(Article changed on September 6, 2013 at 18:34)

(Article changed on September 6, 2013 at 13:31)

The rapid growth of rooftop solar in the US has caught the attention of electric utilities companies who now see distributed power as a threat to their business model. In the past ten years the number of rooftop solar instillations taking advantage of net metering (explained below) has grown 60 fold to cover over 300,000 homes nationwide. The following graph from the U.S. Energy Information Administration depicts the growth of rooftop solar. The full EIA report can be viewed here: http://www.eia.gov/electricity/monthly/update/?scr=email

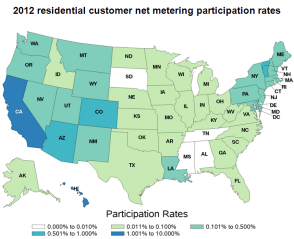

While the number of homes with rooftop solar is still less than 1% of all residential customers, the trend suggests this mix will rapidly change in the coming years. At present, all but four states have passed laws permitting net metering incentives for homeowners. California presently leads the nation in the number of homes with rooftop and other home based power generation. The next graph shows how net metering instillations are distributed among the states.

The economics behind the jump in solar instillations is largely influenced by an 80% decline in the cost of solar panels over the last 10 years and by the Energy Policy Act of 2005, which requires all public utilities to offer net metering to customers upon request.

Net metering allows consumers to directly subtract the kilowatts hours they generate from the kilowatts hours they use at the retail rate they pay per kilowatt hour for electricity. If they generate slightly more electricity than they use they are credited and can carry over that positive balance for a time so they can use it to offset periods where they use more energy than they generate. Additionally, net metering requires that rooftop solar systems may not be designed to generate more energy than the average use for a given home. In other words, a rooftop solar system cannot be used to generate more energy than the homeowner typically uses in a year. The exact details of how net metering works varies from state to state, but the concept is the same.

The problem, as framed by the energy companies, is that they are buying back electricity from customers at the same retail rate they sell it to consumers rather than buying it at the wholesale rate they pay power generation companies. The marginal difference between the wholesale rate and retail rate includes the expenses associated with transmission, distribution and maintenance of the electrical infrastructure (in addition to the utility company's administrative expenses and profits). They claim that rooftop solar customers are no longer contributing their fair share towards these essential costs, shifting this burden to the utility companies and their non-solar customers. In the power industry's view, the per/customer cost of maintaining the system will rise as the number of non-solar customers fall. Additionally, grid operators say they face additional costs associated with modifying the distribution system that allows electricity to flow both directions.

Solar and renewable energy advocates say the energy companies arguments are specious and disingenuous. They say that the utility companies their real agenda from the beginning has been to preserve their profits and basic business model.

In a recent article by EE News's Climate Wire, Bryan Miller of the Alliance for Solar Choice is quoted as saying the alleged cost burden for upgrading the utility grid for two way transmissions isn't true because solar companies are already paying for any legitimate circuit upgrades needed to connect solar customers to the grid. He also pointed out that the peak hours of solar generated power corresponds with periods of peak demand. This relives transmission congestion which saves money utility companies money. Peak shaving more than offsets grid interconnection costs, according the Mr. Miller.

Other advocates have pointed out other value added savings for utility companies. Distributed generation by rooftop solar customers reduces line transmission losses. According to one source, in California, the largest solar market, distributed generation is cutting transmission losses by up to six-percent. Because solar generation peaks during peak demand periods, utility companies need to buy less electricity on the spot markets at higher wholesale prices. Additionally, customer based solar instillations improve the renewable energy mix for utilities relieving them of costs related to meeting federal guidelines for improved efficiency and greater use of renewable energy over time. On balance, advocates claim that rooftop solar delivers more value than it uses while utility companies argue that government grants and tax breaks offering up front incentives for solar conversion are better than ongoing rate-based incentives.

The net metering debate in California could set a precedent for the rest of the nation. In a recent article published by Greentech Solar, both sides in the net metering debate seem to be coming together in a bill ( AB 327 ) that would modify net metering for future rooftop solar customers. In the case of California, the net metering regulations passed in that state were set to expire. Also, a provision in the law specified that the net metering would not be available to customers once the total of distributed generation reached 5% of the utilities total electricity. The agreement that is emerging would keep in place the net metering arrangement for those who already have it and preserve their rate structure. It would also remove the 5% cap on the net metering arrangements, but establish a different rate structure for new net metering customers going forward. If passed, AB 327 would require the California Board of Public Utilities to come up with a new rate structure that is more acceptable to the energy utility companies. The bill states that after January of 2017:

["] all new eligible customer-generators shall be subject to the standard contract or tariff developed by the commission and any rules, terms, and rates developed pursuant to subdivision (b) of this section, and shall not be eligible to receive net energy metering pursuant to Section 2827. There shall be no limitation on the number of new eligible customer-generators entitled to receive service pursuant to the standard contract or tariff after January 1, 2017" .

Early adaptors of rooftop solar or other consumer based energy generation systems are likely to have an financial advantage over those who come later. In general, net metering based on retail energy rates is considered an incentive program to encourage development of solar, wind and other renewable energy sources. The upfront conversion expenses for consumers will remain substantial in the near term. Government grants, tax breaks and current net metering structures are designed to overcome these barriers. Just how much value distributed solar energy has for utilities is still an open question complicated by the fact that laws and regulations vary from state to state. Advocacy groups are needed in every state to balance the interests of consumers and environmentalists against the interests of the big utility corporations.

Correctional note of 9/6/2013: The emerging agreement on California's AB327 bill would keep the net metering rate structure in place, not eliminate it as I mistakenly stated prior to this update.