With individuals more focused on saving than spending, Behravesh said retail consumer spending as a percentage of GDP is likely to fall from 70 percent to 65 percent. � ���"It will take a while, maybe 10 years,� �� � he said. � ���"Correspondingly other countries are going to have to shift in the opposite direction to rely more on their own consumers rather than the U.S. consumers.� �� �[64]

Jason DeSena Trennert, Chief Investment Strategist for Strategas Research Partners, says:

Consumer spending as a percentage of GDP is going to go in one direction for a long time -- lower. [65]

Time points out :

Economist Stephen Roach, chairman of Morgan Stanley Asia, says that "there is good reason to believe the capitulation of the American consumer has only just begun." U.S. consumer spending as a percentage of GDP reached 72% in 2007, well above the pre-bubble norm of 67%. Using that as a gauge, Roach says that only 20% of the potential retrenchment of spending has taken place, even after the dramatic decline at the end of 2008. "The imbalance that contributed to the crisis � ��" overconsumption and excessive savings � ��" cannot continue," says Ajay Chhibber, director of the Asia bureau at the United Nations Development Program in New York City. "The model where you stimulate and [then] go back to the old days is gone."[66]The Wall Street Journal notes:

"Economists also see an upturn in U.S. household saving as the beginning of a prolonged period of thrift....."[67]

Demographics

Financial analysts who have studied U.S. demographics - like Harry Dent and Claus Vogt - point out that the U.S. population is aging:

United States Population Pyramid for 2010

United States Population Pyramid for 2020

United States Population Pyramid for 2050

Vogt argues that an aging population within a given nation is correlated with a decline in that country's economy. [69]. Certainly, a population with less working-age people and more dependent elderly people will experience a drag on its economy.

Dent

argues that one of the main drivers of a country's economic growth is

the number of people in the country who are in their peak spending

years.

For example, Dent says that in the U.S., 45-54 year

olds are the biggest spenders, because that is when - on average - they

are paying for their kids' college, paying mortgage on the biggest

house they will own during their life, etc. Dent argues that the

American economy will tend to grow when the number of 45-54 year olds

grows, and to shrink when it shrinks.

Decline in Manufacturing

As everyone knows, the manufacturing has shrunk in the United States and the service sector has grown. Even in a manufacturing center such as Detroit, manufacturing jobs have been declining for decades:

Indeed, according to professor of economics Dr. Mark J. Perry, manufacturing jobs have dropped to their lowest level since 1941, and are now below 9% of the workforce for the first time. [71]

Wayne State University's Center for Urban Studies argues:

For each job lost in the manufacturing industry, more spinoff jobs are lost than would be in other sectors. Each manufacturing job helps support a larger number of other jobs than do most other sectors. [72]That means that the ongoing reduction in manufacturing jobs will adversely affect unemployment for the foreseeable future.

Destruction of Credit

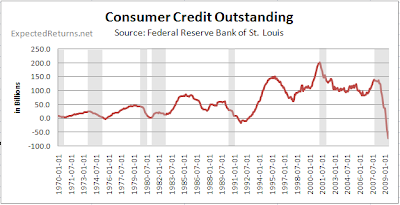

The amount of credit outstanding has been reduced by trillions of dollars in the past year.

For example, the amount of consumer credit outstanding has plummeted:

Banks have become tight-fisted about lending, and this will probably not change any time soon. As the New York Times wrote in an article from October 2008 entitled "Banks Are Likely to Hold Tight to Bailout Money":

"Will lenders deploy their new-found capital quickly, as the Treasury hopes, and unlock the flow of credit through the economy? Or will they hoard the money to protect themselves?

Next Page 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).