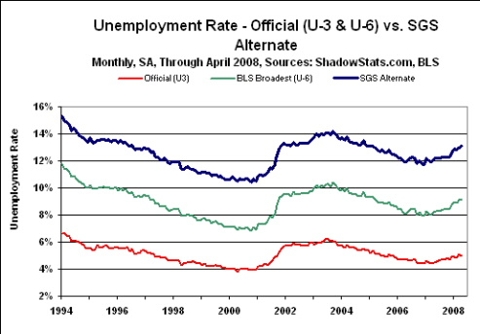

When you include these workers, the unemployment rate is in the range of 16% today, on par with the levels of the early 1980’s.

The world breathlessly awaits the monthly figures on job gains or losses provided by the Bureau of Labor Statistics. There is usually a huge move in the stock market based upon these numbers. The fact is that they are not accurate within hundreds of thousands. They are a pure guess based upon models developed by these government bureaucrats. It takes up to two years before the figures are relatively accurate.

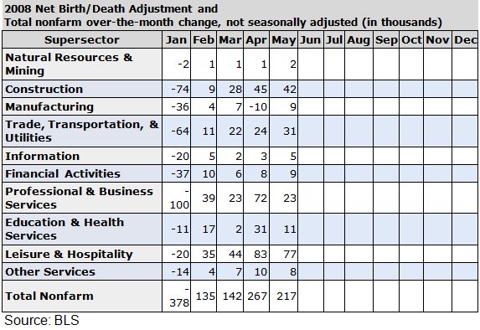

Early in the Bush administration the BLS decided to make the monthly figures more “accurate” by making a birth/death adjustment to the reported figures. Amazingly, the adjustment makes the jobs picture more positive. This adjustment was supposed to take into account all the jobs created by small businesses that didn’t make it into their monthly survey. Over a long period of time, this adjustment may make sense, but on a monthly basis at turning points in the economy is wildly wrong, like now. In the midst of an implosion in the housing market and a meltdown of the financial system, the BLS was telling the American public that we had added 115,000 construction jobs and 23,000 financial services jobs in the beginnig of 2008. If you believe this, I have some beachfront property in Baghdad I’d like to sell you.

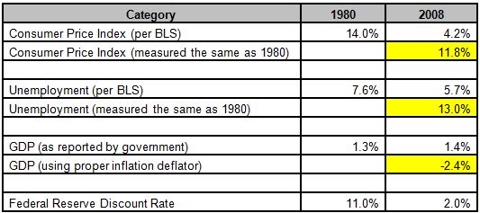

After all the slicing, dicing and manipulation of the data, the true picture is in the chart below. The disconnect, that the mainstream media is reporting regarding people’s mood about the economy is not a disconnect at all. Using the true figures, things are as bad as they were in 1980. The major difference is that the government and consumers now have massive amounts of debt to finance. If the Federal Reserve were to increase rates to where they should be, the whole Ponzi scheme would collapse. So, they keep rates at 2% and try to convince the unknowing masses that everything is just fine.

The only way to change what is going on in this country is to view everything that the government reports with a skeptical eye. Dig into the details to seek the truth. Listen to people who are willing to pull back the curtain and reveal that the Wizard of Oz is just a bumbling fool.

Read the views of David Walker, Pete Peterson, John Mauldin, Barry Ritholtz, and Ron Paul to get the straight scoop on the economic situation of this country. Burying your head in the sand is not an alternative. As usual, Ron Paul sums up the situation as well as anyone.

America became the greatest, most prosperous nation in history through low taxes, constitutionally limited government, personal freedom and a belief in sound money. Deficits have exploded, entitlements are out of control and our personal liberties are threatened like never before. The "solutions" proposed so far--stimulus packages, bailouts and interest rate cuts--just amount to printing more money, which will lead to greater currency devaluation, contribute to the rising costs of living, and further squeeze the middle class and our senior citizens.

Regarding the homeowner bailout bill (That was written by Bank of America) Ron’s views are dead on.

The solution is for government to stop micromanaging the economy and let the market adjust, as painful as that will be for some. We should not force taxpayers, including renters and more frugal homeowners, to switch places with the speculators and take on those same risks that bankrupted them. It is a terrible idea to spread the financial crisis any wider or deeper than it already is, and to prolong the agony years into the future. Socializing the losses now will only create more unintended consequences that will give new excuses for further government interventions in the future. This is how government grows – by claiming to correct the mistakes it earlier created, all the while constantly shaking down the taxpayer. The market needs a chance to correct itself, and Congress needs to avoid making the situation worse by pretending to ride to the rescue.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).