SHARE |

|

He is the author of The Best Way to Rob a Bank is to Own One, and câ??founder of Bank Whistleblowers United.

OpEd News Member for 671 week(s) and 0 day(s)

88 Articles, 0 Quick Links, 0 Comments, 0 Diaries, 0 Polls

Articles Listed By Date

List By Popularity

List By Popularity

Page 1 of 5 First Last Back Next 2 3 4 5 View All

SHARE  Wednesday, June 28, 2017

Wednesday, June 28, 2017

Those to Blame for the Grenfell Fire Victims Include Tony Blair There are many people culpable for the mass loss of life in the Grenfell fire in London. At this time, we know enough about the fire and its causes to be able to discuss these matters with sufficient confidence to draw preliminary conclusions.

Those to Blame for the Grenfell Fire Victims Include Tony Blair There are many people culpable for the mass loss of life in the Grenfell fire in London. At this time, we know enough about the fire and its causes to be able to discuss these matters with sufficient confidence to draw preliminary conclusions.

(1 comments) SHARE  Tuesday, March 28, 2017

Tuesday, March 28, 2017

Why Did Preet Bharara Refuse to Drain the Wall Street Swamp? Dedicated to modern money theory (MMT) and policies to promote financial stability and the attainment of full employment.

Why Did Preet Bharara Refuse to Drain the Wall Street Swamp? Dedicated to modern money theory (MMT) and policies to promote financial stability and the attainment of full employment.

SHARE  Thursday, February 16, 2017

Thursday, February 16, 2017

Andrew Ross Sorkin's Attempt to Make Tim Geithner a Hero I am watching the film Too Big to Fail based on Andrew Ross Sorkin's book of the same name. It led me to check out the price of the used book, which has fallen to $1.02, which is low enough that I am willing to buy a copy of the book, particularly since not a penny will go to Andrew Ross Sorkin.

Andrew Ross Sorkin's Attempt to Make Tim Geithner a Hero I am watching the film Too Big to Fail based on Andrew Ross Sorkin's book of the same name. It led me to check out the price of the used book, which has fallen to $1.02, which is low enough that I am willing to buy a copy of the book, particularly since not a penny will go to Andrew Ross Sorkin.

(1 comments) SHARE  Friday, January 27, 2017

Friday, January 27, 2017

Not 4 Sale: A Principle and a Slogan for Real Democrats This article explains three critical reasons why the Democratic Party's leaders are far more insane than all but a few Democrats understand. It focuses on the leaders of the Democratic National Committee (DNC) and the New Democrats.

Not 4 Sale: A Principle and a Slogan for Real Democrats This article explains three critical reasons why the Democratic Party's leaders are far more insane than all but a few Democrats understand. It focuses on the leaders of the Democratic National Committee (DNC) and the New Democrats.

(4 comments) SHARE  Thursday, January 26, 2017

Thursday, January 26, 2017

The New Democrats' Addiction to Austerity Will Not Die the Democrats should never mimic the Republicans' dishonesty, hysteria, and willingness to inflict austerity on the people of America and the world. Unfortunately, the New Democrats embraced the economic malpractice of austerity with the passion of a convert.

The New Democrats' Addiction to Austerity Will Not Die the Democrats should never mimic the Republicans' dishonesty, hysteria, and willingness to inflict austerity on the people of America and the world. Unfortunately, the New Democrats embraced the economic malpractice of austerity with the passion of a convert.

(4 comments) SHARE  Wednesday, October 26, 2016

Wednesday, October 26, 2016

Debt Derangement Syndrome: Saving Our Grandkids from Wall Street Pete Peterson is back, and his message and rhetoric are always the same. The federal budget deficit is a disaster and -- any day now -- will produce massive inflation. Peterson has written his 20,000th version of this fantasy in the NYT with Paul Volcker. The first rhetorical game that Paulson plays is to assert that it is bad for a sovereign nation to run budgetary deficits because they are not "sound and sustainable."

Debt Derangement Syndrome: Saving Our Grandkids from Wall Street Pete Peterson is back, and his message and rhetoric are always the same. The federal budget deficit is a disaster and -- any day now -- will produce massive inflation. Peterson has written his 20,000th version of this fantasy in the NYT with Paul Volcker. The first rhetorical game that Paulson plays is to assert that it is bad for a sovereign nation to run budgetary deficits because they are not "sound and sustainable."

(22 comments) SHARE  Friday, October 21, 2016

Friday, October 21, 2016

Plutocrats Brag: We Win Because You Fail to Vote The New Democrats and their Republican counterparts' economic policies have created a rigged system of crony capitalism. Crony capitalism produces devastating epidemics of elite fraud that have shrunk the overall economic "pie" and distributed the "pie" overwhelmingly in favor of corrupt corporate elites like Donald Trump and their political cronies like the Clintons.

