SHARE |

|

He is the author of The Best Way to Rob a Bank is to Own One, and c–founder of Bank Whistleblowers United.

OpEd News Member for 599 week(s) and 0 day(s)

88 Articles, 0 Quick Links, 0 Comments, 0 Diaries, 0 Polls

Articles Listed By Date

List By Popularity

List By Popularity

Page 3 of 5 First Last Back Next 4 5 View All

(1 comments) SHARE  Friday, July 11, 2014

Friday, July 11, 2014

Survey of Bankers Unintentionally Documents their Depravity Each year, the survey unintentionally documents how depraved senior bankers are as a group. They come to praise Caesar, but end up burying him in a garbage dump.

Survey of Bankers Unintentionally Documents their Depravity Each year, the survey unintentionally documents how depraved senior bankers are as a group. They come to praise Caesar, but end up burying him in a garbage dump.

(1 comments) SHARE  Tuesday, July 8, 2014

Tuesday, July 8, 2014

It's Long Past Time for Krugman to Name and Shame NYT's Eurozone Reportage the New York Times authoring another of its endless articles that assumes that austerity is essential to a eurozone recovery. My problems are with the NYT reporters ignoring Krugman's views -- views shared by the great bulk of economists -- and with their failure to question whether austerity is the proper response to a recession.

It's Long Past Time for Krugman to Name and Shame NYT's Eurozone Reportage the New York Times authoring another of its endless articles that assumes that austerity is essential to a eurozone recovery. My problems are with the NYT reporters ignoring Krugman's views -- views shared by the great bulk of economists -- and with their failure to question whether austerity is the proper response to a recession.

(2 comments) SHARE  Tuesday, July 1, 2014

Tuesday, July 1, 2014

Implicitly Assuming that the CEO is Not a Crook Misses the Problem Gretchen Morgenson has brought a revealing study to the attention of the public in her article entitled "The CEO is My Friend, So Back Off." Here's the bad news -- the situation is vastly worse than the authors of the study conclude and the policy advice that experts offered Morgenson in response to the findings would fail where they were most needed. Company CEOs typically provide a thin veneer of faux ethical trappings...

Implicitly Assuming that the CEO is Not a Crook Misses the Problem Gretchen Morgenson has brought a revealing study to the attention of the public in her article entitled "The CEO is My Friend, So Back Off." Here's the bad news -- the situation is vastly worse than the authors of the study conclude and the policy advice that experts offered Morgenson in response to the findings would fail where they were most needed. Company CEOs typically provide a thin veneer of faux ethical trappings...

(6 comments) SHARE  Tuesday, June 24, 2014

Tuesday, June 24, 2014

The EU Center-Right and Ultra-Right's Continuing War on the People of the EU The New York Times has provided us with an invaluable column about the interactions of the EU's rightist and ultra-rightest parties. It is invaluable because it is (unintentionally) so revealing about the EU's right and ultra-right parties and the NYT's inability to understand either the EU economic or political crises.

Series: Banking (18 Articles, 50874 views), Economic Reform (99 Articles, 299832 views)

The EU Center-Right and Ultra-Right's Continuing War on the People of the EU The New York Times has provided us with an invaluable column about the interactions of the EU's rightist and ultra-rightest parties. It is invaluable because it is (unintentionally) so revealing about the EU's right and ultra-right parties and the NYT's inability to understand either the EU economic or political crises.

Series: Banking (18 Articles, 50874 views), Economic Reform (99 Articles, 299832 views)

(9 comments) SHARE  Thursday, June 12, 2014

Thursday, June 12, 2014

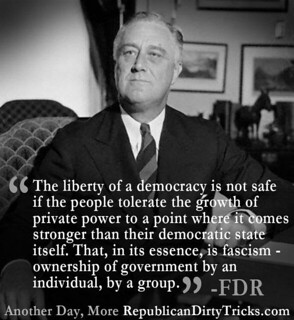

Why the Worst Get on Top -- in Economics and as CEOs Von Hayek implicitly assumes that corrupt CEOs will not control and abuse any political system. Under his own logic CEOs can use the seeming legitimacy, power, and wealth of "their" corporations to serve directly as these demagogues or fund and control proxy demagogues that will serve their interests.

