When it comes to AIG's liquidity crisis, the conventional wisdom on Wall Street absolves Goldman from blame. Goldman's people, so the story goes, were smart and therefore prescient about the declining values of CDOs. So their demands for cash margin from AIG, which insured billions of toxic CDOs for Goldman's benefit, were legitimate. By contrast, AIG's people, the poster boys for financial incompetence, kept flailing about because they were in denial until everything reached a crisis point in September 2008.

Yes Goldman was smart, and yes, the people at AIG were clueless, which is why Goldman could pull off such an audacious scam. Goldman's demands for margin were made in bad faith, and possibly under fraudulent pretenses. The conventional wisdom overlooks a critical point: The legal documents had no teeth and might have been impossible to enforce.

The problems with the documents, in the context of the overall business deal, require a bit of explanation. But it's worthwhile to remember that all these deals are governed by two truisms: First, if you skip a step in analyzing a structured deal, you probably end up with the wrong answer. And second, almost everything about CDOs is kept secret in order to protect the guilty.

Transactions Designed to Prevent Any Sale On The Open Market

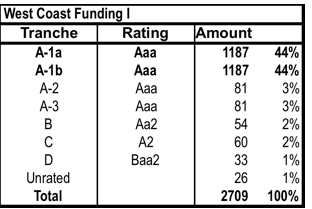

For a sense of how it all worked, consider West Coast Funding I, a $2.7 billion CDO that closed on July 26, 2006. This deal, which was underwritten and structured by Goldman, was exactly like 100 others taken on by AIG. West Coast I had seven rated tranches, of which the most senior four, representing 94% of the total deal, were rated triple-A. The two most senior tranches, A-1a and A-1b, were called "super-senior" because they ranked higher than the other triple-A slices. The exact amount of tranche A-1a was $1,187,950,000. The exact amount of tranche A-1b was $1,187,950,000.

One week before West Coast Funding I closed, on July 19, 2006, AIG Financial Products entered into two credit default swaps with Goldman Sachs International. The trades would be effective on July 26, 2006, the date on which West Coast I first came into existence. Effective that date, AIG insured $1,187,950,000, or 100%, of tranche A-1a, and $1,187,850,000, or 99.992%, of tranche A-1b. The entire super-senior tranche, about 88% of the CDO, was insured for the benefit of one bank on the same day that the CDO closed or came in to existence. This was the fixed template, from which there was almost no deviation, on virtually all of the "multi-sector" CDOs insured by AIGFP.

There was never a single day when anyone, other than AIG, ever took the direct credit risk on the super-senior tranche. The essence of the transaction, the business model for all these deals, was to preempt the possibility that the super-senior tranches could ever possibly be sold on the open market. The West Coast I Offering Circular, issued weeks later on September 16, 2006, gives no indication that 88% of the credit risk was insured by AIG, which also extended interest-rate swaps to the CDO. Again, almost everything is kept secret in order to protect the guilty.

Goldman claimed that it "sold" these tranches to third parties, but that half-truth is highly deceptive. After the deal closed, Goldman held two assets: The super-senior tranches and the credit default swaps. As the insured beneficiary, Goldman would never sell the tranche free and clear on the open market. These particular credit default swaps required physical settlement; Goldman was required to physically deliver title to the tranche securities before it could recover any insurance proceeds in case West Coast I defaulted. If Goldman lost control of the super-senior tranches of West Coast I, its swaps could become worthless.

So Goldman never sold West Coast I, or any of the other insured tranches, free and clear to anyone else. The asset "sales" were structured so that title would revert back to Goldman when it needed to collect on the swaps. In the case of West Coast I, it entered into a series of tie-in sales, package deals that assured Goldman's ability to take back title to the asset in case an insurance claim ever came due. Nominally it "sold" pieces of West Coast I to some obscure European institutions, and simultaneously insured those pieces with credit default swaps. The "buyers," ZurcherKantonalbank, and Depfa Bank and Zulma (see Tab 39 of FCIC exhibits) had no presence in the U.S. residential mortgage market. But they weren't concerned. From their credit perspective, the package deal was pretty much the same thing as buying a bond from Goldman Sachs, with some extra collateral attached. At the point when the CDO defaulted, the European "purchasers" would be reimbursed by Goldman, after they physically delivered back to the investment bank.

West Coast I was unlike many other Goldman CDOs, in that the insured beneficiary was also the bank that structured and underwrote the deal. More often than not, Goldman deals were not insured for the benefit of Goldman, but for the benefit of Societe Generale, which worked closely with Goldman to create the illusion of a real CDO market, one where banks went through the motions of buying and selling the super-senior tranches. Goldman would sell the entire super-senior tranche on a CDO's closing date, and SG would simultaneously close on an AIG swap insuring the entire tranche amount. SG never really "bought" anything free and clear, in that it never assumed one dollar's worth of direct credit risk on Goldman deals for even one single day. Goldman "sold" about $11 billion worth of CDOs for SG this way. It also "sold" another $4 billion worth of CDOs to another French bank, Calyon. But the only party that took direct credit risk on the CDOs was AIG.

Most of the deals insured for Goldman's benefit were underwritten and structured by Merrill Lynch, which was largest CDO underwriter on Wall Street. But again, Goldman "purchased" the entire super-senior tranche on the same day that the CDO was created, and on the same day that AIG insured the entire amount. It didn't matter how large or how small the tranche was, Goldman bought the entire amount and AIG insured the entire amount, and the swap required Goldman to hold on to the tranche in order to collect insurance proceeds. So there was never a moment, when any of these deals could ever be bought or purchased, free and clear, on the open market.

The Impossibility of Measuring An Undefined "Market Value" When Neither the Assets, Nor the Market, Ever Existed

In making its demands for margin, Goldman calculated the value of West Coast I as an asset that was entirely separate from its AIG guarantee. But that asset had never existed in the real world. No one had ever bought or sold those tranches severed from the umbilical cord of a double-A corporate guarantee. When people talk about "market value," they talk about an external reality check from a bona fide market, one dominated by arm's-length purchase/sale transactions, and one with a cash basis, where price discovery is ascertained by people laying out real money. The CDO market, at least the market for the $70 billion worth of super-senior CDO tranches insured by AIG, was nothing more than an illusion.

Was the concept of market value even relevant? Not according to PriceWaterhouse Coopers, the auditor for both AIG and Goldman. It had determined that, under current accounting standards, the fair value of these CDOs could not be measured according to comparable sales or market benchmarks. These were "Level 3" assets, meaning that the only appropriate way a company could measure the assets' value was on a fundamental basis, through financial models developed internally by AIG or Goldman.

Aside from the absence of any real market, or any commonly accepted measure of market value, there was no definition of "market value" in the contracts between AIG and Goldman. The term "market value," is rarely self evident in swap contracts that reference financial instruments traded in real markets. Those contracts don't simply reference the market price of oil; they reference the closing price of West Texas Intermediate quoted at close of the trading day on the NYMEX. They don't simply reference Libor, but JPMorgan Chase 30-day Libor. But the contracts between Goldman and AIG offered no guidance for measuring the market value of the CDOs.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).