It’s all been a scam, and now we’re seeing the result: banks have become so huge and their tentacles have been allowed to reach into so many parts of the economy, that all of the national ones are deemed “too big to fail.” Hence the outrageous bailout, which now has the government pledged to back over $8 trillion in bank debts. (We’re talking about a government, remember, that is itself was already technically insolvent).

So back to my car d

ealer in the post office line. “We’re not going to see things get better until people are confident enough in their incomes to invest in a new car,” he said.

How will we get there? Certainly not by keeping Citibank or B of A afloat. Those big banks should all be busted up, with the fragments left to compete, and to sink or swim along with the rest of the nation’s banks. No bank should be national in scope, and no banking institution should be able to extort federal aid by claiming it is “too big to fail.”

Instead of bailing out the big banks and their investors, the government should be expanding and making more generous the nation’s unemployment compensation program, which has always been scandalously inadequate both in the percentage of the unemployed who are covered, and in the size of the checks paid out, as well as the duration of the benefit. It should be expanding welfare benefits. It should be establishing a program to help people in danger of foreclosure to stay in their homes (note: only the wealthy get tax subsidies, in the form of 100% deductibility of mortgage interest rate payments—those too poor to use itemized deductions get no help). And it should be establishing a major program of publicly funded jobs for those whose employers have gone bust.

___________________

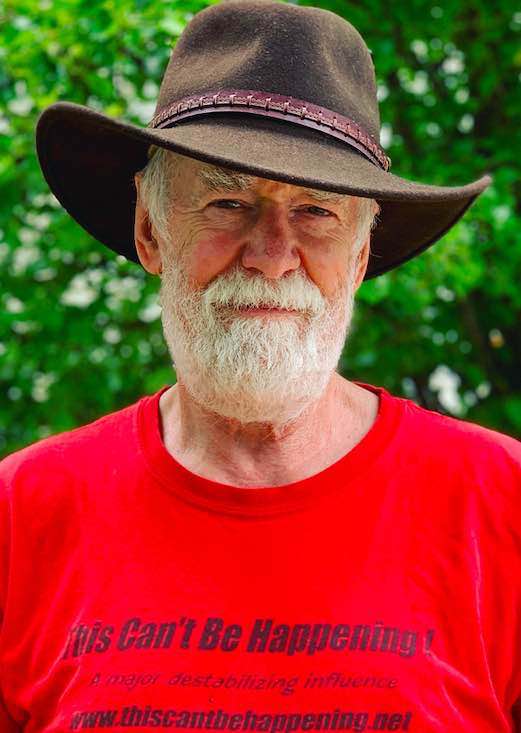

DAVE LINDORFF is a Philadelphia-based journalist and columnist. His latest book is “The Case for Impeachment” (St. Martin’s Press, 2006 and now available in paperback). His work is available at www.thiscantbehappening.net

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).