The entrenched politician rulers of our country who are bought and sold by Big Business lobbyists, the Military Industrial Complex, and Big Media want to preserve the status quo. Their power base depends upon it. Prior to the creation of the Federal Reserve in 1913, depressions were violent and short. Prices for goods and wages adjusted rapidly, which allowed businesses and workers to survive. Having the dollar pegged to gold, limited what the government could do. The Federal Reserve artificially inflated the money supply in the 1920s causing a normal depression to become a Great Depression. Government interference with wage and price controls and government make work projects did not allow the system to fix itself. It took a World War to pull our economy out of the Great Depression.

What is required to happen and what will happen, in the next year, will have calamitous consequences for the future of our country. What needs to take place is:

- Consumers need to cut back dramatically on consuming. Spending as a percentage of GDP needs to decline to 65%, or by $1 trillion. This would be approximately $3,000 less spending per household per year.

- Twenty years of consumer debt accumulation must be unwound. This required deleveraging needs to eliminate $2 trillion of household debt. The result will be thousands of retail store closings, mall closings, restaurant closings, and auto dealership closings. The distinction between needs and wants will reveal itself like a sledgehammer.

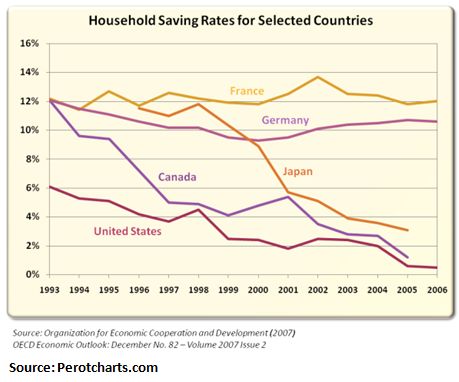

- The consumer needs to increase their savings rate from 2% to 10%. This would provide more capital for investment.

- People who cannot afford the mortgage on their home need to sell or enter foreclosure. When home prices fall far enough, the market will clear the inventory. Lower prices are the only way to eliminate excess supply.

- Companies that have failed to prepare for this downturn by taking on excessive debt, allowing expenses to soar, and having no clear strategic plan should go bankrupt. Unemployment will reach 9%. New businesses will be created and Americans will be hired.

- The government should make sure that no one starves to death or has to sleep on the streets. The safety net of food stamps and unemployment insurance should be strengthened.

- The government’s purpose is to protect its citizens, enforce the laws and maintain the public infrastructure. Our roads are crumbling, we have 156,000 structurally deficient bridges, millions of miles of pipes under our streets are rusting away, and our power grid is antiquated. The job of government was to maintain these things. They have failed miserably. Why does anyone think a new government infrastructure plan will work? Bridges to nowhere will be everywhere.

- Reducing spending dramatically on our military empire would provide funds to support the social safety net that is required during a depression. Congressmen in the pocket of the Defense industry will never allow it to happen.

What needs to occur would inflict too much pain for our politician leaders to allow. A violent short depression will be traded for a decade long extended depression. A painful deflationary depression will be converted into a hyperinflationary depression that could threaten the very existence of our country. President elect Obama has begun his finely orchestrated marketing plan to spend $775 billion of borrowed taxpayer money. His rationale for the stimulus package is classic Washington politics:

Economists from across the political spectrum agree that if we don't act swiftly and boldly, we could see a much deeper economic downturn. That's why we need an American Recovery and Reinvestment Plan that not only creates jobs in the short-term but spurs economic growth and competitiveness in the long-term."An economist is an expert who will know tomorrow why the things he predicted yesterday didn't happen today." – Laurence J. PeterNot one economist on the face of the earth predicted the events of 2008. None of Obama’s list of blue chip economists saw a crisis coming and they have no idea how long or deep the current downturn will be. They make weather forecasters look highly accurate in comparison. Most economists are either, sellouts (Lawrence Yun), cheerleaders (Larry Kudlow), ideologues, or academic theoreticians. If Barack Obama is depending on economists to determine our future, all is lost. Alan Greenspan was an economist. If we had done the opposite of everything he recommended in the last 20 years, the country would be on the right track. President Obama, with the overwhelming support of a Democratic Congress will double down on the trillions already poured down a rat hole by the Bush administration. The scenario that will play out is:

- The $775 billion plan will grow to at least $1 trillion as Obama will need to buy off various factions within Congress with pork projects.

- Congress will approve the 2nd $350 billion tranche of TARP funds. Barney Frank and Nancy Pelosi will shovel billions to homeowners who should be foreclosed upon. Billions more will be given to the automakers. GMAC will get more funds from the taxpayer at 8% interest so they can then loan it to subprime borrowers at 0%. This doesn’t sound profitable, but they’ll make it up on volume.

- TARP funds will be given to commercial developers who foolishly overleveraged, overbuilt, and overpaid for properties. Credit card companies that handed out credit like candy for the last 20 years will see their write-offs triple to over 10% by 2010. The government will give more of your tax dollars to these incompetent bankers so they can send out another 5 million credit card offers to deadbeats.

- The Federal Reserve will buy mortgage debt and long-term Treasuries to artificially reduce market interest rates. With money market funds paying .25%, senior citizen savers will be forced to take on risk to get a return on their money. Penalizing savers to resuscitate reckless gamblers is the path that Ben Bernanke has chosen. When the markets decline another 20% in 2009, more senior citizens will see their retirements destroyed by Mr. Bernanke.

- Consensus among the talking heads on CNBC is that markets will go up in 2009 because they went down so much in 2008. This is what amounts to analysis by business television. The people they interview have a vested financial interest in the market going up. So despite the fact that earnings will collapse in 2009, these pundits are sure the markets will rise. I’d bet against the consensus.

- Citigroup (C) and JPMorgan (JPM) will require additional enormous injections of capital from the taxpayer due to their looming credit card and commercial loan losses. The top 10 biggest banks are insolvent. They are being kept alive on life support systems provided by the Federal Reserve and Treasury. All the bankers who didn’t bankrupt their banks should be outraged at this misappropriation of taxpayer capital to incompetent, reckless, immoral, politically connected bankers.

- Home prices will drop another 15% in 2009 and will remain depressed until 2015. The market will adjust to its natural equilibrium level despite all government efforts to keep prices artificially elevated. When you can buy a house and rent it out and generate a positive cash flow, houses will be reasonably priced.

- Despite the immense spending, zero interest rates, and propping up bankrupt financial institutions, consumers will not spend. Economists, bureaucrats and politicians are so focused on models and theories that they have failed to realize that the social mood of the country has changed forever. The poor economic conditions are being caused by the mood change, not vice versa. A return to frugality, saving, and simpler lives will keep a cap on spending for at least the next decade.

The sum total of all that has been done and all that will be done will eventually lead to a hyperinflationary bust. The money supply is being expanded too rapidly, fiscal stimulus spending will be borrowed from foreigners, the dollar will fall as foreigners refuse to accept 2% for 10 years, and the Federal Reserve will react too late just like they did when this crisis began.

This overstimulation of the economy will lead to a panic out of dollars and into real assets. The government will attempt to control the situation by confiscating gold as they did in the 1930s and Americans will be forced to surrender more liberties. In periods of economic and social upheaval - war, revolution, or dictatorship become possibilities.

The average American needs to wake up from their materialistic stupor and understand the risks that lie ahead. An educated concerned citizen is our only defense against tyranny. Orwellian governmental policies will be inflicted upon the populous. Seek out those who are telling the truth. David Walker, Boone Pickens, Ron Paul, Mike Shedlock, Doug Casey, and John Mauldin are among the truth tellers.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).