The Federal Reserve has slowly and methodically destroyed the American middle class through relentlessly printing more money and purposefully creating inflation, since its reprehensible creation in 1913. For the last three decades only one voice in the wilderness of Washington DC has fought this banking cabal.

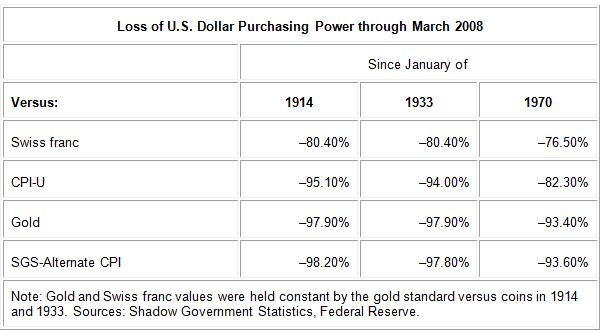

"Since the creation of the Federal Reserve, middle and working-class Americans have been victimized by a boom-and-bust monetary policy. In addition, most Americans have suffered a steadily eroding purchasing power because of the Federal Reserve's inflationary policies. This represents a real, if hidden, tax imposed on the American people.

From the Great Depression, to the stagflation of the seventies, to the burst of the dotcom bubble last year, every economic downturn suffered by the country over the last 80 years can be traced to Federal Reserve policy. The Fed has followed a consistent policy of flooding the economy with easy money, leading to a misallocation of resources and an artificial "boom" followed by a recession or depression when the Fed-created bubble bursts. In conclusion, Mr. Speaker, I urge my colleagues to stand up for working Americans by putting an end to the manipulation of the money supply which erodes Americans' standard of living, enlarges big government, and enriches well-connected elites, by cosponsoring my legislation to abolish the Federal Reserve." -- Ron Paul -- Sept 10, 2002

His colleagues in Congress did not stand up to the Federal Reserve in 2002. Instead, they cheered them on as Greenspan's ultra loose monetary policy led to the greatest housing bubble in history and a financial collapse unparalleled in human history. As the collapse was hurdling down the track in 2006, Representative Paul once again rose in protest against an organization that is rapidly destroying the American dream.

"The coming dollar crisis is not likely to be "fixed" by politicians who are unwilling to make hard choices, admit mistakes, and spend less money. Demographic trends will place even greater demands on Congress to maintain benefits for millions of older Americans who are dependent on the federal government.

Faced with uncomfortable financial realities, Congress will seek to avoid the day of reckoning by the most expedient means available -- and the Federal Reserve undoubtedly will accommodate Washington by printing more dollars to pay the bills. The Fed is the enabler for the spending addicts in Congress, who would rather spend new fiat money than face the political consequences of raising taxes or borrowing more abroad.

The irony is that many of the Fed's biggest cheerleaders are the same supposed capitalists who denounced centralized economic planning when practiced by the former Soviet Union. Large banks and Wall Street firms love the Fed's easy money policy, because they profit at the front end from the resulting loan boom and artificially high equity prices. It's the little guy who loses when the inflated dollars finally trickle down to him and erode his buying power. Someday Americans will understand that Federal Reserve bankers have no magic ability -- and certainly no legal or moral right -- to decide how much money should exist and what the cost of borrowing money should be." -- Ron Paul -- July 11, 2006

The dollar crisis is upon us. Congress and President Obama are avoiding the day of reckoning. The Federal Reserve is enabling profligate spending by politicians, while at the same time enriching their masters on Wall Street. Everything being done in Washington DC seems to be the exact opposite of what should be done. I think the fable of the scorpion and the frog describes our situation best. The scorpion asks a frog to carry him across a river. The frog is afraid of being stung, but the scorpion argues that if it stung, the frog would sink and the scorpion would drown. The frog agrees and the scorpion stings the frog during the crossing, dooming them both. When asked why, the scorpion points out that this is its nature. The Federal Reserve is printing money, creating inflation, enriching billionaire bankers, and dooming the country to certain collapse because that is its nature.

My intentions have been foiled again. I realize that my attempt to put our current economic predicament into perspective will now need to be a five part series. . For a Few Dollars More addressed the Baby Boomer impact on America's decline. A Fistful of Dollars examined how the Federal Reserve's actions over the last few decades have impoverished the middle class and has placed the country at the brink of collapse, The Good, the Bad, and the Ugly will address the nefarious creation of a central bank and the implementation of a personal income tax in the dreadful year 1913. Outlaw Josey Wales will scrutinize the looting of America by a small group of powerful, connected, super rich men lurking in the shadows, but pulling the strings on our puppet politicians. Lastly, Unforgiven will detail the impending collapse of our economic system and the retribution that will be handed out to the guilty.

I can't wait to see how it ends.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).