"Today, most measures of underlying inflation are running somewhat below 2 percent, or a bit lower than the rate most Fed policymakers see as being most consistent with healthy economic growth in the long run. Although low inflation is generally good, inflation that is too low can pose risks to the economy -- especially when the economy is struggling. In the most extreme case, very low inflation can morph into deflation (falling prices and wages), which can contribute to long periods of economic stagnation."

He certainly has succeeded in fighting off deflation. Let's list his anti-deflation accomplishments:

- Oil prices have risen 35% since September 2010.

- Unleaded gas has risen 50% since September 2010.

- Gold has risen 24% since September 2010.

- Silver has risen 85% since September 2010.

- Copper has risen 20% since September 2010.

- Corn has risen 67% since September 2010.

- Soybeans have risen 40% since September 2010.

- Coffee has risen by 44% since September 2010.

- Cotton has risen 88% since September 2010.

Amazing how supply and demand got out of balance at the exact moment that Bernanke unleashed a tsunami of speculation by giving the all clear to Wall Street, handing them $20 billion per week for the last seven months. Another coincidence seemed to strike across the Middle East where the poor, who spend more than 50% of their meager income on food, began to revolt as Bernanke's master plan to enrich Wall Street destroyed the lives of millions around the globe. Revolutions in Tunisia, Egypt, Libya, Yemen, Bahrain, and Syria were spurred by economic distress among the masses. Here in the U.S., Bernanke has only thrown savers and senior citizens under the bus with his zero interest rate policy and dollar destruction.

Bernanke's Virtuous Circle"This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion." Ben Bernanke -- Washington Post Editorial -- November 4, 2010

Ben Bernanke could not have been any clearer in his true purpose for QE2. He wanted to create a stock market rally which would convince the public the economy had recovered. As suckers poured back into the market, the wealth effect would convince people to spend money they didn't have, again. This is considered a virtuous cycle to bankers. He declared that buying $600 billion of Treasuries would drive down long-term interest rates and revive the housing market. His unspoken goal was to drive the value of the dollar lower, thereby enriching the multinational conglomerates like GE, who had shipped good US jobs overseas for the last two decades. Bernanke succeeded in driving the dollar 15% lower since last July. Corporate profits soared and Wall Street cheered. Here is a picture of Bernanke's virtuous cycle:

Whenever a talking head in Washington DC spouts off about a new policy or program, I always try to figure out who benefits in order to judge their true motives. Since August 2010, the stock price of the high end retailer Tiffany & Company has gone up 88% as its profits in the last six months exceeded its annual income from the prior two years. Over this same time frame, 2.2 million more Americans were forced into the Food Stamp program, bringing the total to a record 44.6 million people, or 14.4% of the population. But don't fret, Wall Street paid out $21 billion in bonuses to themselves for a job well done. This has done wonders for real estate values in NYC and the Hamptons. See -- a virtuous cycle.

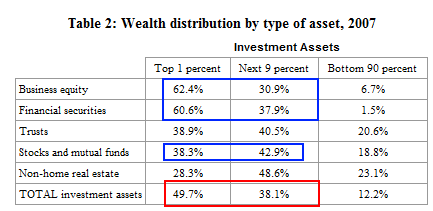

Do you think Bernanke mingles with Joe Sixpack on the weekends at the cocktail parties in DC? Considering that 90% of the US population owns virtually no stocks, Bernanke's virtuous cycle only applied to his friends and benefactors on Wall Street.

But surely his promise of lower interest rates and higher home prices benefitted the masses. The largest asset for the vast majority of Americans is their home. Let's examine the success of this part of his master plan. Ten year Treasury rates bottomed at 2.4% in October 2010, just prior to the launching of QE2. Rates then rose steadily to 3.7% by February 2011. I'm not a Princeton professor, but I think rising rates are not normally good for the housing market. Today, rates sit at 2.9%, higher than they were prior to the launch of QE2.

I'm sure Ben would argue that interest rates rose because the economy is recovering and the virtuous cycle is lifting all boats (or at least the yachts on Long Island Sound). Surely, housing must be booming again. Well, it appears that since Ben fired up his helicopters in November, national home prices have fallen 5% and are accelerating downward at an annual rate of 10%. There are 10.9 million home occupiers underwater on their mortgage, or 22.7% of all homes with a mortgage. There are over 6 million homeowners either delinquent on their mortgage or already in the foreclosure process. It certainly looks like another Bernanke success story.

Bernanke's conclusion at the end of his Op-Ed in November 2010 was that his critics were wrong and his expertise regarding the Great Depression trumped rational economic theory. By enriching Wall Street and creating inflation, his virtuous cycle theory would lead to job creation and a chicken in every pot.

"Although asset purchases are relatively unfamiliar as a tool of monetary policy, some concerns about this approach are overstated. Critics have, for example, worried that it will lead to excessive increases in the money supply and ultimately to significant increases in inflation. But the Federal Reserve has a particular obligation to help promote increased employment and sustain price stability. Steps taken this week should help us fulfill that obligation." Ben Bernanke -- Washington Post Editorial -- November 4, 2010

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).