Simpson and Bowles, those two hired pitchmen for budget-cutting hysteria, are still hawking an economy-killing product called "austerity economics," a product that's designed to benefit their wealthy patrons at everybody else's expense. This philosophy provides some (very thin) intellectual cover for the Republicans' lunatic bloodbath of spending cuts.

Of course, Simpson and Bowles and austerity's other sales people aren't really economic thinkers. They're paid to pitch a product. They didn't invent austerity any more than Alex Rodriguez invented Pepsi.

But what they're peddling isn't a soft drink. It's a lot worse for you than that.

Snake Oil

You don't believe that Simpson and Bowles are frauds, snake-oil salesmen trying to lure you into a bait-and-switch for the rich and powerful? See for yourselves:

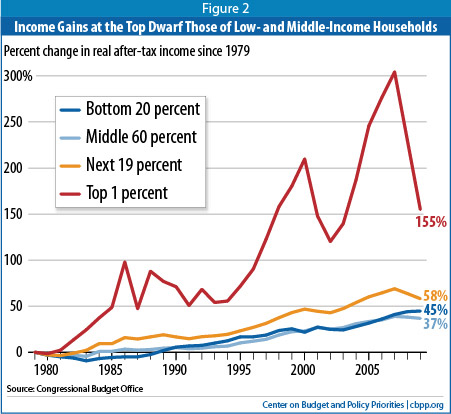

The wealthiest among us captured almost all of the after-tax income gains from the late 1970s up to the financial crisis (which accounts for the sharp drop at the right -- a drop that still left them well ahead of everyone else).

And, as Emanuel Saez has shown, the wealthy captured 121 percent of the "recovery" gains since the 2008 crisis. In other words, they were able to capture even more of our national income after the crisis, while everybody else fell behind.

With the rich earning so much more of our national income, you'd expect Federal tax revenues to go up. After all, they're supposed to pay a higher percentage of their income than everyone else. That might be scant comfort for the pillaging of the middle class, but it's something, right?

Wrong.

Corporations have had it even easier. Take a look:

Total tax revenues have plunged, and corporations are paying far less of the tab than they used to. Does that mean that the wealthy are picking up the slack for corporate tax dodgers?

No. As an analysis originally conducted by the Tax Foundation shows, the effective tax rate for millionaires -- the amount they actually pay -- fell from 66.4 percent in 1945 and 55.3 percent 1965 to 32.2 percent after the Bush tax cuts. While the recent compromise has shifted those figures slightly, billionaires and other very high earners are still paying roughly half of what they paid during the period of our greatest economic growth. They're even paying less than they paid under Reagan.

Who does that leave to pick up the tab? Presumably you and me.

And yet, when Erskine Bowles and Alan Simpson make their spiel, they actually combine their "deficit reduction" pitch with an appeal to lower tax rates for the highest earners and corporations.

They call it "Tax simplification that eliminates loopholes, lowers rates and raises revenue." We call it by a more accurate name: Voodoo.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).