"The government should not be on the hook for the bets of an investment bank which is impossible when you allow a deposit and investment bank to merge."

The re-instatement of Glass_Steagall, which prevents bankers from going to Vegas with grandma's money, is consistently on lists of reforms being being debated by OWS. . (Also please see "Demand to Get the Money Out of Politics: A "One Demand" for Occupy Wall Street?," Truthout)

Glass-Steagall began to be dismantled under Ronald Reagan, with Bill Clinton finishing the job for Wall Street in 1999. When Bill Clinton signed the law, Progressive Historian notes:

"it symbolized the ending of the twentieth century Democratic Party that had created the New Deal. Although the 1999 law did not repeal all of the banking Act of 1933, retaining the FDIC, it did once again allow banks to enter the securities business...

The repeal of one of the most important pieces of legislation in this nation's history came about as a result of another Clinton "triangulation,"..."

The transaction is against the Federal Reserve's own regulations, but as Avery Goodman points out, Congress has given ultimate power to the Federal Reserve to ignore its own enabling Act legislation. The pertinent passage of the enabling legislation reads:

"The Board may, at its discretion, by regulation or order exempt transactions or relationships from the requirements of this section if it finds such exemptions to be in the public interest"

Dave Johnson writing for Truthout.org summarizes the absurdity well:

"This situation of crony government protecting the connected rich while people are in the streets demanding change is more and more reminiscent of Egypt under Mubarak.... Currently in Washington Congress' elite "super committee" represents the 1%, looking at ways to take more money out of the economy, discussing cutting Social Security at a time when many people have lost their pensions and savings. They are discussing cutting Medicare and other health services at a time when more and more people are in need. They are discussing cuts and cuts and cuts, when working people are falling behind and behind and behind.

But the actual causes of the deficits that have Congress so concerned are ignored. Reagan and the Bushes cut taxes on the rich and increased military spending, and the deficits and resulting debt soared. It is right there in front of our faces. But even with such "concern" about deficits the tax cuts for the rich continue and the huge increases in military spending are left alone. Instead Congress discusses austerity - making the 99% pay for the benefits and bailouts for the 1%."

Now why are those protesters out there again? Simple. The ones whose interviews the MSM does not air read the financial pages. At the same time many politicians, including Obama, give plenty of lip service about busting up banks which are "too big to fail." But unless someone does something soon, BoA is a done deal. As always, never listen to what politicians say. Watch what they do. A couple of currency devaluations, and we're in Greece.

It is something when financial geeks in conservative business pages are calling for the government to seize Bank of America now, before it brings just America down with it. That's when you know we are all in this together.

Congress contact page (including the "super committee")

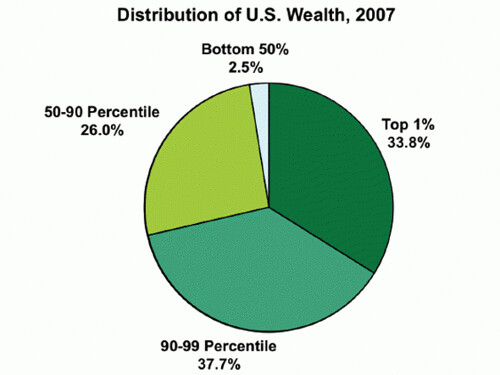

Distribution of wealth in America: one percent own one-third of all assets:

Chart from "21 Mind-Blowing Facts About Inequality in America"

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).