President Obama announced the new National Commission on Fiscal Responsibility and Reform on February 18 to address astronomical federal budget deficits. There has been considerable speculation that this commission will target current and future benefits for Social Security recipients to achieve its goals.

Why would this be the case? We need look no further than the treatment of major retirement funds over the past 20 years to get the answer. When the mob needed cash, it looted the Teamsters retirement fund. When large corporations or government entities get in trouble, they effectively borrow from their employee retirement funds by delaying required payments or otherwise gaming the programs. This provides a source of ready cash, a quick vehicle to cover management errors, or jack up their bonuses.

Think of the Social Security Trust Fund (trust fund) as the most lucrative retirement fund in the country, the ultimate pot of gold, and you'll immediately understand why it is that for decades, big business has plundered the trust fund. How does this happen?

The Biggest Retirement Fund Rip Off Ever

Each year, federal taxes fall short of covering government expenditures. At the same time, Social Security payments are more than enough to cover retirement benefit payments. However, in order to keep funding the rest of its programs, the government takes money paid into the trust fund in return for special issue securities from the Federal Government. These securities (IOUs) are a promise to repay the trust fund, which will then pay your benefits.

The Social Security payroll taxes paid by over 90% of US citizens are the premier means of funding the national debt, well ahead of foreign debt holdings. The 2010 Annual Report by the Board of Trustees noted that, "assets held in special issue U.S. Treasury securities grew to $2.5 trillion" (p. 10).

If there were absolutely no anticipated problems honoring the promised payout of the special issue securities, IOUs, this process might be acceptable. But mega deficits have become habitual behavior in the budget process. Year after year, the government spends money it doesn't have through the vehicle set up to tap your social security payroll taxes.

This entire process is presented as sound budgeting. In reality, it's a scam. Sure we'll pay back the trust fund, no problem. But there is a problem and it is not due to Social Security. It's due to excessive spending authorized by Congress that consumes the trust fund annually, spending driven by those big corporations who benefit most and receive payment through your payroll taxes.

Left alone, the Social Security trust fund can meet its obligations. The rest of the government can't. The 2010 $1.3 trillion deficit makes that abundantly clear. The biggest budget busters are the corporate entitlement programs: defense and homeland security contractors; agricultural subsidies for large corporate farms; and the numerous companies who receive large contracts through the federal budget. In addition, the endless wars in Asia now account for $160 billion annually.

The corporate beneficiaries of those programs want money. They behave as though they're entitled to it. Social Security revenues flow in at rates set by the board of trustees. The receipts, sufficient to fund benefits, are then swallowed up by the true entitlement programs that produce no offsetting revenues.

Ironically, as this budget scam comes to a head in the form of astronomical deficits due to corporate entitlement programs, those who created the problem, the cash hungry beneficiaries of government spending, declare a crisis in Social Security. It is a crisis that they created.

Rigged Commission

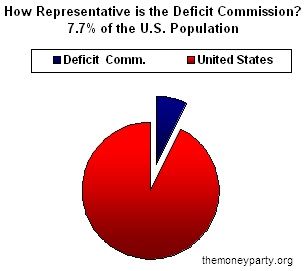

The commission is a rigged panel. The White House selected eighteen members due to report out recommendations for reducing the federal deficit by December 1. Of the eighteen, thirteen are sure votes for higher payroll taxes and lower benefits and the continued reliance on the payroll tax trust fund to keep budget busting programs in place. There are five possible votes against tax increases and lower benefits, although the five lack the cohesion of the thirteen likely to endorse higher payroll taxes and lower benefits.

It takes a majority of fourteen members to report recommendations to Congress. These will be considered by the lame-duck session of the 111th Congress meeting in November and December. Congress will debate the commission recommendations then take an "up-or-down" vote. There will be no amendments allowed, just Yea or Nay on the entire proposal. The all-or-nothing vote makes it easy for Congress to do the dirty work of the Money Party. After the vote, members of Congress will bemoan what a tough decision it was.

The president selected Wall Streeter Erskine Bowles as co-chairman along with former Republican Senator Alan Simpson as the other co-chairman. Simpson has a history of hostility to Social Security. The president hand picked four other members, two Republicans and two Democrats. With the exception of former Service Employee International Union president Andy Stern, this corporate heavy group is a solid vote for ongoing trust fund subsidies for corporate budget items through increased payroll taxes and reduced benefits. Stern may feel some pressure due to a leaked FBI corruption investigation targeting his actions while president of the union. The anti Social Security vote count among these presidential appointees looks like a solid five to one.

The party leaders in the House and Senate picked three members each for a total of twelve members from the 111th Congress. With the exception of Sen. Richard Durbin (D-IL), the Senate contingent represents small, highly conservative, mostly white states.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).