This is probably the most important paper I ever wrote since my article (in French) in le Brognart a defunct weekly for Paris finance professional: "La Bonde du Jacuzzi." Let's call it my closing argument before the jury gets out on Sept. 9th.

After being to late on Monday "The Nemesis of Bonds Yield Bottom" and too late on Tuesday for the reversal on long dated treasuries yields, "The Nemesis Update". I finally got my hammer on the 10 Years US Treasury Notes.

What is ahead?

With the auction on 7 years US Treasury notes coming out tomorrow, which I expect to be bad although not dismal with very low indirect buyers,and as every one knows, with primary security dealers pushing rates up before the auctions (in order to get a high volume at a cheap price.) It is almost a done thing that we will have a gap on the upside on the 10 Years US Treasury which will build a two days island reversal plus a hammer. A very bearish technical configuration for long dated Treasuries.

What is very important to notice is the fundamental environment in which this technical took place. It is clear that yesterday none of the economic figures were good they were all worse than expected:

Consensus Consensus Range Actual

What any trader knows is that if a market trades against the fundamentals it demonstrate a strong capacity to go forward. We know that at the minimum and in a matter of days the yield on the 10 Years US Treasury Notes will close the gap they left when going down and will, at the minimum, get to 2.690% in just a few days.

More importantly it underscores my analysis: I said in "Update on the Nemesis":

What it means is clear: although the demand for investment necessary to maintain the prevalent level of economic activity is very low, probably less than 2.40% on 10 years (discounted for all the risks except interest rate risks). The offer of funds is higher and will get even at higher rates as the market get closer to the fair valuation of long-term interest rates. This is precisely the kind of development I was expecting since the spring of 1994!Although dismal news are in the pipeline long term rates bottomed as the undervaluation of long term yield became unsustainable from an option valuation point of view..

This is precisely why we reached "The Limit of Quantitative Easing."

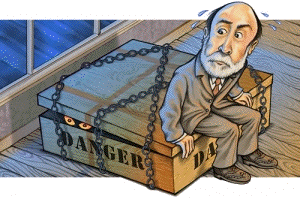

Bernanke Dig His Jackson Hole:

As we may have noticed now every time the Chairman spoke about how he intended to stimulate the economy it rose expectations. We, the vulgus pecum look up at him as the Deus ex Machina.

Bernanke's Helicopter Could Move to New Altitude

Key Jackson Hole question: What more can, and will, the Fed do?

MarketWatch.

If only he didn't run out of gas!

Jackson Hole more goat rodeo than Bretton Woods

Commentary: Fed's weekend conclave unlikely to solve pending crisis

MarketWatch

When we discovered that the King was naked the reactions of markets were always negatives. When we will find out that the Fed has run out of bullets and that even if they can lower the yields of long dated treasuries the result will be even higher risk spreads for corporate loans (the purpose of Quantitative Easing is precisely to lower these yields) the reactions on the bond market will be formidable!

Bill Gross is prone to be prescient on the Bond Market and do something stupid at the last moment (last time was buying MBS immediately after the Great Recession Crash!

What we Need to Watch:

Apart from the fall of long dated Treasuries we need to watch Libor as banks will come to realize that trading with each other is not that safe after all and the famous Credit Default Swap, which both should be increasing sharply from tomorrow on.

A sharp decrease in short term Treasuries Yields (With a term below 2 years that could possibly become negatives.)

Stock market might not be a good indicator.

We have also to look closely on both the Ted Spread and the infamous Credit Default Swaps. Expect an sharp increase of the insurance premium.

Finally and apart from the normal flux of macro economic figures (especially unemployment data) we must watch the auction of 10 Years US Treasury Notes on September 8th and especially the auction of 30 Years US Treasury Bonds on September 9th, which I expect to be dismal.

Friday Sept 10th a, after the close, the number of failed banks as published by the FDIC.

Anecdotes:

The Hindenburg Omen:

This is a buzz on Wall Street now:

Google Trend for Hindenburg Omen

Yes Folks, Hindenburg Omen Tripped Again from the Wall Street Journal.

Hindenburg Omen on Wikipedia

Note that 40 days after the first occurrence of the Hindenburg Omen is September 21st.

The Quadruple Witching Hour:

September Friday 17th from 4:00 PM EST to 5:00 PM EST is Quadruple Witching Hour, which is prone to high volatility.

Rosh Hashana and Yom Kippur:

There is a say on Wall street: "Sell at Rosh Hashana, buy at Kippur." well bad luck this year Rosh Hashana fall on September 9th, the day of that dismal 30 Years US Treasury Bonds auction and Yom Kippur fall on a Saturday immediately after the Quadruple Witching Hour.

This year Erev Yom Kippur, falls on Sept 17th,2010 or 9th of Tishrei, 5771, 911!

Eidal-Fitr (Arabic: Ø �Ù�Ø � Ø �Ù"�Ù �Ø �Ø � 'Ä �du l-Fia' � r� ��Ž)

The Eid (the sacrifice that marks the end of Ramadan will fall (approximately) on September 10th.

For us economists holidays are a way to coordinate the economic activities of those who celebrate as well as those who don't. (confer Christmas for Christians, Passover for Jews,Indian marriage season,...)

You might not believe these urban legends but your opinion or mine are irrelevant to the stock market. What counts is what the average opinion believes the average opinion will be. This is what you must discover:

In one of the greatest investment markets in the world, namely, New York, the influence of speculation (in the above sense) is enormous. Even outside the field of finance, Americans are apt to be unduly interested in discovering what average opinion believes average opinion to be; and this national weakness finds its nemesis in the stock market.

What do we Need to Do:

As I have explained since May on the event "MarketCrash: be Prepared" on Facebook which with 12 days to go has 473 participants:

Don't own any long term assets:

------------------> from September 09th, 2010 at 9:00 AM EST.

------------------> till September 17th, 2010 at 4:00 PM EST.

Long-Term Assets:

Long-term assets are anything you own which is not directed to your own day to day consumption: businesses, Stocks, debt instruments, real estate, and commodities including gold or silver.

The proceeds must be held either in cash or invested in short-term Treasuries (maturing in less than two years and held with the emitting treasuries. (With Treasury Direct for the US Dollar.)

No holding must be deposited with any bank.

Playing the Market Crash:

Given the date of our planned market crash it can be played in a very simple and cheap way:

From the September 1st to September 17th at the open buy out of the money up to 100 points out for SP500!) put on stock index traded on any American market with an expiration date on September 17th at 5:00 PM EST or later. Being so close to the expiration their price will be ridicule even if VIX is high nowadays: it is all a question of timing!

Paying for a high implied volatility price is not the problem in that case. For most of us the transaction price will be even bigger thanthe cost of the option.

Chairman Ben Shalom Bernanke ticking bomb: 13, 12, ..., 1, 0!

With 13 Days to Go:

Our Facebook Page "The Post Crash Economy" has 354 fans.

Our Facebook Group "Prepare for Market Crash Before September 9th." has 69 members.

Consequences:

On Sept. 22nd, I will, on "Market Crash: be Prepared"start to display a series of videos in which I will present my alternative to the Deep Depression as a way to limit its chaotic social, political, military consequences.

"History teaches us that men and nations behave wisely once they have exhausted all other alternatives".

Disclosure: No Positions