The White House snatched back one of the few bones it's thrown to the people outraged at the looting of the United States Treasury by failed financial concerns - the big banks and Wall Street. The promised appointment Elizabeth Warren as head of the new agency to protect consumers from the financial services industry has been seriously downgraded. Instead of running the Consumer Finance Protection Agency, Warren's role has been diminished to that of special assistant to the president and adviser to Treasury Secretary Tim Geithner.

"President Obama, sidestepping a possibly heated confirmation battle, will appoint Harvard law professor Elizabeth Warren as a special advisor to the Treasury Department to launch the government's powerful new Consumer Financial Protection Bureau, according to two Democratic officials familiar with the decision." LA Times, Sept 15

An interim appointment would have given the no-nonsense Warren the full authority to structure consumer bureau in the interests of the people. A special adviser role is defined in a New York Times article as follows:

"Ms. Warren will be named an assistant to the president, a designation that is held by senior White House staff members, including Rahm Emanuel, the chief of staff.

"She will also be a special adviser to the Treasury secretary, Timothy F. Geithner, and report jointly to both men." September 15

The title of the Times article says it all: Warren to Unofficially Lead Consumer Agency.![]()

Of course, President Obama could have set it up for Warren to officially lead the agency through an interim appointment. Warren's outstanding efforts and her extraordinary record of being right on the issues are more than enough justification for that.

Even better, the president could have submitted the nomination to the Senate for approval and dared any or all members of that body to challenge Warren. Her record of written and live presentations has been excellent. Why should we believe the storyline that confirmation is out of the question? It's probably just more corporate media stenography dictated by White House operatives who opposed the appointment from the start.

But here's the kicker. The soon-to-be retired Chris Dodd (D-CT) warned that the consumer agency might implode if Warren received an interim appointment:

"Outgoing Senator Chris Dodd (D-Conn.) warned Tuesday that an interim appointment of Elizabeth Warren to head the Consumer Financial Protection Bureau 'jeopardizes the existence' of the nascent agency." Ryan Grim, Sept 14

That would be the same Sen. Dodd who crafted a financial reform bill that had a highly favorable impact on a financial services firm that employs his wife.

So there you have it. The chairman of the Senate Finance Committee who got a deal we'd never get on a mortgage from a big bank and who authored a self-serving financial reform bill is determining who will protect citizens against the rapacious greed of the financial services industry. Telling, isn't it?

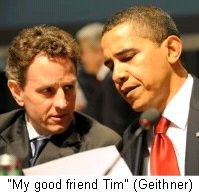

How will Warren be treated by "co-boss" Geithner?

Here's an excerpt from Warren's questioning of her new boss at an oversight hearing on the AIG bailout. She wanted to know why AIG counterparties (mainly large financial institutions) got 100 cents on the dollar while investors in other bailed out entities got much less. Specifically, she wanted Geithner to tell her if he'd had conversations with any of the beneficiaries of the sweet AIG deal. Here's a key portion of the exchange.

Geithner: "Where are you going. What would you like to know?"

Warren: "Did treasury have conversations with any of the counterparties"

Geithner: "I was not Secretary of Treasury but I was president of the New York Fed and of course I was central to the basic judgment we reached together to prevent default by AIG. I'm sure that was the right judgment at the time and you're right to point out that that action did help make the system more stable, did have broad benefits to the stability of the system, including the direct counterparties." (Starts 1:44)

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).