Why the Worst Get on Top -- in Economics and as CEOs Von Hayek implicitly assumes that corrupt CEOs will not control and abuse any political system. Under his own logic CEOs can use the seeming legitimacy, power, and wealth of "their" corporations to serve directly as these demagogues or fund and control proxy demagogues that will serve their interests.

(6 comments) SHARE  Thursday, June 12, 2014

Thursday, June 12, 2014

Yes, Theoclassical "Economists [are] Basically Immoral" The failures of theoclassical economists and economics are total and myriad. Many of their theories are long-falsified dogmas. Their methodological preference is econometrics -- which gives the worst possible results in bubbles and when accounting control fraud epidemics occur.

Yes, Theoclassical "Economists [are] Basically Immoral" The failures of theoclassical economists and economics are total and myriad. Many of their theories are long-falsified dogmas. Their methodological preference is econometrics -- which gives the worst possible results in bubbles and when accounting control fraud epidemics occur.

SHARE  Tuesday, June 10, 2014

Tuesday, June 10, 2014

The Criminology of the "Sure Thing" Portrayed as "Risk" John Coates, a former derivatives trader at Goldman Sachs is now a researcher. He wrote a column in the New York Times entitled "The Biology of Risk" that I hope will be widely read. Coates' description of the crisis as triggered by a biologically-induced excessive risk-aversion on the part of traders rests on a failure to understand why varieties of financial risk are vastly different.

The Criminology of the "Sure Thing" Portrayed as "Risk" John Coates, a former derivatives trader at Goldman Sachs is now a researcher. He wrote a column in the New York Times entitled "The Biology of Risk" that I hope will be widely read. Coates' description of the crisis as triggered by a biologically-induced excessive risk-aversion on the part of traders rests on a failure to understand why varieties of financial risk are vastly different.

(1 comments) SHARE  Monday, June 9, 2014

Monday, June 9, 2014

GM's Cartoon Version of von Hayek's "Road to Serfdom" -- on the 70th Anniversary of D-Day Thank God that GM warned us all, decades ago, so that we could take a hard right exit off the road to serfdom. Please repeat after me the GM mantra of freedom. As a further act of unintentional self-parody, a libertarian blogger chose the 70th anniversary of D-Day to post GM's cartoon. The cartoon's premise is the supposed absurdity of the government being competent to plan anything.

GM's Cartoon Version of von Hayek's "Road to Serfdom" -- on the 70th Anniversary of D-Day Thank God that GM warned us all, decades ago, so that we could take a hard right exit off the road to serfdom. Please repeat after me the GM mantra of freedom. As a further act of unintentional self-parody, a libertarian blogger chose the 70th anniversary of D-Day to post GM's cartoon. The cartoon's premise is the supposed absurdity of the government being competent to plan anything.

(3 comments) SHARE  Wednesday, June 4, 2014

Wednesday, June 4, 2014

The Troika Continues to Harm the Eurozone and the WSJ continues to Miss the Story The ECB's failure tells us something enormously important about what is wrong with the eurozone's economy and the troika's bleeding of that economy through austerity. Indeed, its failure has been growing steadily. (Ed. Note: In Economics, Demand is defined as the desire or need for goods and services AND the ability to pay for it. Actual Demand is only the first part and exists all the time).

The Troika Continues to Harm the Eurozone and the WSJ continues to Miss the Story The ECB's failure tells us something enormously important about what is wrong with the eurozone's economy and the troika's bleeding of that economy through austerity. Indeed, its failure has been growing steadily. (Ed. Note: In Economics, Demand is defined as the desire or need for goods and services AND the ability to pay for it. Actual Demand is only the first part and exists all the time).

SHARE  Wednesday, May 28, 2014

Wednesday, May 28, 2014

Madness Posing as Hyper-Rationality: OMB's Assault on Effective Regulation Rather than leading the emergency, top priority effort to adopt the regulations to end the criminogenic environment in finance, OMB remains a leader of the effort to prevent effective regulation. In a rational world the Office of Management and Budget (OMB), under Presidents Bush and Obama, would have responded to the financial crisis by demanding an emergency effort as a top national priority.

Madness Posing as Hyper-Rationality: OMB's Assault on Effective Regulation Rather than leading the emergency, top priority effort to adopt the regulations to end the criminogenic environment in finance, OMB remains a leader of the effort to prevent effective regulation. In a rational world the Office of Management and Budget (OMB), under Presidents Bush and Obama, would have responded to the financial crisis by demanding an emergency effort as a top national priority.

