6. The ongoing housing price decreases are now affecting prime mortgages, home equity loans, and home equity lines of credit. Prime mortgages for less than $417,000 had a delinquency rate of 2.44% in May, up 77% from last year. Prime jumbo loans over $417,000 had a 4.03% delinquency rate in May, up 263% from last year. According to the ABA, 1.1% of all home equity lines are in delinquency, the highest level since 1987.

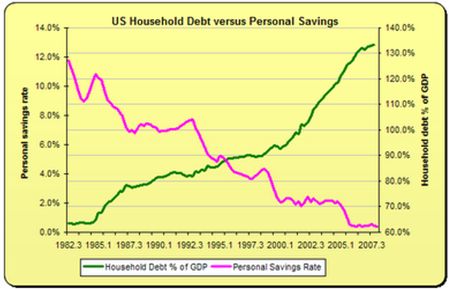

7. Consumers have dramatically increased the use of credit cards, now that the housing ATM has run out of cash. The average American household has credit card debt of $9,840 versus $2,966 in 1990, at an average interest rate of 19%. Credit card delinquencies have increased to 4.51% in the 1st quarter. Amex just announced a major unexpected write-off because its prime customers have hit the wall and are defaulting. Consumers used their credit and debit cards to buy $51 billion of fast food in 2006 according to Carddata. According to the Federal Reserve, 40% of American families spend more than they earn. This has led to the result in the chart below. The reversal of this trend will be necessary but traumatic. It has already begun, with the savings rate increasing to 2.6% in early 2008. David Rosenberg, the brilliant economist from Merrill Lynch, describes what has happened and what is to come:

"This is an epic event; we're talking about the end of a 20-year secular credit expansion that went absolutely parabolic from 2001-2007.

"Before the US economy can truly begin to expand again, the savings rate must rise to pre-bubble levels of 8pc, that the US housing stocks must fall to below eight months' supply, and that the household interest coverage ratio must fall from 14pc to 10.5pc.

"It's important to note what sort of surgery that is going to require. We will probably have to eliminate $2 trillion of household debt to get there," he predicts, saying this will happen either through debt being written off, as major financial institutions continue to do, or for consumers themselves to shrink their own "balance sheets".

The elimination of $2 trillion of household debt will lead to the closing of thousands of retail stores, strip malls, restaurants, and bank branches. There should be a lot of vacant buildings available in the next few years, and a few suspicious fires.

Source: Creditwritedowns.com

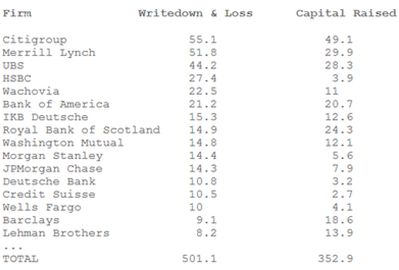

8. Banks are doing what they usually do. They are closing the barn door after the pigs have escaped. As their losses have crossed the $1 trillion mark, it is getting tougher for them to convince more suckers to buy their stock. They have so much toxic waste “assets” on and off their books at inflated values that they can not or will not lend. The Federal Reserve reported that banks have tightened standards for all loans in record numbers. After giving loans to anyone with a pulse for the last five years, this information is refreshing. But based on the well qualified assessments of Bridgewater Associates and NYU economist Nouriel Roubini, there is still $1.0 to $1.5 trillion in losses to go. Bank lending to consumers will be subdued for years.

Source: Mike Shedlock

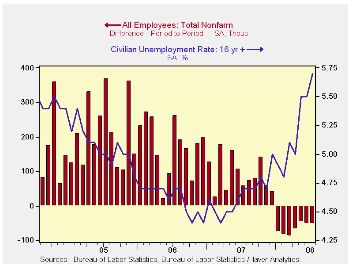

9. Government unemployment figures have begun to skyrocket, while the true unadjusted unemployment figures point to a major recession. If the number of people who have given up looking for a job were included, the official 6.7% unemployment rate would jump to 15%. People without jobs can’t spend money or make mortgage payments. With the deep recession that I anticipate, the official figures will reach 9%. This will result in lower consumption.

Source: Haver Analytics

Next Page 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).