A dedicated group within Controllers performs an independent price verification of the mortgage inventory. The team is highly specialized and has extensive experience in the valuation of mortgage related products...Price verification analysis utilizes four core strategies, [including] Fundamental analysis [which] utilizes discounted cash flow (DCF), option adjusted spread (OAS) or securitization analysis. Observable market data or inputs are incorporated when available and appropriate.

Almost certainly, the disclosure of those cash flows would have been damning, not because Goldman had overstated the declines in values of the CDOs insured by AIG, quite the opposite. It might have revealed how Goldman and others had been artificially propping up the values of toxic securities, as part of an elaborate pump and dump scheme.

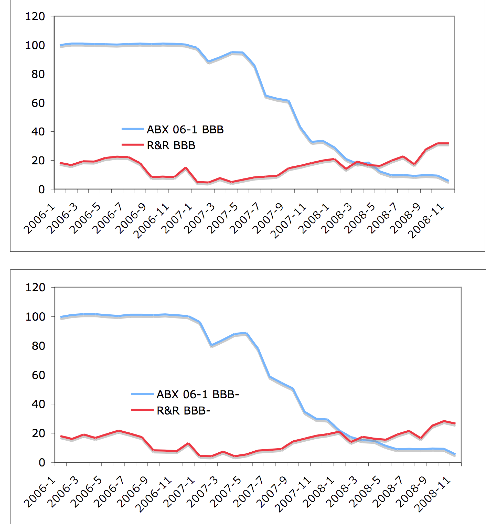

Two years ago, Sylvain Raynes, formerly of Goldman and Moody's and currently a principal at R&R Consulting, replicated the type of cash flow analysis done by Goldman and every major Wall Street bank. By statistically evaluating the cash flows of the 20 subprime bonds referenced in the ABX 2006-1 indice s, Raynes calculated their composite values beginning in January 2006, when the ABX was first launched. Beginning in January 2006, all of the indices, aside from the AAA index, were worth pennies on the dollar. In December 2006, Goldman closed on its new $2 billion CDO, Hudson Mezzanine Funding I, which insured all of the BBB and BBB- bonds in the ABX at 100 cents on the dollar. In the months that followed, Goldman offered up ABACUS 2007 AC-1, Anderson Mezzanine Funding, and other toxic CDOs that were designed to fail.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).