Another Triumph for The Money Party

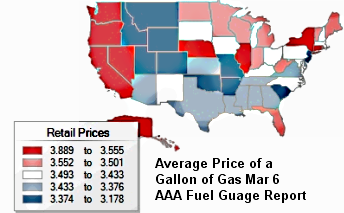

The average price for a gallon of gas rose 30% from $2.69 in July 2010 to $3.49 as of March 6. Most of that 30% has come in just the last few days.

We're about to embark on another period of let the markets take care of it. The Money Party manipulators are again jerking citizens around in the old bottom-up wealth redistribution program. Their imagineers are writing the storyline right now.

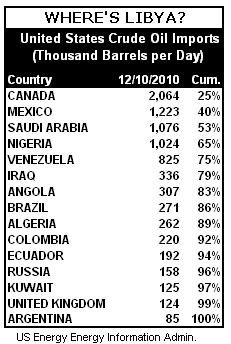

The conflict in Libya is causing the spike in oil prices over the past ten days or so according to the media script. Take a look at the chart to the right. Can you find Libya among the top fifteen nations supplying the United States with crude oil?

Why the Current Panic Over Gas Prices?

The general explanation points to the crisis in Libya as the

proximate cause. The anti Gaddafi regime revolution began in earnest on

February 17. But if the Libyan revolution were the cause, we'd have to

attribute a 50% drop

in a 2% share of the world's oil supply as the cause of the panic. We

would also have to attribute the increase in US gas prices to a nation

that doesn't impact the US crude oil supply and, as a result, should not

impact the price of gas here..

The speculators have an answer. The Libyan situation entails fears of broader unrest in oil and non-oil producing nations in North Africa and the Middle East. There is unrest, without any doubt. Citizens are insisting that their kleptocratic rulers cease and desist from looting their nation's treasuries and resources. The demonstrations across the region, revolution in Egypt, and war in Libya are all being fought under the banner of broader participation in government, greater access to essentials like food, jobs, and hope for future improvements. Notably lacking is anti-US rhetoric or religious fanaticism. (Image)

Somehow, the opportunity for secular, democratic regimes equals a crisis for US energy prices. The embedded assumption is that the conflicts leading to new regimes will cause a disruption in the flow of oil. With the exception of Libya, none of these countries have reduced their oil production, including oil producing Egypt. In fact, Saudi Arabia and the United Arab Emirates increased oil production to compensate for the short fall due to the military conflict in Libya.

If we don't believe that Libya is the cause, then we get the excuse of emerging democracies. If emerging democracies fail to catch on as the scapegoat, there will be other excuses.

The Money Party bottom line is apparent. It's time to take some more money from citizens. Any plausible reason will do. When you own the media, you have no worries. Who's going to bust you?

The Big Payday at Your Expense

The gas price shock and awe is not evenly distributed. The Western states, New York, Illinois, and Nebraska are taking the biggest hits. There's some explanation for this but not a very good one. All that matters is taking as much in extra profits as possible while the extraordinary events in Libya and the rest of the region allow a plausible storyline. This time, democracy is the villain.

These gas prices will have a direct impact on those least able to afford it. It will cost more to go to work or look for jobs. Commodities will go up even more than they are now. Transportation for the distribution of all products will have an impact on prices. Tourism will fall off. The feeble increases in hiring may be at risk and there will be more gloomy news about how this all impacts the prospects for any sort of economic recovery.

What's Really Driving Gas Prices?

In a recent Business Insider column, David Moenning noted:

"At least part of the reason behind

crude's rude rise is the price action itself. Hedge funds and other

fast-money types have begun to pile into what appears to be a burgeoning

uptrend in the oil charts (take a peek at a weekly chart of USO and

you'll see what we mean). Then when you couple the price action with the

news backdrop, this appears to be the new place to be for the "hot

money.'" David Moenning, Business Insider Mar 6

We have the usual suspects looking for hot money. The fast-money types, as Moenning calls them, smell another victory in the air. Their market activity is driving prices in a self-reinforcing cycle of increases that are highly profitable when you get in and out at the right time (and if you pull the strings for the market, that's easy). (Image: Fuel Gauge Report)

Who is looking out for our interests?

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).