6. GM, Ford, and Chrysler offered 0% financing on their cars through their finance arms, while also encouraging low rate leases. Credit card companies sent out 5.3 billion offers in 2007. In 1968, when the credit card was a new concept, total credit debt was $8 billion. Now the total exceeds $880 billion, according to the Federal Reserve.

7. Wall Street created new investment vehicles that allowed mortgages to be packaged and sold to investors throughout the world with investment grade ratings provided by Moody’s and S&P, for a price.

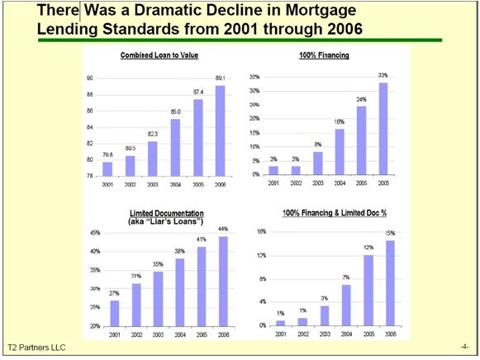

8. Mortgage companies and lenders developed ARMs, Option ARMs, teaser rate loans, no-doc loans, negative amortization loans and 100% financing loans.

9. Low income people started buying homes, with these exotic mortgage products, from middle income people. Middle income people started to buy larger houses from rich people, boosting demand for new homes. Rich people bought mansions and second homes. Bidding wars for houses were common.

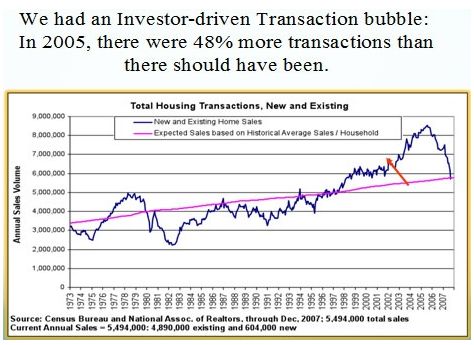

10. The demand caused by this influx of new home buyers drove prices skyward, with home prices doubling in five years. This price rise brought in the speculators/flippers, who began to buy multiple houses with nothing down, pre-construction, with plans to sell them for a profit without ever moving into them.

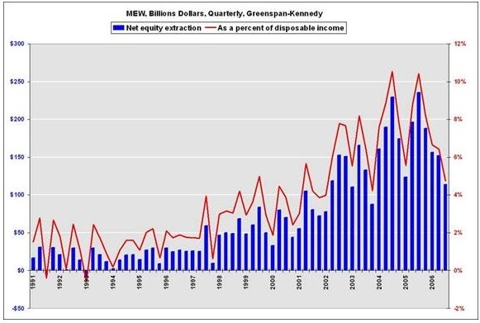

11. Average Americans who saw their paper wealth growing rapidly, as their home value increased, took advantage of this by refinancing their mortgages and extracting the equity from their homes and spending it. The chart below shows that in 2004 and 2005, Americans sucked $800 billion from their homes in each year.

Source: Calculated Risk.com

12. Homebuilders throughout the U.S., but particularly in California, Arizona, Florida, and Nevada, went on the biggest building binge in the history of the U.S. These builders either believed their own bull about demographics, or just decided to ride the wave as far as it would take them. This binge led to 8.5 million total home sales in 2005, about 3.5 million more than what would have been expected based on historical rates.

13. The massive number of excess home sales and equity withdrawal led to huge demand for home furnishings, remodeling services, appliances, electronic gadgets, BMWs, and exotic vacations. This led to massive expansion by retail and restaurant chains based on extrapolation of this demand.

14. Retailers, homebuilders, restaurants, and car makers extrapolated the false demand far into the future. There are now over 7,000 Wal-Marts, 6,000 CVSs, and 30,000 McDonalds. Any company that built their business on false assumptions and excess debt will be meeting their maker, shortly.

15. Because the originators of virtually all loans to consumers were immediately selling the loans off, they had no incentive to follow any guidelines or due diligence when issuing the loans. Anyone with a pulse could get a mortgage, car loan, or credit card. Unscrupulous mortgage brokers popped up everywhere, luring uneducated and willing people to join the party. Greedy appraisers went along with the scam by overvaluing houses to whatever the banks desired.

16. The debt induced spending that occurred from 2001 until 2007 accounted for virtually all the GDP growth over this time. Without the mortgage equity withdrawal, the U.S. would have had less than 1% average GDP growth for the entire period.

Next Page 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).