(1 comments) SHARE  Monday, May 19, 2014

Monday, May 19, 2014

We've Known for 75 Years Why GM Killing Customers Isn't Treated as "Real Crime" The recent NY Times article does not report on the number of people who were injured and killed because GM designed a defective ignition system, knowingly hid the defect from its customers and the government, and once it knew that its defective design was injuring and killing its customers GM deliberately covered up the existence of the defect and the cause of the easily avoidable injuries and deaths.

We've Known for 75 Years Why GM Killing Customers Isn't Treated as "Real Crime" The recent NY Times article does not report on the number of people who were injured and killed because GM designed a defective ignition system, knowingly hid the defect from its customers and the government, and once it knew that its defective design was injuring and killing its customers GM deliberately covered up the existence of the defect and the cause of the easily avoidable injuries and deaths.

(1 comments) SHARE  Tuesday, May 13, 2014

Tuesday, May 13, 2014

Geithner's Other Ad Hominem Attacks Against Barofsky In my first article on Timothy Geithner I exposed the revealing and disgusting nature of his bizarre ad hominem attack on Neil Barofsky, the Special Inspector General for the Troubled Assets Relief Program for the great sin of providing his law enforcement officers with side arms and protective vests. In this article I discuss very briefly his other two ad hominem attacks on Barofsky and his staff.

Geithner's Other Ad Hominem Attacks Against Barofsky In my first article on Timothy Geithner I exposed the revealing and disgusting nature of his bizarre ad hominem attack on Neil Barofsky, the Special Inspector General for the Troubled Assets Relief Program for the great sin of providing his law enforcement officers with side arms and protective vests. In this article I discuss very briefly his other two ad hominem attacks on Barofsky and his staff.

(2 comments) SHARE  Wednesday, April 30, 2014

Wednesday, April 30, 2014

It's Good - no - Great to be the CEO Running a Huge Criminal Bank You know what happened; no senior banker or bank was prosecuted. No banker was sued civilly by the government. No banker had to pay back his bonus that he "earned" through fraud. Every day brings multiple new scandals. At least they used to be scandals. Now they're simply news items strained of ethical content by business journalists who see no evil, hear no evil, and speak not about evil.

It's Good - no - Great to be the CEO Running a Huge Criminal Bank You know what happened; no senior banker or bank was prosecuted. No banker was sued civilly by the government. No banker had to pay back his bonus that he "earned" through fraud. Every day brings multiple new scandals. At least they used to be scandals. Now they're simply news items strained of ethical content by business journalists who see no evil, hear no evil, and speak not about evil.

SHARE  Tuesday, April 29, 2014

Tuesday, April 29, 2014

The New Book on Regulation I Just Decided to Write: Blame it on Monaco Theoclassical economists have mounted an unholy war to discredit and intimidate regulation and regulators -- and to replace them with anti-regulators -- for over a century. This is the third article in a series of columns devoted to financial regulation prompted by the comments of a Swiss academic at the XIIth Annual CIFA Forum in Monaco.

The New Book on Regulation I Just Decided to Write: Blame it on Monaco Theoclassical economists have mounted an unholy war to discredit and intimidate regulation and regulators -- and to replace them with anti-regulators -- for over a century. This is the third article in a series of columns devoted to financial regulation prompted by the comments of a Swiss academic at the XIIth Annual CIFA Forum in Monaco.

(2 comments) SHARE  Sunday, April 27, 2014

Sunday, April 27, 2014

Corporate CEOs Demand that they be Tipped Off When a Whistleblower Reports their Crimes The goal is to minimize taxes and governmental spending by denying governments revenues. The aim is to encourage the wealthiest people to move that wealth and income to nations with the lowest taxes on wealth and income.

Corporate CEOs Demand that they be Tipped Off When a Whistleblower Reports their Crimes The goal is to minimize taxes and governmental spending by denying governments revenues. The aim is to encourage the wealthiest people to move that wealth and income to nations with the lowest taxes on wealth and income.

(1 comments) SHARE  Wednesday, April 16, 2014

Wednesday, April 16, 2014

The 11th Lesson We Need to Learn from Charles Keating's Frauds: Bring back Glass-Steagall One of the subtle aspects of the savings and loan debacle that is that we ran a real world test of the importance of the provisions of the 1933 Banking Act known as the Glass-Steagall Act. Unfortunately, Glass-Steagall was doomed by the combination of politicians eager for campaign contributions from big finance and theoclassical economists who inhabit a fantasy-based world of dogma that ignored the results.

