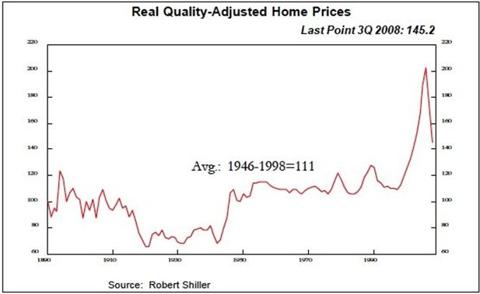

I’ve scrutinized the four most well known bubbles in history. They all deflated completely. There are hundreds of other bubble examples throughout history and none of them deflated halfway. This brings us to the housing market today. The following chart from Gary Shilling’s newsletter clearly shows that home prices went into a classic bubble frenzy after Alan Greenspan reduced interest rates to 1% and urged Americans to take out adjustable rate mortgages. Americans believed the hype from the National Association of Realtors and Wall Street shills that home prices would go up forever. You may notice that home prices will need to fall another 21% to reach pre-bubble levels. Jim “I haven’t gotten one right yet” Cramer is calling for a June 2009 bottom in housing. It looks like he won’t break his streak of great predictions. I’m sure Jon Stewart will remind him.

-- Henry David ThoreauOur houses are such unwieldy property that we are often imprisoned rather than housed by them.

There are 75 million houses in America. Twenty four million don’t have a mortgage. Of those 51 million homeowners with a mortgage, approximately 15 million are underwater. According to Mr. Shilling, with the further decline in prices a given, 25 million homeowners will be underwater to the tune of $1 trillion. Anyone predicting a recovery by the end of 2009 is delusional.

Most of the luxuries and many of the so-called comforts of life are not only not indispensable, but positive hindrances to the elevation of mankind.

--Henry David Thoreau

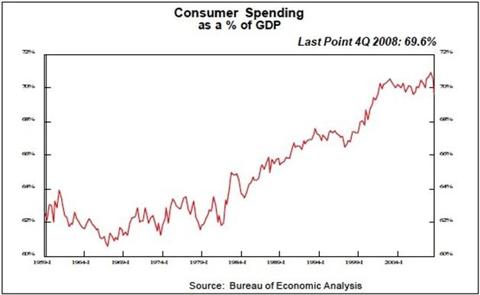

The next bubble just peaked in 2008, so it has a long way to go on the downside. Consumer spending as a percent of GDP peaked at 71% in the 2nd quarter of 2008. Americans allowed their savings rate to drop below 0% and counted on their home appreciation to fund their retirements. They believed the Wall Street hype about 10% long term stock returns. This overconfidence led millions of Americans to borrow and spend at excessive levels. In order to get back to pre-bubble levels of 62% of GDP will take years. With home prices down 25% and retirement funds down 50%, only an insane person would continue to spend at previous levels. Ben Bernanke and the Obama administration are praying that Americans will continue the insanity. They will not. Consumer spending will decline by $1.3 trillion annually for years to come. This bubble will not burst halfway.

-- Henry David ThoreauMost men lead lives of quiet desperation and go to the grave with the song still in them.

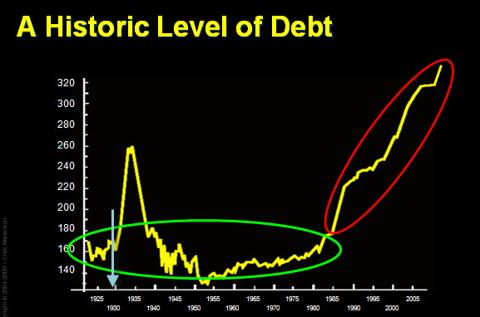

The last and most dramatic bubble is total U.S. debt. There is no doubt that it is unsustainable. It currently amounts to 340% of GDP. It would need to go back to 200% of GDP or below to retrace its bubble path. This would require $20 trillion of debt to be paid off or written off. The implications of this are staggering. The Federal Reserve and politicians running the country will fight the deflation of this bubble with all of their might. It won’t work. Bubbles always burst. This bubble bursting will change America forever. The American standard of living will decline significantly. Not many people are prepared for this wrenching future. The mantle of ruling the world will be passed to some other lucky country. The government is trying to keep all three bubbles from popping. Their solutions are dangerous and could result in a collapse of our economic system.

Source: Chris Martenson

If the machine of government is of such a nature that it requires you to be the agent of injustice to another, then, I say, break the law.

--Henry David Thoreau

Civil DisobedienceThere's nothing that I detest more than the stench of lies.

--Colonel Kilgore – Apocalypse Now

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).