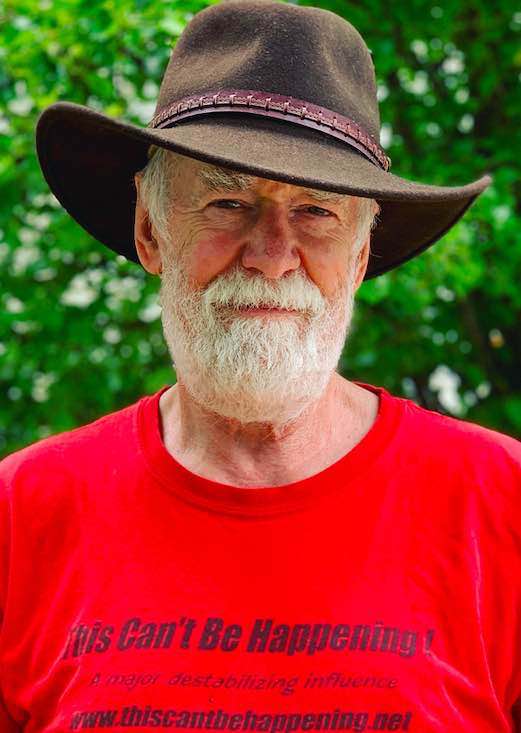

By Dave Lindorff

My bank, a small regional institution that was not involved in sub-prime lending, and that was not a recipient of any TARP bailout money, cut off my home equity line of credit two weeks ago. They did it abruptly, with no notice—I only discovered it had happened when I tried to get a $500 advance from it to cover a payment I was making on my credit card. When I asked what was going on, the local branch manager informed me that “we are closing out a lot of credit lines while we reassess the value of houses in this region, which have been falling.”

Now, in my particular case this was ridiculous. First of all, in our county, just north of Philadelphia, property prices have been static, but not falling. Furthermore, I had taken out a $160,000 mortgage 12 years ago, and it was now paid down to $60,000, and my balance on the home equity credit line was pretty small, so there was no way that we were in any way “under water”—in fact our equity in our home is much higher than it was 12 years ago.

The bank informed me that it was no problem. I could simply take out a new credit line, at no charge, and transfer the balance on the current line over to the new one. The only hitch: Instead of paying one percent over prime as I had been, I would be paying nearly 4 percent over prime on that balance, effectively doubling the cost of borrowing money.

This kind of thing is going on all across America, as banks that once spread around credit like a Philadelphia Democratic Party ward captain on Election Day, start tightening the screws on individuals and on small businesses.

While the Obama administration and the Treasury and the Fed are bulldozing funds into the coffers of the big banks, allegedly to get them to lend, the banks, from the largest to the smallest, are pulling back, afraid that borrowers will end up going bust on them. So much for economic stimulus efforts.

Not that borrowers have been lining up to get credit. Rather, most people, if they aren’t simply going bankrupt or letting collection agents harass them for nonpayment, are trying to pay off credit card balances, and to cut expenses. With official unemployment approaching 10%--a level it may hit this month—and real unemployment, as measured the way it used to be back in 1980, at closer to 20 percent, the majority of Americans not only have friends and family members who are unemployed or working part-time or at odd jobs involuntarily, but are worried about getting the axe themselves.

Meanwhile, the short-lived but incredibly expensive Obama rescue program, like a stagecoach at the end of a spaghetti western chase scene, is about to have the wheels fall off and go sliding over a cliff.

Bond yields and commodity prices are spiking as investors are waking up to the reality that massive borrowing by the US Treasury and massive printing of money by the Federal Reserve are going to lead to serious, perhaps even hyper inflation of the dollar. That in turn will force the Fed at some point, probably fairly soon, to raise interest rates, choking off not only those so-called economic “green shoots” that the cheerleading media have been citing as evidence that the recession is “bottoming out,” but also even the recent stock market rise, which was being touted as one of those signs of economic “spring.” On Tuesday, the interest rate or “yield” on the benchmark 10-year Treasury Bill jumped from 3.86% to 3.98 percent, and at one point went over 4%. Meanwhile, crude oil prices rose to over $70/barrel—an odd thing given the significant decline in demand caused by the global recession, but evidence that investors are anticipating a dollar slump and aren’t interested in supply and demand issues. Other commodity prices are also jumping for the same reason.

News that the big banks that were recipients of hundreds of billions of dollars in federal TARP loans were paying some of that money back to the government in order to be able to go back to their old ways was hardly reassuring. Those banks, like Bank of America and Citibank and Goldman Sachs, are not suddenly healthy. They have used accounting gimmicks to disguise the fact that they are what some economists have dubbed “zombies,” with liabilities far in excess of their assets. And they will stay that way, while enriching their top managers with bloated salaries and “bonus” payments, while keeping credit tight and available only to the absolutely best corporate borrowers.

Obama’s wars in Iraq and Afghanistan are going from bad to worse. There is no savings coming out of Iraq, as he had claimed would happen during last year’s presidential campaign, and even if there were, it’s all simply being transferred over to Afghanistan, where the US war effort is morphing from a small special forces operation into a full-scale war, destined to rival or even surpass the one in Iraq in terms of human and financial costs.

It’s all coming unglued, just as the president puts forward his signature program—a health care reform scheme that is supposed to guarantee health care for everyone in the country.

Fat chance that one has. When America’s economic house of cards finally really collapses, which looks to be starting to happen now, there simply won’t be any cash in the till for health care.

So far, most Americans remain unaware of the scale of this crisis. The news media continue to tout shamelessly whatever signs of recovery they can detect, leaving all those whose personal finances are falling apart to feel like it’s just their problem. Astonishingly, given the extent of the joblessness, there has been no national jobs march on Washington, no mass protests over the inadequacy of unemployment benefits, which reach only a minority of workers and are at levels far below what they were in prior recessions, no sit-down strikes at companies that are laying workers off or cutting salaries. The labor movement, such as it is at this point, is so wedded to Obama and the ruling Democrats, and so narrowly focused on trying to win passage of the seemingly doomed Employee Free Choice labor law reform bill, that the unions aren’t trying to organize any mass actions to demand economic justice.

Maybe this public passivity in the face of rampant corporate welfare and corporate pillage will come to an end as unemployment benefits begin to run out and unemployment rates continue to climb.

The coach is heading for the cliff, but there is still time for people to jump out.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).