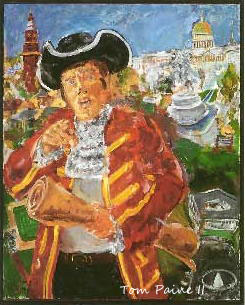

To Free A Lender-Owned Nation

The rich ruleth over the poor, and the borrower is servant to the lender. Proverbs, 22:7

Part I. Greenbacker Lawsuit Highlights 21-Year Treasury-Fed Coin-Swap Cover-Up

An 1862 "greenback"

This is the first of four articles writing up an activist litigation that I filed in federal court in San Francisco on December 28, 2011, against the U.S. Treasury. Johnson v. Department of the Treasury of the United States, et al. , case No. CV11 6684 (NJV). The suit alleges suppression of debate re great benefits that the government would automatically gain from replacing Federal Reserve notes with new issues of United States notes.

Part I introduces the issues.

Part II will present the lawsuit's scaffolding of facts and law, that raises the issues.

Part III will detail the Treasury-Fed Coin-Swap Cover-Up.

Part IV will add context.

The 1862 greenback's green back

1. The Subprime Dollar

Ha! Ha! Ha! How very funny! We don't even own our money!

[Greenbacker slogan]

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).