Plutocrats Brag: We Win Because You Fail to Vote The New Democrats and their Republican counterparts' economic policies have created a rigged system of crony capitalism. Crony capitalism produces devastating epidemics of elite fraud that have shrunk the overall economic "pie" and distributed the "pie" overwhelmingly in favor of corrupt corporate elites like Donald Trump and their political cronies like the Clintons.

(6 comments) SHARE  Tuesday, August 2, 2016

Tuesday, August 2, 2016

Policing as a Tool of Systemic Racism In order to understand the discussion of blood libels I need to provide the reader with a very brief overview of the key policing practices most relevant to race. This thumbnail history is necessary to understand a series of paradoxes that I will discuss in this series of articles. These paradoxes often are critical to understanding the intersection of police, policing, crime, gender, age, and race.

Policing as a Tool of Systemic Racism In order to understand the discussion of blood libels I need to provide the reader with a very brief overview of the key policing practices most relevant to race. This thumbnail history is necessary to understand a series of paradoxes that I will discuss in this series of articles. These paradoxes often are critical to understanding the intersection of police, policing, crime, gender, age, and race.

(4 comments) SHARE  Tuesday, June 28, 2016

Tuesday, June 28, 2016

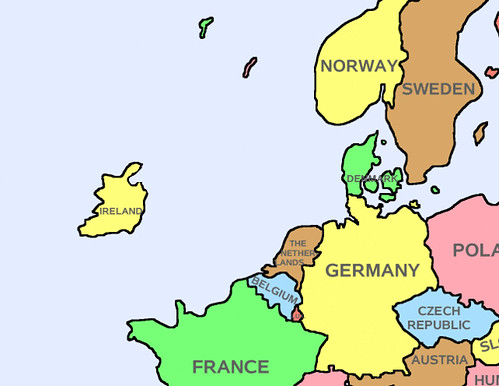

BREXIT Part 2: Roger Cohen's column on Brexit Roger Cohen published a column decrying BREXIT. Yes, "Project Fear" failed in its goal of intimidating voters. It isn't simply the "politicians" that failed, it was the "experts" -- the elites that rig the system in finance and the ideologues who create the self-inflicted wounds of EU austerity -- who designed the failed policies and grew wealthier and more powerful because of those policies.

BREXIT Part 2: Roger Cohen's column on Brexit Roger Cohen published a column decrying BREXIT. Yes, "Project Fear" failed in its goal of intimidating voters. It isn't simply the "politicians" that failed, it was the "experts" -- the elites that rig the system in finance and the ideologues who create the self-inflicted wounds of EU austerity -- who designed the failed policies and grew wealthier and more powerful because of those policies.

SHARE  Wednesday, April 20, 2016

Wednesday, April 20, 2016

Too Big to Fail From the Eyes of a Specialist Dr. William Black concludes: "One of the reasons we, the Bank Whistleblowers United, proposed getting rid of the systemically dangerous institutions through the use of banking regulators' powers...is that it allows vastly quicker remedial action than the cumbersome FSOC procedure that took over two years to designate MetLife as posing a systemic risk." Black is an economic advisor to Bernie Sanders.

Too Big to Fail From the Eyes of a Specialist Dr. William Black concludes: "One of the reasons we, the Bank Whistleblowers United, proposed getting rid of the systemically dangerous institutions through the use of banking regulators' powers...is that it allows vastly quicker remedial action than the cumbersome FSOC procedure that took over two years to designate MetLife as posing a systemic risk." Black is an economic advisor to Bernie Sanders.

SHARE  Friday, March 25, 2016

Friday, March 25, 2016

Democrats Need to Give Up Being Deficit Hawks Even When it Feels Good Politically The leaders of both parties share the hypocrisy of bashing the rival party for supporting budgetary stimulus in circumstances in which stimulus is vital. Particular forms of budgetary stimulus can be simultaneously desirable (relative to austerity) and inferior relative to alternative forms of budgetary stimulus.

Democrats Need to Give Up Being Deficit Hawks Even When it Feels Good Politically The leaders of both parties share the hypocrisy of bashing the rival party for supporting budgetary stimulus in circumstances in which stimulus is vital. Particular forms of budgetary stimulus can be simultaneously desirable (relative to austerity) and inferior relative to alternative forms of budgetary stimulus.

SHARE  Wednesday, February 3, 2016

Wednesday, February 3, 2016

How Many Lies Can the WSJ Pack into a Chart on Liar's Loans? How Many Lies Can the WSJ Pack into a Chart on Liar's Loans? This is the second article in my series prompted by the Wall Street Journal report that "big money managers" want to bring back "liar's loans." Given that the best study of liar's loans during the crisis found a fraud incidence of 90% -- this is a startling proof of how openly addicted to fraud the "big money managers" remain.

How Many Lies Can the WSJ Pack into a Chart on Liar's Loans? How Many Lies Can the WSJ Pack into a Chart on Liar's Loans? This is the second article in my series prompted by the Wall Street Journal report that "big money managers" want to bring back "liar's loans." Given that the best study of liar's loans during the crisis found a fraud incidence of 90% -- this is a startling proof of how openly addicted to fraud the "big money managers" remain.

