I can’t believe the news today

Oh, I can’t close my eyes and make it go away

How long...

How long must we sing this song?

How long? how long...U2 – Sunday, Bloody, Sunday

Every day seems worse than the previous day. Five hundred thousand people are getting laid off every month. Our banking system is on life support. Retailers are going bankrupt in record numbers. The stock market keeps descending. Home prices continue to plummet. Home foreclosures keep mounting. Consumer confidence is at record lows. You would like to close your eyes and make it go away. Not only is the news not going away, it is going to get worse and last longer than most people can comprehend. The Great Depression lasted 11 years, but the more pertinent comparison is Japan from 1990 until today. A two decade long downturn has a high likelihood of occurring in the United States. There are many similarities between the U.S. and Japan, but in many areas the U.S. has a much direr situation. If the next decade resembles the Japanese experience, there will be significant angst and social unrest.

The talking heads on CNBC were almost unanimously predicting a second half recovery for the economy in the 1st week of January. Most of these people manage money and only earn money if dupes invest their hard earned dollars in their funds. Their analytical case for predicting recovery is that it was so bad last year that it has to go higher in 2009. This is what passes for analysis on Wall Street. The market is already down 7% in four weeks. These “experts” fail to see the big picture and have no sense of history. It took 28 years to get to this point and it will take at least a decade to repair the damage. If the politicians running this country try to take the easy way out (very likely), add another decade to the recovery timeframe. Some indisputable facts will put our current predicament in perspective:

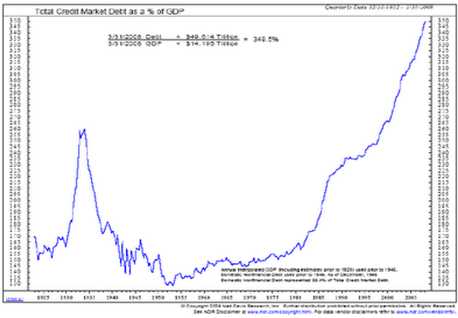

- The U.S. National Debt was $930 billion in 1980, or 33% of GDP. Today it is $10.7 trillion, or 76% of GDP. The National Debt has grown by 1,150% in 28 years. With the planned fiscal stimulus (taxing future generations), the National Debt will reach 100% of GDP during the Obama administration. When Argentina’s economy collapsed in 1998, their National Debt as a percentage of GDP was 65%. The Great Deniers say we are not Argentina. They say we are safe because the U.S. dollar is the reserve currency of the world. This is like jumping off a 20 story building and as you pass the 10th floor someone yells out the window asking how you are doing. You answer, “Good, so far”.

Source: Creditwritedowns.com

Source: Creditwritedowns.com- GDP was $2.8 trillion in 1980. Today it is $14 trillion and declining. GDP has grown by 500% since 1980. Our National Debt has grown more than twice as fast as GDP. This is an unsustainable trend. Our economic disaster took 28 years to create and will not be fixed in a year or two.

- Total US consumer debt in 1980 was $352 billion. Today, US consumer debt totals $2.6 trillion. Consumers have increased their total debt level by 738% in 28 years. Revolving credit increased from $56 billion in 1980 to $982 billion today, a 1,750% increase in 28 years.

Source: Mike Shedlock

Source: Mike Shedlock- The real median household income was $41,258 in 1980. The real median household income in 2007 was $50,233. Over the course of 28 years households are bringing home 22% more. The trickledown theory turned out to be a drip.

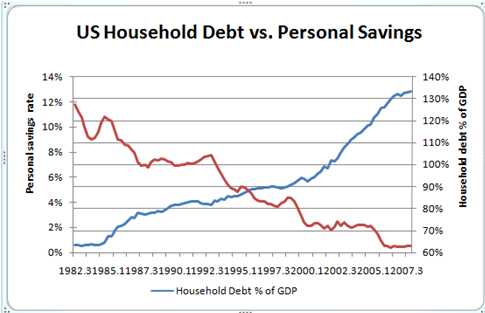

- The personal savings rate was 12% in the early 1980’s and reached negative 1% during the Bush administration. It has inched above 2% in the last few months. Based on the previous data, it is not surprising that the savings rate dropped below zero. With virtually no income growth in three decades, consumers have lived hand to mouth and utilized easy debt to maintain their desired lifestyle. This was encouraged by government, banks, big media, corporate America and advertising industry.

