When California Got Ken Lay'd

In olden days, before "deregulation," your local gas and electric company was not allowed to burn down your house, blow it up, cut off your oxygen tank and then bill you for it.

So what happened?

PG&E's transformation from a public utility into an Academy for Accidental Arsonists began 30 years ago with Ken Lay, chief executive of Enron. Enron, a criminal enterprise parading as a power company, convinced California to lead the nation in "deregulating" its power markets.

Until then, utilities were dull things, controlled like government agencies with highly detailed budgets for operation and maintenance that, when approved by regulators, had to be spent on ... maintenance and operations. If they failed to use the money as promised, regulators punished the company with a severe hit to profits already tightly capped by law.

Then, deregulation allowed utilities to pocket unspent money as an efficiency incentive. In practice, deregulation became decriminalization of skimming on safety and reliability.

I can only imagine what Robert "Bat" Batinovich would have done to the company for the deadly delay which likely resulted in the Kincade fire. Batinovich, appointed chairman of the California Public Utilities Commission by Young Governor Jerry Brown, was known as the toughest regulator in America.

Decades later, the Elderly Governor Brown filled the PUC with louche industry buddies dedicated to defending the company except when the TV cameras are on.

What did PG&E do with the maintenance fund embedded in the bills of its captive customers? While those with lives and homes burned are obvious victims of PG&E's cost-shaving devil-may-care operations, all of those who pay the monthly bill deserve their day in court.

As we did in New York, the state and local governments should file legal action on behalf of every customer. And that will, justly, cut the price of a takeover.

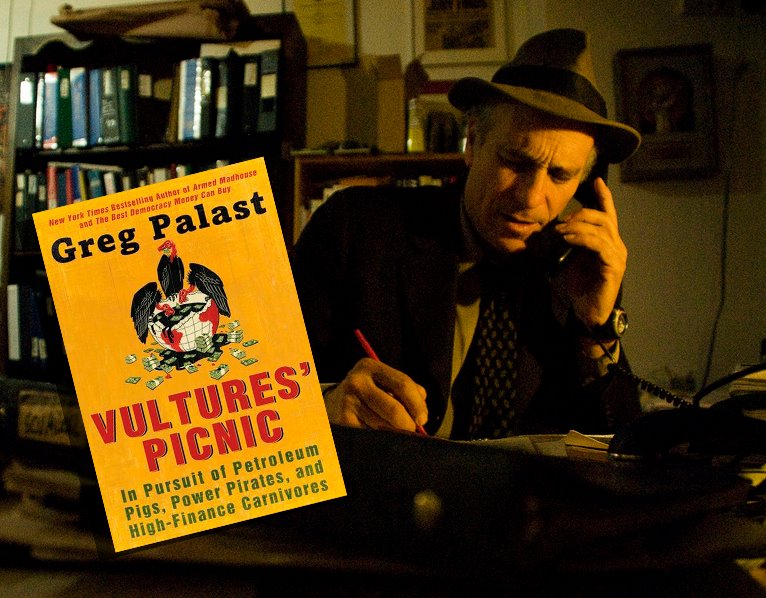

The Vulture Swoops In

The only thing more dangerous than leaving PG&E in the hands of its current mis-managers is the proposal to give control of PG&E to the financier known as "The Vulture," Paul Elliott Singer of Elliott Management.

Singer has bought up a hunk of PG&E's debt cheaply, and he's looking to the bankruptcy court to adopt a re-organization plan that would give him a giant payday at ratepayers' expense.

I've been tracking Singer for BBC Television for 12 years.

Here's how Singer operates. In 2009, Singer and his vulture colleagues bought control of Delphi Corp., which was once General Motors' auto parts division. Singer's team threatened to cut off delivery of parts to GM unless the U.S. Treasury paid him billions of dollars. President Barack Obama's auto bailout chief, Steve Rattner, called it "extortion."

Obama had no choice but to give in because the parts cut-off would have forced GM's liquidation, costing half a million jobs. Singer got his billion-dollar payoff, then Delphi shifted almost every union job overseas.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).