(3 comments) SHARE  Saturday, January 30, 2016

Saturday, January 30, 2016

Announcing the Bank Whistleblowers' Group's Initial Proposals Announcing the Bank Whistleblowers' Group. so we ask each presidential candidate -- which portions of the Whistleblowers' 60-Day plan will you pledge to implement? We hope the candidates will commit to breaking Wall Street's power over our economy and democracy.

Announcing the Bank Whistleblowers' Group's Initial Proposals Announcing the Bank Whistleblowers' Group. so we ask each presidential candidate -- which portions of the Whistleblowers' 60-Day plan will you pledge to implement? We hope the candidates will commit to breaking Wall Street's power over our economy and democracy.

SHARE  Sunday, August 2, 2015

Sunday, August 2, 2015

The OSU Band Exemplifies Why Economists Err by Ignoring Corrupt Culture The OSU band story is featured in the Wall Street Journal in an article entitled "Holocaust Victims Mocked in Ohio State Band Parody Songbook."

The OSU Band Exemplifies Why Economists Err by Ignoring Corrupt Culture The OSU band story is featured in the Wall Street Journal in an article entitled "Holocaust Victims Mocked in Ohio State Band Parody Songbook."

(10 comments) SHARE  Saturday, July 11, 2015

Saturday, July 11, 2015

History's Largest Financial Crime that the WSJ and NYT Would Like You to Forget To review the bidding, the LIBOR bid rigging cartel was the largest cartel in history, manipulating the prices of an estimated $300+ trillion in assets.

History's Largest Financial Crime that the WSJ and NYT Would Like You to Forget To review the bidding, the LIBOR bid rigging cartel was the largest cartel in history, manipulating the prices of an estimated $300+ trillion in assets.

(9 comments) SHARE  Wednesday, July 8, 2015

Wednesday, July 8, 2015

The New York Times Urges the Troika to "Make an Example of Greece" It is often the moral and economic blindness of New York Times articles about the EU crisis that is most striking. The newest entry in this field is entitled "Now Europe Must Decide Whether to Make an Example of Greece."

The New York Times Urges the Troika to "Make an Example of Greece" It is often the moral and economic blindness of New York Times articles about the EU crisis that is most striking. The newest entry in this field is entitled "Now Europe Must Decide Whether to Make an Example of Greece."

(6 comments) SHARE  Tuesday, June 30, 2015

Tuesday, June 30, 2015

The BBC's Inept but Revealing Attempt at a Game Theory View of Greek Crisis Austerity is a coercive, non-cooperative "game" that makes both parties worse off (but aids the EU's worst politicians).

The BBC's Inept but Revealing Attempt at a Game Theory View of Greek Crisis Austerity is a coercive, non-cooperative "game" that makes both parties worse off (but aids the EU's worst politicians).

SHARE  Saturday, May 9, 2015

Saturday, May 9, 2015

Prime Minister Cameron's "Southern Strategy" Wins (and Loses) I write to emphasize the lunacy of the parties opposed to the Tories demonizing the Scots as an election strategy -- and the failure of the media to condemn Cameron for his divisive version of (in U.S. terms) "the Southern strategy."

Prime Minister Cameron's "Southern Strategy" Wins (and Loses) I write to emphasize the lunacy of the parties opposed to the Tories demonizing the Scots as an election strategy -- and the failure of the media to condemn Cameron for his divisive version of (in U.S. terms) "the Southern strategy."

(3 comments) SHARE  Saturday, April 11, 2015

Saturday, April 11, 2015

Hillary Remains Clueless About Regulation on the 28th Anniversary of the Keating Five Meeting Hillary Remains Clueless About Regulation on the 28th Anniversary of the Keating Five Meeting. But the Clintons and their bankster allies learned something far worse -- the need to push the three "de's" to ensure that never again would banksters and their political cronies be prevented from looting "their" banks or be held accountable for their looting.

Hillary Remains Clueless About Regulation on the 28th Anniversary of the Keating Five Meeting Hillary Remains Clueless About Regulation on the 28th Anniversary of the Keating Five Meeting. But the Clintons and their bankster allies learned something far worse -- the need to push the three "de's" to ensure that never again would banksters and their political cronies be prevented from looting "their" banks or be held accountable for their looting.

SHARE  Wednesday, April 8, 2015

Wednesday, April 8, 2015

The Libertarian Plea to Bring Back Jim Crow: An Oxymoron Yes, there are few things better designed to increase "liberty" than to encourage merchants to refuse service to whatever groups they hate. According to conservatives, every leading candidate for the Republican Party's nomination for the presidency rushed to embrace the right of merchants to discriminate in the Indiana Act as originally passed.

The Libertarian Plea to Bring Back Jim Crow: An Oxymoron Yes, there are few things better designed to increase "liberty" than to encourage merchants to refuse service to whatever groups they hate. According to conservatives, every leading candidate for the Republican Party's nomination for the presidency rushed to embrace the right of merchants to discriminate in the Indiana Act as originally passed.