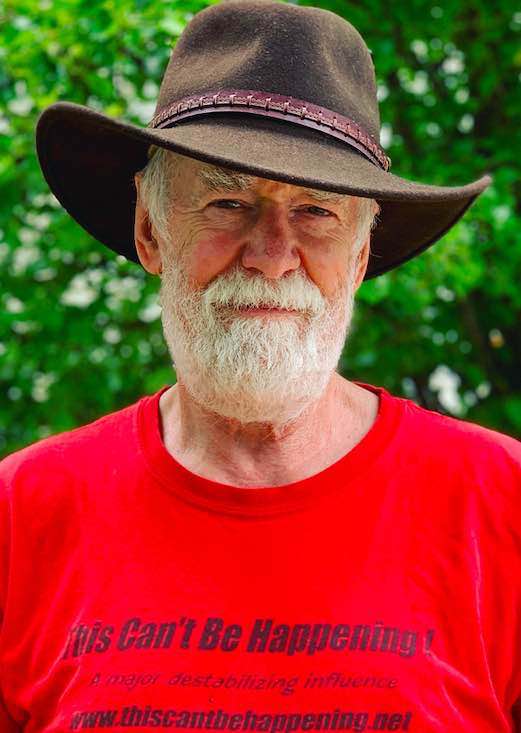

By Dave Lindorff

Wait a minute! Did I hear correctly? Did Treasury Secretary and former New York Federal Reserve Bank screw-up Tim Geithner really tell a House Financial Services Committee today that he needed “new powers” to allow the federal government to take control of non-bank financial corporations whose actions threaten the financial system or the economy and “break them up”?

The subject under discussion at the hearing was AIG, and Geithner and Fed Chairman Ben Bernanke, under attack for those AIG “bonus payments” to executives, were trying to talk tough about the evil insurance giant.

But aren’t the powers that Geithner is calling for exactly the powers that he and Bernanke already have in the case of the banking industry?

Yes they are.

So why aren’t we seeing the Obama administration and the Fed going after the banking giants that have been co-conspirators with AIG in wreaking havoc with the US and the global economy by creating dodgy structured financial instruments that allowed banks and other financial companies to make huge off-balance-sheet bets that virtually guaranteed a future collapse?

Good question, but not one that the House Finance Committee was asking.

Instead of doing the obvious—which would be to use the Fed’s and the Federal Deposit Insurance Corporation’s powers to take over failed banking institutions, break them up, and sell the healthy parts off to stronger institutions—Geithner, Bernanke and the Obama financial team have been pouring dollars into a group of zombie banks that are already technically insolvent by any honest accounting standards, and that have no chance of standing on their own. They are borrowing money at such a prodigious rate that the Chinese government, America’s major creditor, and the United Nations, are talking about the need to do away with the dollar as the global currency, to be replaced by some basket of currencies, and in the process virtually assuring that the US currency will shrink dramatically in value, They are putting a colossal debt upon future generations of Americans. And they are putting at risk all the progressive goals that voters sent Obama to Washington expecting him to enact: health care reform, energy reform, education reform, etc.

If Geithner and Bernanke think it is important, and appropriate, to break up dangerously large and threatening enterprises like AIG, why are they not even talking about breaking up Citigroup, Bank of America, Wells Fargo, Goldman Sachs and other overlarge large banking firms?

Too big to fail should simply mean too big to exist. It’s that simple.

Not one more dollar should be spent trying to rescue these zombie banks. In fact, they should be ordered to give back the hundreds of billions of dollars that were already poured into them, most of which they have reportedly simply invested in Treasury notes, since there was nobody creditworthy who wanted to borrow the money. Then the regulators should move in and shut all the big banks down, and begin the process of tearing them apart. Those parts that are deemed hopelessly in debt because of huge holdings of Credit Default Swaps and other toxic financial products should be shut down, with shareholders and bondholders taking the hit. The healthy parts—the banks with all the deposits—can be auctioned off in pieces to smaller state and regional banks.

Never again should there be federal banks whose branches and brokerage and insurance subsidiaries span the nation and the globe.

There is no need for such entities. For one thing, they are too powerful politically, with operations in every congressional district, much like the Pentagon and the arms industry, and we’ve seen where that gets us. For another, particularly when it comes to insurance, the regulators are state based, making national companies largely out of reach. Finally, national banks have little or no interest in small businesses and their credit needs.

If large global firms need bank loans, let the banks organize syndications to accommodate them. That has always worked in the past, and in fact, is still done for big global firms.

Geithner should be forced to explain why he needs new powers to break up non-bank financial companies, if he is unwilling to use the powers he already has to break up too-large banks.

Then he should be fired and someone should be brought in to replace him who will demand the breakup of those banks.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).