It was Lucy with the football, and DiNapoli was Charlie Brown lying on his back. To add insult to injury, the industry arranged for the Trump administration to lift a block on offshore oil drilling along the Atlantic coast -- including Long Island, where DiNapoli began his political career. As an environmentalist.

So the question is, what happens next. Exxon, for instance, has another shareholder meeting later this month. Big investors have already announced that they find Exxon's climate-risk report "defective." It's possible that they'll just ask for another one and the charade will carry on for a few more years, and a few more tenths of a degree, and a few more inches of sea-level rise. It's a dance everyone has grown comfortable with. The Independent Petroleum Association of America recently wrote a letter to the Financial Times saying "active engagement will always be the practical choice for investors," the operative word being "always."

If you wonder why the oil industry doesn't mind the DiNapolis of the world using it as an occasional punching bag, it's because the alternative -- divestment -- truly scares them. In the past six months, a pair of academic studies have demonstrated that the six-year campaign has had two powerful effects. One of those studies showed that divestment had dragged the issue of climate change, and the oil industry's culpability for it, squarely into the political mainstream, "dramatically alter[ing] the climate change debate." That was our aim as campaigners from the start -- we wanted to help take away fossil fuel's social license. But even we were surprised to read the other study, which demonstrated that divestment had actually begun to cost the industry real money.

As the researchers put it, "We've concluded that investors, and the market as a whole, perceive divestment as integral to the long-term valuation of the fossil fuel industry. Lower share prices increase the costs of capital for the fossil fuel industry, which in turn decreases their ability to explore new resources." Which is just what the physicist ordered.

The oil industry is slowly being cornered, like the tobacco industry before it. Just as they once promised to go "Smoke Free," towns across the country are now pledging to go "Fossil Free," banning new fossil-fuel projects and committing to 100 percent renewable energy for all. New York City is suing the five biggest oil companies for the damages that came with climate change; so are San Francisco and Seattle, where the county executive put the case plainly: "The companies that profited the most from fossil fuels should help bear the costs of managing these disasters," he said, and it's hard to disagree -- or to add up the potential damages.

Sea-level rise alone is likely to be costing the planet tens of trillions (with a T) of dollars by the end of the century -- and even at their most profitable back in the dirty old days, oil companies didn't make that kind of money. Cities are likely to be underwater, but so are investments.

So the moment has come when the steady stream of divestment announcements needs to turn into a flood. And Tom DiNapoli might still turn out to be a bit of a hero. After all, no one can claim to have tried longer and harder to make Exxon and its ilk see the light. And he's still trying: Reached for comment, DiNapoli's office told me, "Given Exxon Mobil's disappointing 2 degree scenario report, we continue to push the company to adapt to the growing low carbon global economy." But in March, DiNapoli and Cuomo announced the creation of the Decarbonization Advisory Panel, which will evaluate divestment and other strategies for dealing with climate change. Its first meeting was in early May, and when DiNapoli made a recent campaign stop in Manhattan's West Village, journalists reported that divestment was his office's "goal," but that DiNapoli said it needed to be done carefully to avoid damaging pensioners: "We have to balance it. I'm going to approach it in a very deliberate way," he said.

Which would be fine with the divestment movement, which from its start has asked only that leaders commit to selling stock, and take a maximum of five years to do it. But with carbon dioxide hitting levels not seen in 15 million years, DiNapoli and others need to get the ball rolling right this minute, standing up to the anti-science policy pouring out of Washington. What matters is the message that he and others decide to send, the level of courage these leaders muster. Because it's not DiNapoli's fault that Exxon won't budge -- it turns out that the tiger in the tank simply won't change his stripes. It's only DiNapoli's fault if he won't budge, he and the others like him who cling to the old normal.

You wouldn't have guessed the state comptroller of New York might make a palpable difference in how high the seas will eventually rise or how many species will persist into the next century. But he and a thousand others like him could -- and it would be a gift worth far more than that $108.

Next Page 1 | 2

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).

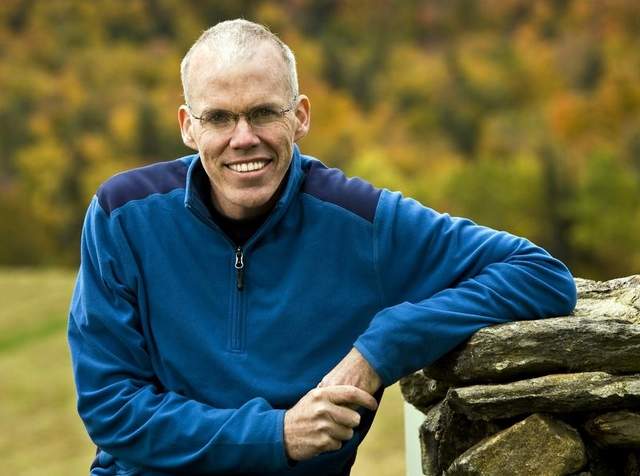

Bill McKibben is the author of a dozen books, including The End of Nature and Deep Economy: The Wealth of Communities and the Durable Future. A former staff writer for The New Yorker, he writes regularly for Harper's, The Atlantic Monthly, and The (

more...)