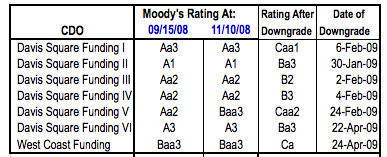

Moody's announcement, contemporaneous with the November 10 deadline, backs up Baxter's testimony. AIG's A3 rating, which had been under review for possible downgrade, was affirmed, following the government-supported restructuring plan, which included "de-risking" the CDO exposures.

The dates are critical. The New York Fed was first authorized to negotiate on behalf of AIG on November 6th, 2008, which was a Thursday. And the New York Fed believed that the absolute deadline for setting everything with 14 different banks was the following Monday, when AIG was required to file its 10-Q with the SEC. That might have been possible if the banks were motivated to cooperate. But, as The New York Timesreported, one of the largest CDO counterparties, Goldman Sachs, "did not own the underlying bonds. As a result, Goldman had little incentive to compromise."

If people have little incentive to compromise, they don't make themselves available over a four-day holiday weekend. It's a safe bet that most senior bankers and bank regulators in France took that Monday, November 10, as a vacation day to segue into Armistice Day. The same was true for a lot of bankers in the U.S., where Veterans Day is a bank holiday.

There's another reason why a banker would be disinclined make himself available over the weekend. He would need to assemble a group of very a senior executives in order to say, "I need an emergency approval to agree to something that will force us to write off billions of dollars on a deal that's been the subject of contentious negotiations for the past fifteen months. And the reason why I need an answer right away is because..." If you convene such a meeting, you need to be prepared for tough questions, which may include, "Are we legally required to do this?' or "Are the other banks also taking a comparable haircut?" If you value your career, you'd better have some good answers to show that you are acting on behalf of the bank.

On Friday, November 7, 2008, a subsidiary of Societe Generale, another large CDO counterparty, put AIG on notice that it had defaulted on the swaps of several CDOs. And those defaults could not possibly be cured. Those defaults were triggered by the S&P and Moody's downgrades.

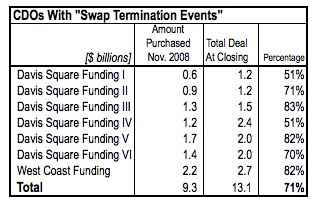

Trust Company of the West, an SG subsidiary, was the collateral manager for Davis Square Funding I, Davis Square Funding II, Davis Square Funding III, Davis Square Funding IV, Davis Square Funding V, Davis Square Funding VI, and West Coast Funding I. All of those deals, with the exception of Davis Square Funding II, were originally structured and underwritten by Goldman. Each of those deals is a separate legal entity. Each of those entities had entered into one or more swap agreements with AIG Financial Products. Under the various swap agreements, if AIG were ever downgraded below certain levels, AIG had so many days to find a substitute swap counterparty, with a higher rating, to assume AIG's contractual obligations. Of course, in the fall of 2008, no substitutes were to be found. Nobody was interested in becoming the swap counterparty to a bunch of toxic CDOs.

If 30 days had passed following the downgrade, and AIG had failed to find eligible substitutes, the entities were entitled to terminate the swaps. But Trust Company of the West did not deliver those notices of termination on October 15, or November 3, when those rights first became effective. Only after the New York Fed took over negotiations did TCW deliver that notice on Friday, November 7, the last business day before AIG was required to file its 10-Q, and the day after the New York Fed took over the process. At the Paris headquarters of TCW's parent, the business day is over by noon, New York time.

When testifying before Congress, Neil Barofsky, the Special Inspector General for TARP, said, "I think very much these negotiations could have been conducted in a different way, a more forceful way." Yes, the negotiations might have been very different, if the New York Fed had more than two business days to wrap up a a contentious 14-bank negotiation that had dragged on for 15 months.

The unexamined part of the negotiation was AIG's incentive to acquire majority control over these seven CDOs. The deal with the banks was twofold: terminating the credit default swaps which insure the banks' investments ion these CDOs, and also turning over the underlying CDO investments. By acquiring those investments, the New York Fed, through Maiden Lane III, also acquired majority control over the seven CDOs managed by TCW. On March 6, 2009, TCW went to court, seeking a declaratory judgement to terminate all the relevant swaps. Because the New York Fed controlled the legal entities, it was able to effectuate a withdrawal of the suit 10 weeks later. The Fed's ability to control the process was part of the "de-risking" that Moody's referenced on November 10, 2008. It's an issue that has not been adequately examined by Barofsky, Congress or the press.

As with everything related to the backdoor bailout of the banks, timing and dates are critical. In the weeks and months following the de-risking of AIG's CDOs, the ratings of those seven deals were slashed severely. The ratings agencies are regulated by the Federal government. There is no way that Congress can understand the AIG bailout without carefully scrutinizing the decision making process behind these specific ratings and subsequent downgrades.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).