Likewise, some may argue that wealthy people, for whom Social Security benefit checks are just play money, should be taxed on their benefits to help pay for the program. I don't have a problem with that notion either. Again, it would be easy to set some level -- perhaps $80,000 for an individual or $120,000 for a retired couple -- after which Social Security income would be taxed. But it clearly should be set at a level that only affects well off retirees, not people who are struggling to get by as is the case today.

These are demands that everyone in America should support. Retirees clearly want it. So do people nearing retirement. And younger people, who want the best for their parents and grandparents, and who certainly don't want to have to support their elders while they are also saddled with the cost of raising kids of their own or paying off their college debts, should support them too.

Once we've won this battle over the taxing of Social Security benefits, which is premised upon a return to the basic concept behind Social Security, which was to alleviate poverty among the elderly and disabled, we can turn to the necessary bolstering of the Social Security system for everyone. We need to ensure that those working and paying into the system now can rest assured that it will be there in full for them when they reach old age. Currently over a third of millennials, thanks to scare stories from conservative politicians, shameless ad campaigns by financial advisory firms and mass media propaganda, say they don't believe Social Security will be there for them when they get old.

The first step in easing those fears and fixing the system is to act now, and to get rid of the politicians in Congress -- mostly Republicans -- who have been stalling and delaying, causing the price of fixing the system before 2034 to rise by the year in hopes that it will eventually be so high that the system will collapse, leaving us all to the tender mercies of the Darwinian capitalist system as it was before 1936.

Nobody, Republican or Democrat, who doesn't agree to a fix of Social Security's future funding in the next Congress that gets seated January 3, should be returned to office. Period.

And no fix they come up with should come out of the pockets of workers or retirees.

So where do we get the money? Actually it's still not that hard to find. The first thing is to eliminate entirely the cap in income -- currently $128,400 per year -- after which no FICA tax is owed. Let the rich pay the full 6.2% on all income they earn into the system. While we're at it, let's also put a FICA tax on so-called "unearned income" from non-retirement investments (not IRAa and 401(k) funds -- and also a small tax -- say 0.5% -- on high-speed computerized and day-traded stocks and bonds. These measures alone would probably solve the problem with Social Security's long-term funding, but we could also raise benefits to allow our elderly and disabled to live better.

How? Well, if you think about it, there is absolutely no reason why the employer share of the FICA tax has to be equal to the share paid by their workers. In Europe, where government social security pensions are generally much more generous, often intentionally designed to allow retirees to maintain their standard of living after retiring from their jobs, it is common for employers to pay substantially more in payroll taxes into the system than do their employees. Just adding another 2% to the payroll tax paid by employers in the US for each worker's salary would most of the way towards keeping Social Security adequately funded until the last Baby Boomer has departed this world (about 2064 when the last Boomers born in 1964 will be turning 100). Allowance could be made for the self-employed and for small businesses with only a few employees so they wouldn't get hit with those increases. (Years ago, self-employed people didn't pay the employer share, or didn't pay it in full. That approach should be re-adopted, especially given the trend among large employers to turn their employees into "independent contractors" without benefits.)

We need to do all this so that our kids and grandkids can have confidence that when they reach retirement the Social Security program that they are currently paying taxes for will be there for them, and that it will be adequate for them to survive on.

Social Security is not the "ponzi scheme" that conservatives love to call it, nor is it an annuity where you pay in money and then get it back with interest. Rather it is and has been from day one a contract between generations in which the current working population pays for the benefits of current retirees, expecting future worker to pay for their own retirement benefits. The only problem, totally unintended but unavoidable and to some extent unanticipated, is that we're all living longer as time goes by, partly thanks to improving medical science and increased access to medical care, and in part because we, as a people, are living better than we lived in the past. And we're having fewer children. But we still have that contract and need to stand by it. That requires the young to keep supporting a program that is paying benefits to their parents and grandparents, and for the elderly to keep supporting a program that will be taking care of their offspring when they reach retirement age.

It's that simple.

The only problem is a political class that cares more about the welfare of Wall Street and the rich who pay for their political campaigns and election or re-election than they do for the people they ostensibly represent: the people of the United States.

That needs to change.

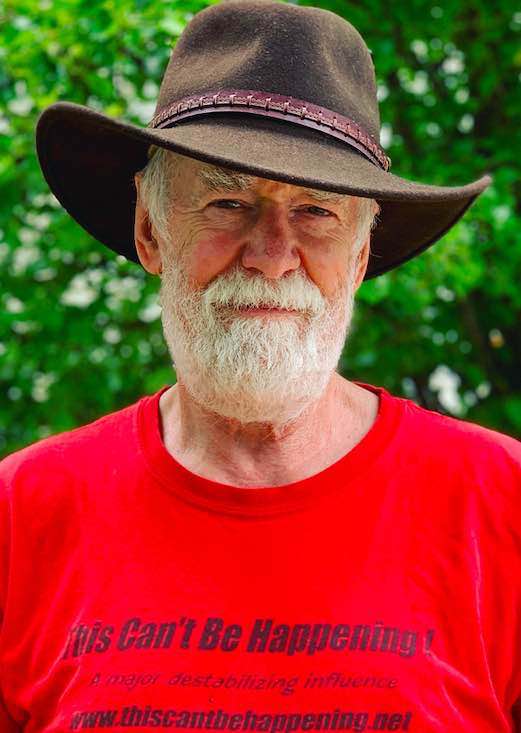

Full disclosure: The author is 69 and will begin collecting his full Social Security benefit in April of next year. He has two children who are currently paying plenty in taxes for their own retirement. While he has no intention of retiring at 70, he wants to insure that his and his wife's and his friends' and relatives' Social Security benefits are secure and that all our kids will also have full Social Security benefits available to them decades from now when they become eligible for them

be found at www.thiscantbehappening.net

fo(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).