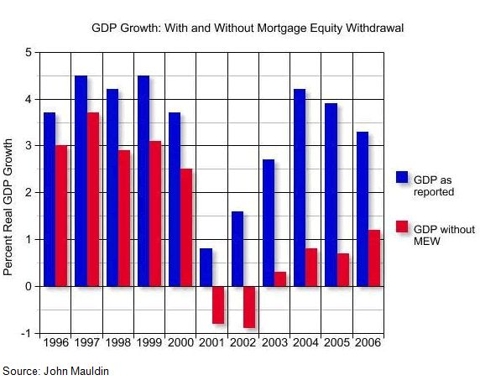

Source: John Mauldin

Negative Feedback Loop – UnderwayThe pseudo-wealth that has been created in the last seven years has begun to unwind, but will increase in speed in 2009. You only know how you’ve lived your life over the last seven years. Your neighbor who has been getting their house upgraded, sending their kids to private school, driving a BMW, and taking exotic vacations may have been living the high life on debt. As usual, Warren Buffet’s wisdom comes in handy.

“Only when the tide goes out do you discover who’s been swimming naked.”

The tide is on its way out, and the naked swimmers are numbered in the millions. Mohamed El-Erian, the number two man at PIMCO, fears a negative feedback loop consuming the country. I believe we have begun the negative feedback loop and it is starting to accelerate. The stages are as follows:

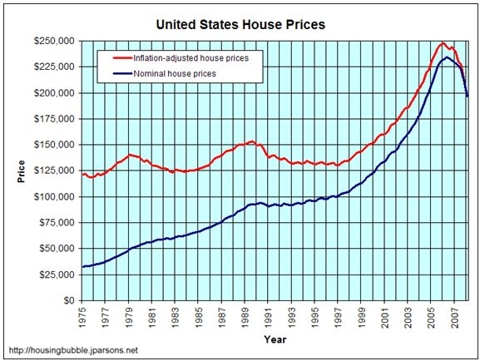

1. Home prices reached an unsustainable level in 2006. Prices had gone parabolic between 2001 and 2006, with the average price reaching above $225,000. In 2001, prices were just above $125,000. As the pundits keep looking for a bottom in housing, the chart below clearly shows there is a long way to go.

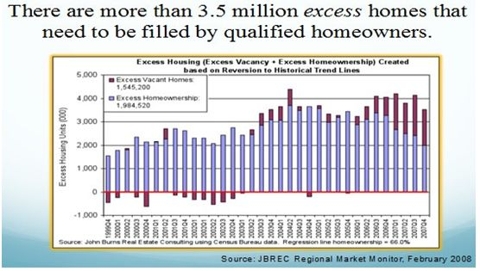

2. The massive overbuilding based on false demand has led to 3.5 million excess homes in the U.S. based upon historical trends. The most shocking fact is that there are 2.5 million vacant homes. This oversupply can only be corrected by massive price decreases.

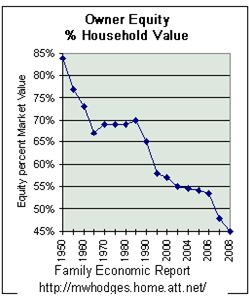

3. With the tremendous price increases in houses over the last decade, you would think that equity would be at all-time highs. But no, owner equity as a percentage of house value has reached an all-time low of 45%. People have sucked the equity out of their homes and spent it faster than the prices were rising. The problem is that house prices can and will fall, debt remains like an anchor around your neck until paid off or it drags you down into bankruptcy.

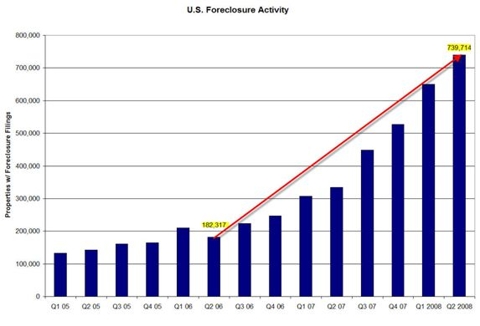

4. The millions of exotic mortgages (subprime, alt-A, ARMs, no-doc, and negative amortization), which have started to blow up, has led to a tsunami of foreclosures. In 2005 there were less than 600,000 foreclosures in the U.S. In the 1st two quarters of 2008 there have been more than 1,350,000 foreclosures, with the pace accelerating. Approximately 15% of all subprime mortgages and 7% of all Alt-A mortgages are in delinquency. According to UBS, 27.2% of subprime mortgages originated in 2007 by Washington Mutual are in delinquency. Washington Mutual is the poster child for how not to run a savings and loan.

Source: MBA

5. The combination of oversupply, over-leverage, and foreclosure tsunami has now taken on a life of its own. Home prices have been spiraling downward for two years to the point where 29% of all households that purchased in the last five years owe more than their house is worth according to Zillow, the home valuation company. For those who bought in 2006, 50% have negative equity. It is now making economic sense for people to just walk away from their house and send the keys to the lender. This is referred to as ‘jingle mail’.

Next Page 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).