Peter Cooper is right, I think:

An understanding of modern money makes clear that a democratically accountable government with the backing of the greater part of the electorate would already, under present institutional arrangements, be in a position to begin an extensive transformation of social and economic institutions. But it would require going against the interests of the rich and powerful. To do that successfully, government needs the overwhelming backing of the electorate. And, for that to happen, the electorate needs to be liberated from its confusion over "money" and comprehend the viability of following such a course.

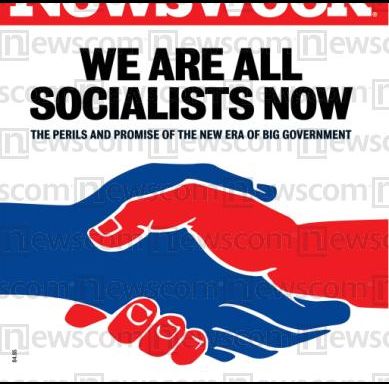

MMT will not get us where we want to go, but it will pull back the curtain on what's conjuring up the show that's been mesmerizing us. Understanding and explaining the MMT paradigm will not bring socialism, but it will get us off the yellow brick road of distraction, and point out a more direct path towards it.

Henry Ford's feared, and our hoped-for, new revolutionary day requires understanding that the earth revolves around the sun, not vice-versa. The road to a socialist dawn will dead-end unless more people understand that everything we thought we knew about taxes, spending, and money "is not just wrong -- it's backwards," and we damn well better get it turned around.

1 Modern Monetary Theory is associated with the work of economists like Warren Mosler, Steve Keen, Stephanie Kelton, Randall Wray, Michael Hudson, and others. Its academic home in the U.S. was at the University of Missouri--Kansas City, though it's branched out from there. A good primer on it can be found at New Economic Perspectives. I've also found Robert Bostwick's short pieces on it helpful.

2 Everything discussed here pertains to the realm where the fiat dollar is the Monetary Sovereign. That certainly comprises the domestic economy of the United States. International sectors based on other currencies would be another story, and beyond the scope of this discussion. But it's worth noting that the fiat dollar is also the effective reserve currency of the world--meaning almost all of international financial and most of international commercial transactions are carried out in dollars. As this discussion indicates, that makes the dollar a very powerful instrument, a key support of America's imperial hegemony. It also makes rising economic powers eager to break from the dollar, and their attempts to do so particularly threatening to the American state.

3 It's important not to confuse dollars with circulating cash in the form of physical currency. 90% of the entire dollar money -supply is comprised of deposits in (simplifying) various kinds of accounts, only 10% of it is portable physical tokens--bills, coins--of cash currency. Those coins and bills are tokens of numbers in account ledgers, the "real" money in this system. That's why governments are embarking on campaigns to eliminate cash. They can, and will, ensure that there is no money, no claims on value, untraceable to those accounts. Another virtually inevitable development that can have good or bad effects, depending on who controls it and for what ends.

Gold-bug conservatives see fiat currency as a terrible thing. They think that money must be tied to a physical commodity in order to prevent inflation and achieve "economic discipline." But why should a nation's money supply be constrained by an external commodity, subject to manipulation by the those who control the production of, or access to, that commodity? The point of a fiat currency--which modern Keynesian economists do, and socialists should, understand--is to free a polity from any external constraint against putting as much money in circulation for whatever purposes it wants.

Next Page 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).