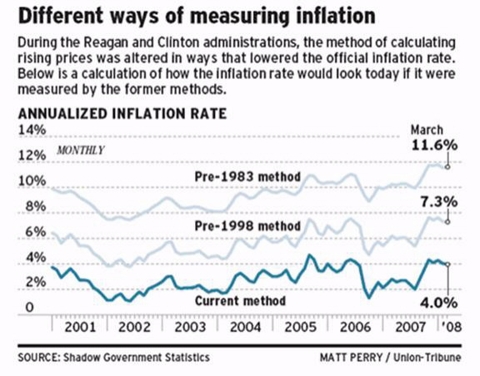

The true misery index (unemployment rate + inflation rate) was near the all-time high. This explains why the University of Michigan sentiment index was the lowest in history.

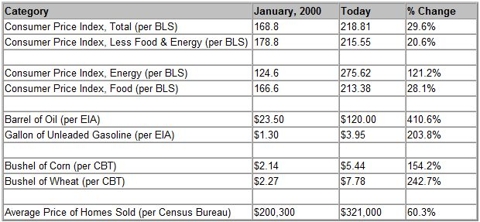

A 72 year old, risk averse, grandmother, with a husband in a nursing home and $100,000 in her IRA is now only able to get 1% in CDs or a money market fund. She has paid10% to 20% more for food, energy, and health care in the last year. The most susceptible Americans, our senior citizens, are being sacrificed to benefit the huge banks who loaned money to people who could never pay them back, and now need to be saved.

Ben Bernanke and the Fed have chosen to throw the savers under the bus to prop up banks that are essentially bankrupt. Not surprising, considering the Federal Reserve is essentially owned by the banks they are propping up.

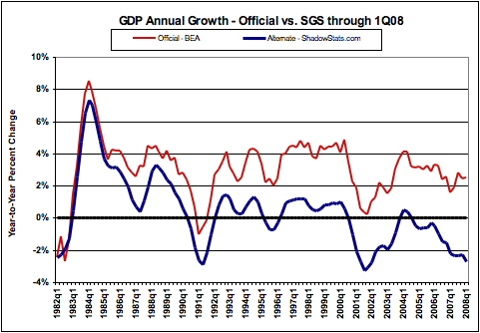

The misleading CPI figures contribute to the false readings on GDP. I heard numerous talking heads over the last year say that we weren't in a recession because GDP had not gone negative. The GDP numbers are adjusted for inflation. If we are underestimating true inflation by 7%, then GDP is systematically overstated. When adjusted for the true CPI, our economy has been in a recession for most of the last 8 years. No wonder that Americans are in such a bad mood. Maybe if we had used the $700 billion that have been poured into the “War on Terror” for productive initiatives in the United States, we wouldn’t have had such lethargic growth.

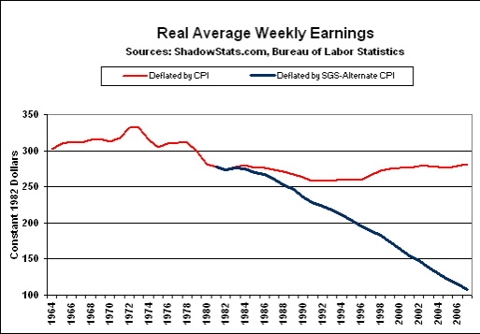

In America, anyone can become rich. This is a hallmark of capitalism. The reason the vast majority of people don’t feel like they are getting ahead is because they aren’t.

According to Jim Jubak,

Incomes are a lot less equal than they used to be. In 1979, for example, the top 1% of earners had an income 9.4 times that of the average person in the bottom 90%, according to the Economic Policy Institute. By 2006, that ratio had climbed to almost 20-to-1.

This is the classic rich getting richer and poor getting poorer story. Real average weekly earnings for all Americans over the last four decades has been cut in half due to the persistent year after year inflation. Workers no longer can rely on unions to fight for wage increases. Employers have the leverage to keep wages low, while everyday costs rise.

Again, the serial cheerleaders like Larry Kudlow and Ben Stein are on TV every day saying that the economy is not bad because the unemployment rate is only 6.7%. How could we have a recession with the unemployment rate at 6.7%? We can have a recession, because the unemployment rate is not really 6.7%. The government only reports the U3 rate, which is of course the lowest level. If you use the U6 rate, unemployment is currently 11%. U6 includes discouraged and marginally attached workers. Only our government would exclude people who want a job, but are discouraged because they can’t get one.

According to John Williams,

Up until the Clinton administration, a discouraged worker was one who was willing, able and ready to work but had given up looking because there were no jobs to be had. The Clinton administration dismissed to the non-reporting netherworld about five million discouraged workers who had been so categorized for more than a year.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).