Reprinted from Robert Reich Blog

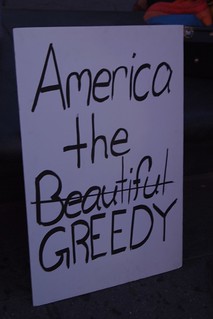

An economy depends fundamentally on public morality; some shared standards about what sorts of activities are impermissible because they so fundamentally violate trust that they threaten to undermine the social fabric.

It is ironic that at a time the Republican presidential candidates and state legislators are furiously focusing on private morality -- what people do in their bedrooms, contraception, abortion, gay marriage -- we are experiencing a far more significant crisis in public morality.

We've witnessed over the last two decades in the United States a steady decline in the willingness of people in leading positions in the private sector -- on Wall Street and in large corporations especially -- to maintain minimum standards of public morality. They seek the highest profits and highest compensation for themselves regardless of social consequences.

CEOs of large corporations now earn 300 times the wages of average workers. Wall Street moguls take home hundreds of millions, or more. Both groups have rigged the economic game to their benefit while pushing downward the wages of average working people.

By contrast, in the first three decades after World War II -- partly because America went through that terrible war and, before that, the Great Depression -- there was a sense in the business community and on Wall Street of some degree of accountability to the nation.

It wasn't talked about as social responsibility, because it was assumed to be a bedrock of how people with great economic power should behave.

CEOs did not earn more than 40 times what the typical worker earned. Profitable firms did not lay off large numbers of workers. Consumers, workers, and the community were all considered stakeholders of almost equal entitlement. The marginal income tax on the highest income earners in the 1950s was 91%. Even the effective rate, after all deductions and tax credits, was still well above 50%.

Around about the late 1970s and early 1980s, all of this changed dramatically. The change began on Wall Street. Wall Street convinced the Reagan administration, and subsequent administrations and congresses, to repeal regulations that were put in place after the crash of 1929 -- particularly during the Roosevelt administration -- to prevent a repeat of the excesses of the 1920s.

As a result of that move towards deregulation, we saw a steady decline in standards -- a race to the bottom -- on Wall Street and then in executive suites. In the 1980s we had junk bond scandals combined with insider trading. In the 1990s we had the beginnings of a speculative binge culminating in the dotcom bubble. Sad to say, under the Clinton administration the Glass-Steagall Act -- that had been part of the banking act of 1933, separating investment banking from commercial banking -- was repealed.

In 2001 and 2002 we had Enron and the corporate looting scandals. Not only did this reveal the dark side of executive behaviour among some of the most admired companies in America -- Enron had been listed among the nation's most respected companies before that time -- but also the complicity of Wall Street. Wall Street traders were actively involved in the Enron travesty. And then, of course, we had all of the excesses leading up to the crash of 2008.

II

Where has the moral center of American capitalism disappeared? Wall Street is back to its same old tricks. Greg Smith, a vice-president of Goldman Sachs, has accused the firm of putting profits before clients. Almost every other Wall Street firm is doing precisely the same thing and they've been doing it for years.

The Dodd-Frank bill was an attempt to rein in Wall Street, but Wall Street lobbyists have almost eviscerated that act and have been mercilessly attacking the regulations issued. Republicans have not even appropriated sufficient money to enforce the shards of the act that remain.

The Glass-Steagall Act must be resurrected. There has to be a limit on the size of big banks. The current big banks have to be broken up using anti-trust laws, as we broke up the oil cartels in the early years of the 20th century.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).