Now remember, when things look bad and it looks like you're not gonna make it, then you got to get mean. I mean plumb, mad-dog mean! Cause if you lose your head and you give up, then you neither live nor win. That's just the way it is.

Clint Eastwood in Outlaw Josey Wales

Things do look bad and Americans need to get mad-dog mean. The meanness that I’ve witnessed so far has been from 35 year old jerks driving leased BMW 525is who have 3 underwater condos and have lost 70% of their faux wealth in the market. They’re the ones who come up behind you at 90 mph, lock onto your bumper and flash their brights at you to get out of their way. I slow down.

Average Americans need to get mean about spending and saving. Between 2002 and 2008, Americans sucked over $3 trillion of equity out of their houses and spent it on gadgets and goodies. That well is dry. There are no more wells. Ignore the crap you are hearing from Paul Krugman about the paradox of thrift. You must become thrifty because you have no choice. The future is approaching at hyper-speed and Americans have saved little. Their choice is to save now or acquire a taste for dog food. The saving rate in January jumped to 5%, the highest level since 1995. This trend will continue up to 10% in the coming years.

For decades homeowners had a ridiculous notion that they should slowly but surely pay off their mortgages. Why pay off your mortgage when your home value is guaranteed to increase 10% per year for infinity? After the greatest housing boom in history Americans are left with 45% equity in their homes versus 68% in 1985. With home prices destined to fall another 20% to 30%, equity will fall to 35%. One in seven homeowners across the country has negative equity, and of homeowners who bought in the last five years, 29.5% are under water.

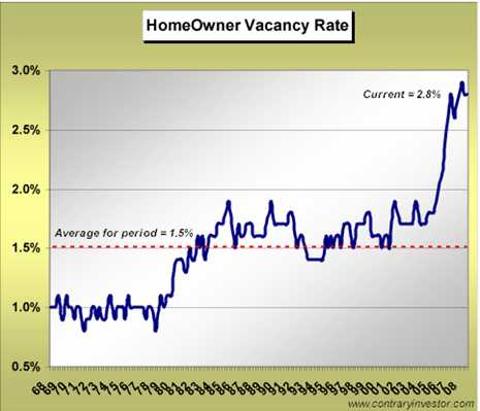

Reversion to the mean is a concept that government bureaucrats refuse to accept. They are willing to spend as much of your money as they can get their grubby little hands on to reverse a non-reversible trend. Home prices must fall another 30% to reach the long term mean value. Taking money from prudent homeowners giving it to deadbeat homeowners and allowing politically motivated judges to decide who deserves a lower mortgage will not reverse the downward trajectory of home prices. It will just prolong the pain and create unintended consequences.

The number of homes for sale is still at record levels. With foreclosures accelerating, more houses will come onto the market and prices will fall. Unemployment will reach 10% in the next year. There are 2.1 million vacant homes in the U.S. today. This is 1 million more than the historical trend. No one is going to buy these homes at the current asking prices. If you wait until foreclosure, you may get a house 50% cheaper than today’s asking price. This is a rational approach and will lead to lower prices.

A normalized level of homes for sale would be in the range of 2 million. There is 9.5 months supply of homes for sale. A normalized level would be 4 months.

Next Page 1 | 2 | 3 | 4 | 5 | 6 | 7

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).