Gretchen Morgenson of the New York Times just published one of the few feel good stories

in months following the 2008 financial crisis. She describes a

possible day of reckoning for the perpetrators of the 2008 crisis and

much of the pain that has followed.

The newly elected New York attorney general, Eric Schneiderman (D), wants information from Goldman Sachs, Bank of America, and Morgan Stanley. Among other things, the information concerns mortgage pooling and bundling. This may well include information on collateralized debt obligations (CDO's) and mortgage backed securities (MBS). New York state officials told Morgenson:

"The New

York attorney general has requested information and documents in

recent weeks from three major Wall Street banks about their mortgage

securities operations during the credit boom, indicating the existence

of a new investigation into practices that contributed to billions in

mortgage losses." New York Investigates Banks' Role in Financial Crisis New York Times, May 16

Morgenson indicated where the attorney general might be heading - securitization fraud:

"Some litigants have contended, for example, that the banks dumped loans they knew to be troubled into securities and then misled investors about the quality of those underlying mortgages when selling the investments."

"The

possibility has also been raised that the banks did not disclose to

mortgage insurers the risks in the instruments they were agreeing to

insure against default." New York Times, May 16

![]()

In addition to the leaked investigation, Morgenson makes a critical

point about ongoing federal and state attorneys general efforts for

settlement order on mortgage fraud, fictional mortgage agreement s, and matters related to ForeclosureGate.

"By

opening a new inquiry into bank practices, Mr. Schneiderman has

indicated his unwillingness to accept one of the settlement's terms

proposed by financial institutions -- New York Times, May 16

Matt Tiabbi explained what this means:

"If the

AGs were to sign off on a friendly global settlement for mortgage abuses

prematurely, it would be like a DA offering a millionaire murderer a

2-year plea bargain before the cops even had a chance to interview all

the eyewitnesses. It would be a blatantly political arrangement." Matt Tiabbi, May 17

The settlements (consent orders that avoid a trial) by the Obama Department of Justice and the state attorneys general would cost the big banks and Wall Street a few billion dollars in legal fees but free them from civil suits that could stretch into the trillions and jail time for criminal fraud.

The New York AG's actions stop any settlement in its tracks since, according to Tiabbi; it takes all 50 states to generate a consent order. Should it become official, Schneiderman's investigation would also set a high bar for any other settlements. It could also simulate demands for serious prosecutions around the country.

Serious charges by Schneiderman would also make a federal settlement like the one leaked to American Banker look simply awful to the public.

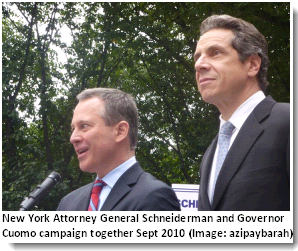

Nexus between Cuomo 2009 Charges against Bank of America, Schneiderman's Investigation, and the Senate Report on "Wall Street and the Financial Crisis"

On February 4, 2009, then New York Attorney General Andrew Cuomo filed a complaint against the Bank of America, Kenneth D. Lewis, and Joseph L. Price.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).