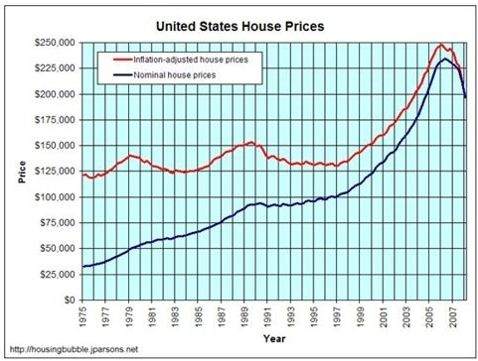

The Democrats, and even some Republicans, seem to think that we need to stabilize home prices. That is a ridiculous idea. Home prices need to fall to their natural level of affordability. If the government attempts to artificially prop up home prices, the market will not recover for a decade. If we let supply, demand, and price work its magic, the housing market will be stabilized by 2011. The top 10 cities in the U.S. are expected to see significant declines in 2009. These price decreases will ultimately lead to higher sales. Artificially keeping prices higher through government intervention will deny affordable housing to future buyers.

Based on the chart below, prices have a long way to go before reaching an equilibrium level.

Foreclosures are currently running at an annual rate of close to 2 million. There are approximately 2.3 million vacant houses in the United States. Close to 15% of all homes (approximately 11 million homes) in the U.S. have a mortgage balance that is higher than their value. There are thousands of adjustable rate mortgages that will reset in 2009. The lowlife politicians who make it sound like a foreclosure is the end of the world are wrong. If you cannot afford your mortgage payment, you should not own a home. My solution for someone who is losing their home to foreclosure is: RENT! There are 4 million vacant rental units in the U.S. Rent for a few years, save your money until you have a 20% down payment and then buy a home you can afford this time.

Bailout SolutionsBailing out banks, insurance companies, and now car companies is a bastardization of our capitalist system. The $850 billion bank bailout was supposed to bring confidence back to our financial system and allow banks to lend. The markets were so confident with the actions of our “leaders” that it has declined 17% since President Bush showed so much courage by signing a bill. We are now propping up banks that should have gone bankrupt. It is good to see we’ve learned the lessons of Japan’s miss steps, and have made the identical mistakes they made in the 1990s. Zombie banks that will not lend are the result of government intervention with the natural process of capitalism. The supposed excuse for “saving” Bear Stearns and AIG was the systematic risk. These lowlife shallow bureaucrats don’t even bother with this fake argument anymore. What systematic risk is posed by letting General Motors, Ford, or Capital One go bankrupt? Bankruptcy is an essential part of capitalism. These companies would not liquidate, they would downsize and restructure. Stockholders would be wiped out, bondholders would lose money, workers would be fired, inefficient plants would be closed, union contracts would be renegotiated and leaner more competitive companies would resurface.

Instead, Congress will pour billions of our grandchildren’s tax money into these bloated companies, while retaining their short-sighted, worthless management. This is the same management that staked their companies on trucks and SUVs. There are 251 million passenger vehicles in the U.S., an average of 2.4 vehicles per household in the U.S. GM and Ford have been horribly run for decades. How could people who reached the top management of these companies extrapolate the 17 million annual sales pace of 2005? Don’t they get paid millions to think strategically? Sales trends are currently 11 million. Both GM & Ford are burning through billions of cash per month. GM will run out of cash in 2 months. The message we send to banks and all large companies when taxpayers bail them out is that bad decisions, excessive risk taking and poor planning has no consequences. The Democratic Congressional leaders will say that we need to save these “essential” companies. The truth is that they will bail out these companies as a payoff for Union votes during the election. As millions of average Americans lose their jobs and see Corporations and CEOs bailed out, they are angrier thanthey have been since the 1970’s. People in this country are feeling a mixture of hopelessness, fear, anger and denial.

Congressional SolutionMr. Obama should tell the big mouths in Congress to shut up. Nancy Pelosi, Barney Frank and Harry Reid should not and cannot set the agenda for his Presidency. Congress has earned its 17% approval rating. I’d like to meet someone from the 17% to see if they are mentally defective. During the two months before taking the reins of government, I would suggest that Mr. Obama read the writings of some of our Founding Fathers to gain some wisdom. I recommend Thomas Paine and Thomas Jefferson.

Government, even in its best state, is but a necessary evil; in its worst state, an intolerable one. (Thomas Paine)

I predict future happiness for Americans if they can prevent the government from wasting the labors of the people under the pretense of taking care of them. (Thomas Jefferson)

He who is the author of a war lets loose the whole contagion of hell and opens a vein that bleeds a nation to death. (Thomas Paine)

Mr. Obama needs to think long-term and ignore short-term popular decision making. He needs to scrap what isn’t working. The American people do not need to be taken care of. We spend $56 billion annually on a Department of Education that has led us to the 25th position in the world in scores for math and science. If a Department fails, it should be scrapped. We spend $25 billion annually on the Department of Energy with the result being no strategic plan for our energy future. We spend $67 billion annually on the Department of Transportation resulting in 156,000 structurally deficient bridges. These expenditures appear to be just pouring money down a rat hole. More government bureaucracy will not solve our long-term issues. Outside the box thinking is required.

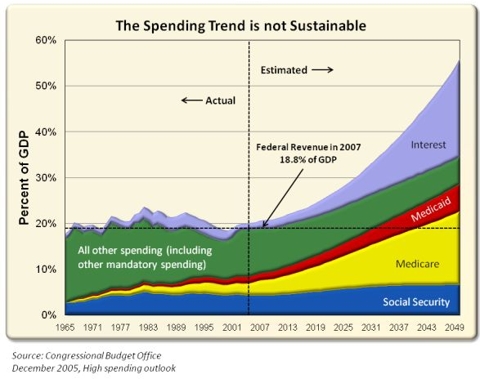

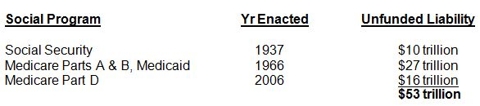

Expanding government is not possible. We have a $10.6 trillion debt, with $53 trillion of unfunded liabilities looming in the near future. We cannot grow our way out of these problems. We must cut spending, cut benefits and generate more revenue. It is disingenuous to blame FDR for all of our unfunded liability problems. George W. Bush, Mr. Fiscal responsibility himself, signed an expansion of the Medicare program in 2006 that has committed far more money than FDR did with Social Security in 1937. Both parties are great at spending our money without making the hard choices of cutting something or increasing taxes. Increasing spending without a plan to pay for it is a tax on future generations, and is immoral.

Winding down our two wars would save the country $150 billion per year. Billions would be saved by withdrawing the 57,000 military personnel in Germany, 33,000 in Japan and thousands more in another 115 countries throughout the world. Our vast overseas military empire cannot be supported if we want to pay for our domestic obligations.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).