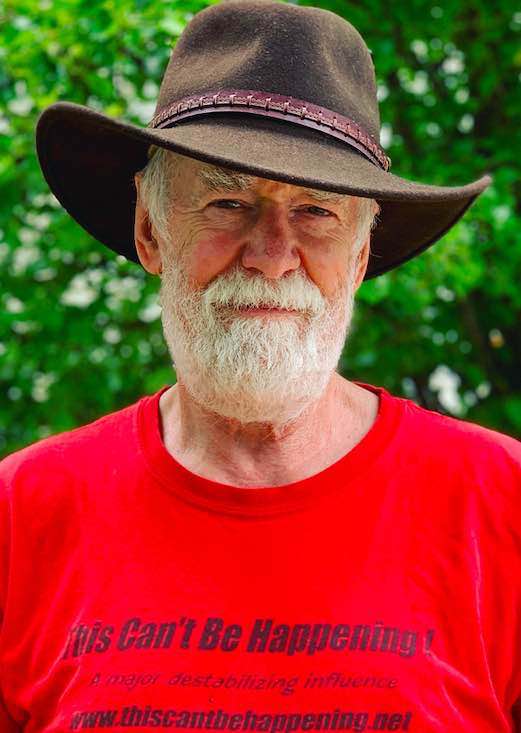

By Dave Lindorff

A brief conversation I had earlier this week with a car dealership executive while standing in a post office line demonstrated simply both why the bank deregulation and consolidation process of the past two decades has been a screw job for ordinary people, and why the Washington bailout has been both a taxpayer rip-off and a failure (if it was even intended to work!).

I was chatting with the guy standing behind me who works at one of the 14 dealerships in a Philadelphia-area regional family-owned chain of GM dealerships called Bergey’s. Noting that a number of big dealers like Knopf (a Chrysler Dealer) and McGarrity’s (Ford) had been closing, I asked this Bergey’s manager if the problem was that the banks had frozen lending, making it hard for people to buy new cars.

He laughed. “There’s no problem getting car loans from the small community banks around our dealerships,” he said. “They’ve got plenty of money to lend, and they’re happy to lend it to car buyers. The problem is that people are too worried about the economy and about their jobs to go out and buy a new car.”

And that’s it in a nutshell. The so-called “credit freeze” is a problem afflicting the giant national and global banks, like Citibank and B of A, which went on a tear with all of those derivative investments and loans, like CDOs and subprime mortgages, and which have been pushing credit on consumers with usurious rates that could only lead to default eventually. Most smaller community banks, many of them family owned or privately held, credit unions, and S&Ls (which were suitably chastened by their own disastrous scandals of two decades ago), have been lending responsibly and are fully solvent and happy to extend credit to people who are credit-worthy.

The big banks may be technically insolvent, and in desperate need of federal bailouts lest they go under and leave their investors holding the empty bag, but the small banks that serve most of the nation’s ordinary folks have a different problem. They themselves aren’t insolvent, but their clients are—or at least they are worried that they might become that way.

That’s why they aren’t buying houses and seeking mortgages, and it’s why they aren’t buying cars.

What’s needed, clearly, is not money for the big commercial banks that got greedy and ran into a ditch. It’s support for the American people, so that they don’t have to hunker down into a crouch and not continue to participate in the economy.

When you see foreclosed signs going up along your own street, it makes you start worrying about making your own mortgage payments. When one in eight people are losing their jobs, just about everyone with a job starts to have friends and relatives who are out of work, and that paycheck starts to seem pretty precarious.

The hundreds of billions of dollars paid to and invested in big commercial banks that don’t do much for the little guy anyway is doing nothing at all to ease that pain and anxiety among the grassroots. Instead, it’s just being pocketed by bank managers and rich investors, to be put to a “higher” use somewhere else than on a depressed “Main Street.” (Note that the government has put no strings on the money, much of which is being used to buy other banks, or even to lend overseas.)

That’s why all those car dealerships are folding.

This brings me to that feeding frenzy of bank deregulation I mentioned earlier. The whole idea of allowing the creation of national banks like Citibank and Bank of America and Wells Fargo, and of going one step further and allowing banks to merge with brokerages and insurance companies, which began in earnest during the Clinton administration and went ballistic in the Bush administration, was deceptively marketed to the public as being “good for the consumer.” The come-on was that by allowing state and regional banks to merge into national institutions, and by allowing them to add investment banking and insurance operations, consumers would get more services from their bank and have the supposed "advantage" of “one-stop shopping” at their bank.

Anyone who watched it happen, however, saw how bogus that claim was. I lived in New York City as it was going on, and as banks like Citibank bought up their competitors, fees began to appear for services that had no fees before, like checking and even passbook savings, savings accounts began to require minimum deposits, CD interest rates fell as penalties proliferated, and small loans became harder to get. Some banks actually began to state, at least to analysts and to reporters in the financial press, that they were no longer interested in serving “small” clients, and were instituting measures designed to discourage them or drive existing small clients away.

Soon, it was impossible in many neighborhoods of New York to find a bank to serve ordinary people.

As a matter of fact, these big banks don’t even help when it comes to “big bank”-type stuff. Consider international finance activities like foreign currency exchange. When my wife, a harpsichordist, came home last week from a month-long tour of performances in China, Taiwan, Hong Kong and Macau, she had with her $1000 worth of Taiwanese currency—the fee for a gig that she had not had time to change into US currency while in Taiwan or Hong Kong, where such transactions are commonplace and inexpensive. Back in Philadelphia, we called around to the big commercial banks—all global institutions—to see if they could change the money. They could, but at absurd cost. Take Citibank. That institution said it would only change up to $700 worth of bills unless my wife had an account with them, and in any event, it was offering a rate of 39.5 Taiwanese dollars to one US dollar—way worse than the posted rate that day of 33.5/1. In other words, they were willing to change up to $700 worth of currency, but at a cost of 18%, plus a $10 fee! That means they’re making 35% on a two-way conversion of currency! Thanks a lot! The other banks were no better.

Want another example. Bank of America was a big recipient of taxpayer funded bailout money from the US Treasury and the Federal Reserve Bank. But it has refused to lend money to Republic Windows & Doors Co., a factory in Chicago, that has been forced to close and lay off its 300 workers with only three days' notice, foregoing the legally required 60-days' pay and earned vacation pay. This is a story that will be repeated more and more. At Republic, the workers, members of the United of Electrical Workers union, are fighting back with a sit-down strike demanding their money. If you want to support them, go to:

Union Voice Campaign

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).