But as I do reflect on it, and I do a lot, that nobody saw this coming. S&P and Moody's didn't see it coming, but they simply just downgrade bonds, they don't take hits. Bear Stearns certainly didn't see it coming. Merrill Lynch didn't see it coming. Nobody saw this coming.KenThompson, former CEO of Wachovia, October 2007:

I’m confident our company is in the right businesses for the long term and that our strategy of being in high growth businesses and markets, our laser focus on customer service, our expense discipline, and our commitment to strong credit risk management, will create value for our shareholders in the future.

The lesson that must be learned is that you cannot trust anything “experts” tell you. They are looking out for their own best interests, not yours. For the last two weeks I’ve watched “experts” conclude that the U.S. automakers must be saved and a stimulus package of at least $700 billion is needed to save America.

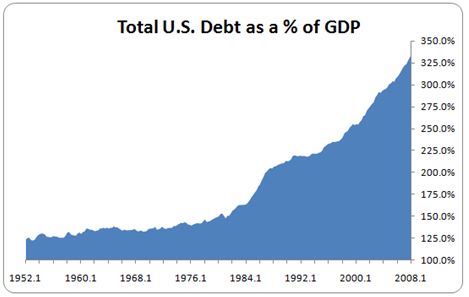

The same experts that told us everything was fine a year ago are now telling us we must spend at least $700 billion to save our economy. Why should we believe them now? Our country, our banks, our consumers, and our corporations are extremely overleveraged. We cannot stimulate ourselves out of this over leveraged situation. The debt must be paid off, and it cannot be done without much pain and sacrifice. Stimulus is just another name for more leverage.

President elect Obama says that we can’t worry about the short term impact on the deficit. When was the last time that government worried about the short-term, medium term, or long-term impact of their actions on deficits? That is why our National Debt is $10.6 trillion and we have $53 trillion of unfunded liabilities. When this crisis subsides, the government will not recapture the stimulus spending and pay down our National Debt. There will be another crisis that “must” be addressed.

SHOES FALLING EVERYWHEREDavid Goldman:

And what we have now is more dissaving, where you have got a spike in credit card usage because consumers are trying to keep up their level of consumption, when they should be reducing it and saving. So, Mr. Market is going to have to kick their teeth down their throat to change their behavior.

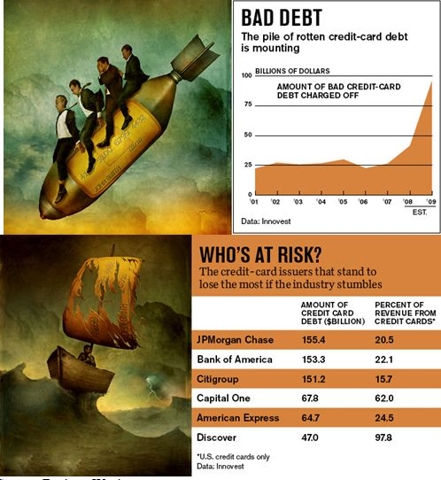

Source: Creditwritedowns.comColossal amounts of credit card debt and auto loans will be defaulting in 2009. Consumers currently owe $2.6 trillion of consumer debt, up from $2.1 trillion in 2004, or a 24% increase. $976 billion of this debt is revolving. This amounts to approximately $9,000 per household. According to a recent article in BusinessWeek Magazine Innovest projected that credit card write-offs would reach $41 billion in 2008 and $96 billion in 2009. This was before the recent upsurge in unemployment. With 3 million more job losses in 2009, the credit card losses will be much greater than $100 billion. JP Morgan, Bank of America, and Citigroup will sidle up to the taxpayer trough again due to these unforeseen losses. With their proven risk management models, these banks have managed to loan 30% of these funds to subprime borrowers. This is much higher than the 11% of subprime mortgage borrowers. This will surely end well.

Source: BusinessWeek

Nationwide, an estimated $575 billion in new and used auto loans are written every year by auto manufacturers, banks, credit unions and other lenders. About 30% of the loans that are originated by banks, and 100% of those issued by automaker financiers, are, like mortgages, repackaged and sold as securities, according to the Consumer Bankers Assn. Most lenders offer financing on 100% or even 125% of the sticker price, and some offer the most credit-worthy buyers loans for twice the value of the vehicle they’re purchasing. The average amount financed for new cars reached 99%, according to the Consumer Bankers Assn., up from 95% in 2005. With the average length of auto loans exceeding 5 years and the tremendous downturn in demand, there are millions of consumers underwater with their car loans. Rising home equity and easy credit are history. Losses on auto loans will soar in 2009. If there are public companies that make money by repossessing cars, their stocks should soar in 2009.

It is quite clear that consumers are collapsing. The toxic combination of reduced spending and mass layoffs will bring down the last remaining pillar of the economy, commercial real estate. According to the Wall Street Journal,

Commercial real-estate loans, including commercial mortgage-backed securities and collateralized debt obligations, total $3.7 trillion. It is only a slow burn right now: Many of those CMBS and CDOs mature in 2010 and 2011, leading Barrack to predict a “refinancing crisis” in the next three years–and with buyers drying up, egress will be difficult. “The overriding problem for all refinancing issues is that sale is not a viable option. Who stands to hurt the most? The list starts with the biggest holders of the loans, which include insurance companies, hedge funds and banks, specifically regional banks.

After the coming horrific holiday sales, weak heavily indebted retailers will be filing for bankruptcy en mass. Mall owners that had expanded hastily with generous amounts of debt in the last few years will see rents dry up and their debt payments will choke them to death. Vacant strip malls and ghost town regional malls will dot the landscape. With 2 million job losses this year and likely 3 million more in 2009, the need for office space is declining rapidly. Office occupancy will decline and rental income will tank. There are over $700 billion of commercial back mortgage securities outstanding. Banks have done their usual magic and sliced and diced junk into AAA rated securities. I’m sure there won’t be further implications to our banking system.

There are $50 trillion of credit default swaps still outstanding. The hundreds of billions in taxpayer funds that have been poured into AIG have been used to pay out CDSs. According to the brilliant bank analyst, Chris Whalen, at least $15 trillion of these CDSs will need to be paid out. All the Central Banks in the world cannot create that much paper out of thin air. He insists that the government needs to let AIG go bankrupt and get our system functioning correctly:

President-elect Obama and the American people have a choice: embrace financial sanity and safety and soundness by deflating the last, biggest speculative bubble using the time-tested mechanism of insolvency. Or we can muddle along for the next decade or more, using the Paulson/Geithner model of financial rescue for the AIG CDS Ponzi scheme and embrace the Japanese model of economic stagnation.

Next Page 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).

Is America on a Downward Slope?By Jim Quinn (Page 6 of 8 pages) Become a premium member to see this article and all articles as one long page. 4 comments

|

|

|

Rate It | View Ratings |

James Quinn is a senior director of strategic planning for a major university.

James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of (more...)

The views expressed herein are the sole responsibility of the author

and do not necessarily reflect those of this website or its editors.

OpEdNews depends upon can't survive without your help.

If you value this article and the work of OpEdNews, please either Donate or Purchase a premium membership.

STAY IN THE KNOW

If you've enjoyed this, sign up for our daily or weekly newsletter to get lots of great progressive content.

If you've enjoyed this, sign up for our daily or weekly newsletter to get lots of great progressive content.

To View Comments or Join the Conversation: