SHARE |

|

Ellen Brown is an attorney, founder of the Public Banking Institute, and author of twelve books including the best-selling WEB OF DEBT. In THE PUBLIC BANK SOLUTION, her latest book, she explores successful public banking models historically and globally. Her websites are http://EllenBrown.com, http://PublicBankSolution.com, and http://PublicBankingInstitute.org.

OpEd News Member for 954 week(s) and 3 day(s)

291 Articles, 2 Quick Links, 545 Comments, 4 Diaries, 0 Polls

List By Popularity

Page 1 of 5 First Last Back Next 2 3 4 5 View All

More Banks to Fail? Not in North Dakota U.S. banks are again in the crosshairs. Standard and Poor's has downgraded five new middle-tier banks and put three others on negative outlook. This follows sweeping downgrades earlier in August by Moody's, which cut credit ratings on 10 banks and placed four of the 15 largest U.S. banks on review for possible downgrade. As with the banks going into"

How to green our parched farmlands and finance critical infrastructure America achieved it's greatest ever infrastructure campaign in the midst of the Great Depression. We can do that again today and we can do it with the same machinery: off-budget financing through a government-owned national financial institution.

A Reset That Serves the People To the extent that prices are rising it is not from money printing but from lockdowns and supply chain disruptions and shortages, the same disruptions triggering price inflation globally.

The Coming Global Financial Revolution - Russia Is Following the American Playbook No country has successfully challenged the U.S. dollar's global hegemony-until now. How did this happen and what will it mean?

The Real Antidote to Inflation Stoking the Fire Without Burning Down the Barn - The Fed has options for countering the record inflation the U.S. is facing that are more productive and less risky than raising interest rates.

Nature's Own Fuel Could Save Us From the Greenhouse Effect and Electric Grid Failure Hemp fuel and other biofuels could quickly reduce carbon emissions while saving the electric grid, but they're often overlooked for more expensive, high-tech climate solutions.

Going From Mom-and-Pop Capitalism to Techno-Feudalism In a matter of decades, the United States has gone from a largely benign form of capitalism to a neo-feudal form that has created an ever-widening gap in wealth and power.

Tackling the Infrastructure and Unemployment Crises: The "American System" Solution The National Infrastructure Bank of 2020 can rebuild crumbling infrastructure across America, pushing up long-term growth, not only without driving up taxes or the federal debt, but without hyper-inflating the money supply or generating financial asset bubbles.

Why the Fed Needs Public Banks The Fed's policy tools -- interest rate manipulation, quantitative easing, and "Special Purpose Vehicles" -- have all failed to revive local economies suffering from government-mandated shutdowns. The Fed must rely on private banks to inject credit into Main Street, and private banks are currently unable or unwilling to do it. The tools the Fed actually needs are public banks, which could and would do the job.

From Lockdown to Police State: The "Great Reset" Rolls Out All this is such a radical curtailment of our civil liberties that we need to look closely at the evidence justifying it; and when we do, that evidence is weak.

When Profits and Politics Drive Science: The Hazards of Rushing a Vaccine at "Warp Speed" More than 100 companies are competing to be first in the race to get a COVID-19 vaccine to market. It's a race against time, not because the death rate is climbing but because it is falling - to the point where there could soon be too few subjects to prove the effectiveness of the drug.

Meet BlackRock, the New Great Vampire Squid BlackRock is a global financial giant with customers in 100 countries and its tentacles in major asset classes all over the world; and it now manages the spigots to trillions of bailout dollars from the Federal Reserve.

Another Bank Bailout Under Cover of a Virus State and local governments with a mandate to serve the public interest deserve to be treated as well as private Wall Street banks that have repeatedly been found guilty of frauds on the public. How can states get parity with the banks? If Congress won't address that need, states can borrow interest-free at the Fed's discount window by forming their own publicly-owned banks.

Crushing the States, Saving the Banks Banks can now borrow effectively for free, without restrictions on the money's use. Following the playbook of the 2008-09 bailout, they can make the funds available to their Wall Street cronies to buy up distressed Main Street assets at fire sale prices, while continuing to lend to credit cardholders at 21%.

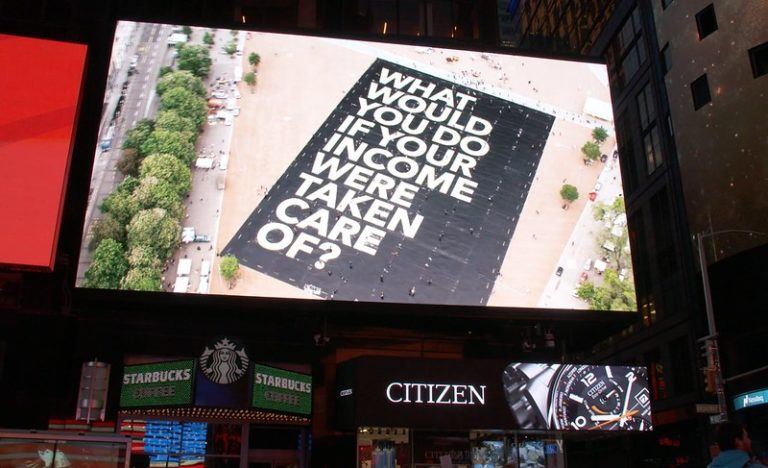

A Universal Basic Income is Essential and Will Work A government-mandated shutdown has left households more vulnerable than at any time since the Great Depression, a UBI seems the most direct and efficient way to get money to everyone who needs it. But critics argue that it will just trigger inflation and collapse the dollar.

Was the Fed Just Nationalized? Wall Street and the stock market were driven onto life-support by a virus. It took only a few days for Congress to unanimously pass the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which will be doling out $2.2 trillion in crisis relief, most of it going to Corporate America with few strings attached.

Socialism at Its Finest after Fed's Bazooka Fails In what is being called the worst financial crisis since 1929, the US stock market has lost a third of its value in the space of a month, wiping out all of its gains of the last three years. When the Federal Reserve tried to ride to the rescue, it only succeeded in making matters worse.

The Fed's Baffling Response to the Coronavirus Explained In an attempt to contain the damage, the Federal Reserve on March 3 slashed the fed funds rate from 1.5% to 1.0%, in its first emergency rate move and biggest one-time cut since the 2008 financial crisis. But rather than reassuring investors, the move fueled another panic sell-off.

The Fed Protects Gamblers at the Expense of the Economy Solutions are available, but Congress itself has been captured by the financial markets, and it may take another economic collapse to motivate Congress to act.

The Key to Solving the Climate Crisis Is Beneath Our Feet Saving the planet from environmental destruction is not only achievable, but that by focusing on regenerative agriculture and tapping up the central bank for funding, the climate crisis can be addressed without raising taxes and while restoring our collective health.