Source: Creditwritedowns.com

Source: Creditwritedowns.comIt is unambiguous, after examining the data, that we have borrowed ourselves to the brink of disaster. Both government and consumers have leveraged themselves to an untenable level. The only logical way to resolve this quandary is to reduce spending, pay down the debt, and increase savings. This is what consumers have begun to do. With consumer spending accounting for 72% of GDP, we are experiencing a serious recession due to the decrease in consumer spending. The excesses are being painfully wrung out of the system. This process is unacceptable to the socialist politicians who are in domination of the United States today. The government and Federal Reserve have already committed $8 trillion of taxpayer funds to bailing out criminally negligent insolvent banks. Now the Obama administration is going to spend in excess of $1 trillion in an effort to stimulate the economy. They insist that it must be bold and swift. How about well thought out, deliberative, and effective?

Every single dime of the $1 trillion will be borrowed. The government will borrow $1 trillion from foreign countries, hand it out to its constituents, while encouraging them to resume borrowing and spending. Barney Frank and Charlie Rangel will force insolvent banks to lend money to companies, consumers, and deadbeats in foreclosure proceedings. The change we can believe in is - we will borrow and spend our way out of the largest debt bubble in history. Consumers and companies are acting rationally and trying to purge themselves of debt. The government will not allow that to happen. A massive additional dose of leverage will revive the patient. The definition of insanity is doing the same thing over and over, expecting a different result. Are the politicians running this country insane, unintelligent, or just so corrupt that special interests outweigh the interests of the American people? The current pork laden stimulus package will lead to a rerun of Japan’s lost decade, with one vast difference. Our lost decade will terminate in a hyperinflationary collapse.

Japanese Experience

For all of the buy and hold, stocks for the long run, and indexing advocates, please take a long hard look at the following chart.

Source: Mike ShedlockOn December 29, 1989 the Japanese Nikkei Index reached 38,957. Today, the Nikkei Index stands at 8,106, an 80% decline over the course of two decades. It was at this same level in 1983, twenty six years ago. This is what you call a secular bear market. There have been three bear market rallies of 60% and one rally of 140%, but the market is still 80% lower than the peak. The “experts” on Wall Street will tell you this could never happen here. They also won’t tell you that we’ve already lost a decade.

Source: Mike ShedlockThe S&P 500 reached 1,553 in 2000 and took seven years to breach that level in late 2007 at 1,576. It currently stands at 850, 46% below its all-time high. It is at levels reached in 1997, twelve years ago. As the U.S. makes all of the same mistakes Japan made in the 1990’s, another lost decade with stock prices going lower is in the cards. History does not repeat, but it does tend to rhyme. The events and actions by government that led to Japan’s lost decades are eerily similar to what is happening in the U.S. today.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).

- The personal savings rate was 12% in the early 1980’s and reached negative 1% during the Bush administration. It has inched above 2% in the last few months. Based on the previous data, it is not surprising that the savings rate dropped below zero. With virtually no income growth in three decades, consumers have lived hand to mouth and utilized easy debt to maintain their desired lifestyle. This was encouraged by government, banks, big media, corporate America and advertising industry.

- Total US consumer debt in 1980 was $352 billion. Today, US consumer debt totals $2.6 trillion. Consumers have increased their total debt level by 738% in 28 years. Revolving credit increased from $56 billion in 1980 to $982 billion today, a 1,750% increase in 28 years.

- GDP was $2.8 trillion in 1980. Today it is $14 trillion and declining. GDP has grown by 500% since 1980. Our National Debt has grown more than twice as fast as GDP. This is an unsustainable trend. Our economic disaster took 28 years to create and will not be fixed in a year or two.