Series: Banking (18 Articles, 50874 views)

The 11th Lesson We Need to Learn from Charles Keating's Frauds: Bring back Glass-Steagall One of the subtle aspects of the savings and loan debacle that is that we ran a real world test of the importance of the provisions of the 1933 Banking Act known as the Glass-Steagall Act. Unfortunately, Glass-Steagall was doomed by the combination of politicians eager for campaign contributions from big finance and theoclassical economists who inhabit a fantasy-based world of dogma that ignored the results.

Series: Banking (18 Articles, 50874 views)

(2 comments) SHARE  Sunday, April 6, 2014

Sunday, April 6, 2014

The Kamikaze Economics and Politics of Forcing Austerity on the Ukraine So, our strategy is to play into Putin’s hands by inflicting austerity and turning the Ukraine into “a Western hell.†Not to worry says our man in Kiev. Playing into Putin's hands by inflicting austerity on the Ukraine and producing "hell" is ludicrous. The Ukraine faces severe problems beyond Russia and its energy dependence on Russia.

The Kamikaze Economics and Politics of Forcing Austerity on the Ukraine So, our strategy is to play into Putin’s hands by inflicting austerity and turning the Ukraine into “a Western hell.†Not to worry says our man in Kiev. Playing into Putin's hands by inflicting austerity on the Ukraine and producing "hell" is ludicrous. The Ukraine faces severe problems beyond Russia and its energy dependence on Russia.

(2 comments) SHARE  Wednesday, April 2, 2014

Wednesday, April 2, 2014

Dr. Draghi Prescribes a Dose of Deflation for Spain as his latest Quack Cure This morning brought two April Fools' Day articles about France and Italy that are also about the gratuitous second Great Recession (in the core) & the second Great Depression (in Spain, Italy, and Greece) inflicted by the troika's infamous austerity dogmas. In conjunction with quotations from Draghi’s fellow troika-trolls in the articles about France and Italy, they reveal the troika’s fanatical devotion to failed dogma.

Dr. Draghi Prescribes a Dose of Deflation for Spain as his latest Quack Cure This morning brought two April Fools' Day articles about France and Italy that are also about the gratuitous second Great Recession (in the core) & the second Great Depression (in Spain, Italy, and Greece) inflicted by the troika's infamous austerity dogmas. In conjunction with quotations from Draghi’s fellow troika-trolls in the articles about France and Italy, they reveal the troika’s fanatical devotion to failed dogma.

(2 comments) SHARE  Sunday, March 16, 2014

Sunday, March 16, 2014

The Most Dishonest Number in the World: LIBOR The FDIC has sued 16 of the largest banks in the world plus the British Bankers Association (BBA) alleging that they engaged in fraud and collusion to manipulate the London Inter-bank Offered Rate (LIBOR). BBA called LIBOR "The most important number in the world." LIBOR is actually many numbers that depend on the currency and term (maturity) of the loan. The collusion involved manipulating most of these rates.

The Most Dishonest Number in the World: LIBOR The FDIC has sued 16 of the largest banks in the world plus the British Bankers Association (BBA) alleging that they engaged in fraud and collusion to manipulate the London Inter-bank Offered Rate (LIBOR). BBA called LIBOR "The most important number in the world." LIBOR is actually many numbers that depend on the currency and term (maturity) of the loan. The collusion involved manipulating most of these rates.

(1 comments) SHARE  Saturday, March 1, 2014

Saturday, March 1, 2014

Key House Republicans Almost Get Accounting Control Fraud To prepare myself for a guest lecture to a class at the University of Kansas I did some research about the House Financial Services Committee, now chaired by Jeb Hensarling (R. TX). I was pleased to learn that the Committee's home page emphasizes the key role that accounting control fraud played at Fannie and Freddie. A description of how such fraud occurs, follows.

Key House Republicans Almost Get Accounting Control Fraud To prepare myself for a guest lecture to a class at the University of Kansas I did some research about the House Financial Services Committee, now chaired by Jeb Hensarling (R. TX). I was pleased to learn that the Committee's home page emphasizes the key role that accounting control fraud played at Fannie and Freddie. A description of how such fraud occurs, follows.