Here's a very common scenario in loan workout negotiations. Several creditors agree to some kind of temporary forbearance to keep the borrower out of bankruptcy. But one holdout creditor shows no flexibility. He prefers to push the borrower into bankruptcy, even if it means that the eventual recovery will be far less. The holdout owns a credit default swap, kept secret from everyone else, that will reimburse him immediately. With complex securitizations and credit default swaps, the opportunities for bad faith dealings in debt restructuring grow exponentially.

The only way to achieve an orderly and fair workout process is to clarify who comes to the table with clean hands.

Once the government assembles the data of what's actually happening, it can assert pressure to enforce an orderly and reasonable restructuring of America's financial albatross.

Of course, this approach holds political peril. It's easier to harangue against the banks than it is to take responsibility for the mess created by someone else. Any kind of government intervention is red meat for the tea bagging crowd. Remember how it all started in February 2009?

Do we really want to subsidize the losers' mortgages? This is America! How many of you people want to pay for your neighbor's mortgage? President Obama, are you listening?" We're thinking of having a Chicago Tea Party in July. All you capitalists that want to show up to Lake Michigan, I'm gonna start organizing.

CNBC's Rick Santelli, who disclaimed any political affiliation after his famous rant, provided inspiration for Larry Kudlow and countless others. You would think that people would have wised up by now. But consider this, the sand states' economies are all blighted by record multi-year droughts. Yet large blocks of voters are still brainwashed by a cable network that says global warming is not real.

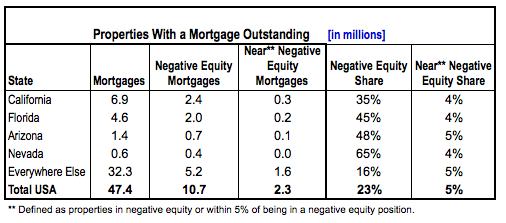

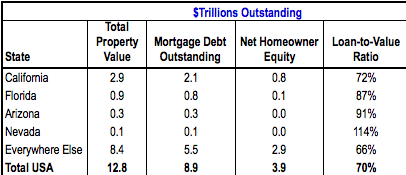

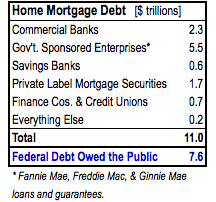

Finally, here are the numbers, simplified:

Source:First American CoreLogic

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).