1990

2000

2008

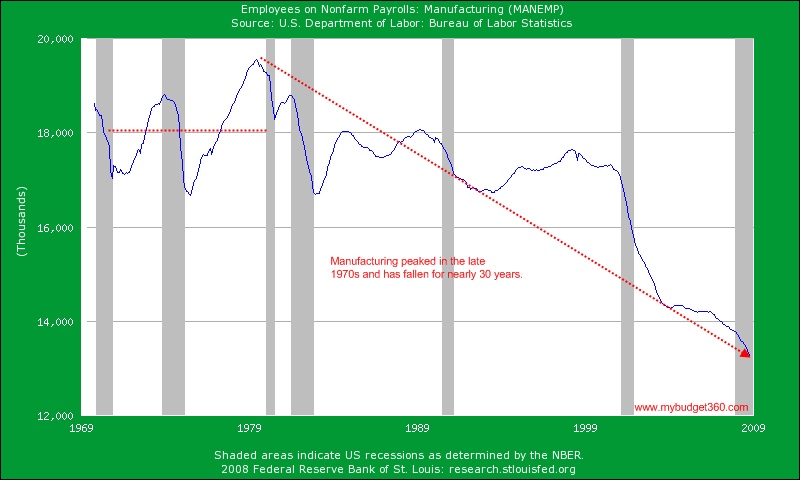

Manufacturing 22.7% 20.0% 16.3% 14.5% 11.5%Construction 4.8% 4.7% 4.3% 4.4% 4.1%Retail & Wholesale Trade 14.5% 14.0% 12.9% 12.7% 11.9%Finance, Insurance, Real Estate 14.6% 15.9% 18.0% 19.7% 20.0%Professional Services 5.4% 6.7% 9.8% 11.6% 12.7%Educational Services 0.7% 0.6% 0.7% 0.8% 1.0%Health Services 3.2% 4.4% 6.0% 6.1% 7.1%Government 15.2% 13.8% 13.9% 12.3% 12.9%Other 18.9% 19.9% 18.1% 17.9% 18.8%TOTAL 100.0% 100.0% 100.0% 100.0% 100.0%Source: BEAhttp://my.caseyresearch.com/displayTcr.php?id=21#cc1

The "creativity" of Wall Street was complimented by corporate America instituting "free trade" and "globalization" policies (NAFTA) supported by politicians in Washington DC. The terms free trade and globalization were code for corporate CEOs shipping US manufacturing jobs to China, India, and Vietnam, while expanding their corporate earnings per share 3 cents above analyst expectations per quarter. As reward for gutting American industry, the CEOs demanded their Board of Director toadies give them stock options for 1 million shares and $10 million raises. Does it require a Harvard degree and ingenious brilliance to fire 100,000 American workers making $20 per hour and build a plant in China paying peasants $1 per hour and depending on cheap oil to inexpensively ship the goods back to America? Only one problem, people without jobs have trouble buying stuff. Without middle class jobs, corporate CEOs turned to their Harvard buddies on Wall Street to create $1.2 quadrillion of financial derivatives to convince the middle class they really had wealth to spend on cheap Chinese goods. This corporate/banking collusion was fully supported by their paid for representatives in Washington DC. This unholy alliance between big business and big government enriched the ruling elite, while impoverishing the middle class.

Once In A Lifetime

"Indeed, recent research within the Federal Reserve suggests that many homeowners might have saved tens of thousands of dollars had they held adjustable-rate mortgages rather than fixed-rate mortgages during the past decade, though this would not have been the case, of course, had interest rates trended sharply upward." Alan Greenspan, February 2004

"Even though some down payments are borrowed, it would take a large, and historically most unusual, fall in home prices to wipe out a significant part of home equity. Many of those who purchased their residence more than a year ago have equity buffers in their homes adequate to withstand any price decline other than a very deep one." Alan Greenspan, October 2004

"Improvements in lending practices driven by information technology have enabled lenders to reach out to households with previously unrecognized borrowing capacities." Alan Greenspan, October 2004

"The use of a growing array of derivatives and the related application of more-sophisticated approaches to measuring and managing risk are key factors underpinning the greater resilience of our largest financial institutions ". Derivatives have permitted the unbundling of financial risks." Alan Greenspan, May 2005

You may find yourself living in a shotgun shack

You may find yourself in another part of the world

You may find yourself behind the wheel of a large automobile

You may find yourself in a beautiful house, with a beautiful wife

You may ask yourself: well" how did I get here?

Letting the days go by/let the water hold me down

Letting the days go by/water flowing underground

Into the blue again/after the money's gone

Once in a lifetime/water flowing underground

You may ask yourself

How do I work this?

You may ask yourself

Where is that large automobile?

You may tell yourself

This is not my beautiful house!

You may tell yourself

This is not my beautiful wife!

You may ask yourself

What is that beautiful house?

You may ask yourself

Where does that highway lead to?

You may ask yourself

Am I right?" Am I wrong?

You may say to yourself

My God!" what have I done?

Next Page 1 | 2 | 3 | 4 | 5 | 6

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).