David Walker, the former head of the GAO from 1998 until 2008, compared the U.S. Empire to the Roman Empire in August 2007. He has been warning the country about our unsustainable fiscal path for over a decade.

- Since August 2007 the National Debt has increased from $8.9 trillion to $14.6 trillion, a 64% increase in four years.

- We've increased our cumulative expenditure on our wars of choice in the Middle East to $1.3 trillion since 2001.

- Our annual military spending rose from $653 billion in 2007 to the current $966 billion, a 48% increase in four years.

- Federal government transfers for Social Security, Medicare, Medicaid, Unemployment, Veterans, Food Stamps, and Welfare increased from $1.7 trillion in 2007 to the current level of $2.3 trillion, a 35% increase in four years.

It goes without saying that Mr. Walker's advice was not heeded. And regarding declining moral values and political civility, I would point you to the fine examples of morality displayed by Wall Street since 2007 along with the display of civility seen in Washington DC over the last few weeks. The striking similarities that David Walker acknowledged are in full bloom for the world to see.

English historian Edward Gibbon wrote his masterpiece The Decline and Fall of the Roman Empire in 1776, ironically in the year the American Empire was born. He detailed the societal collapse encompassing both the gradual disintegration of the political, economic, military, and other social institutions of Rome and the barbarian invasions that were its final doom in Western Europe. Gibbon concluded there were five marks of the Roman decaying culture:

- Concern with displaying affluence instead of building wealth.

- Obsession with sex and perversions of sex.

- Art becomes freakish and sensationalistic instead of creative and original.

- Widening disparity between very rich and very poor.

- Increased demand to live off the state

Gibbon's analysis captured the essence of what happens to all empires. It subsequently happened to the Dutch, Spanish and British empires and has been eating away at the greatest empire of all over the last several decades. Larry Elliot, writer for the UK Guardian, recently described the rot that has destroyed every empire in history:

"The experience of both Rome and Britain suggests that it is hard to stop the rot once it has set in, so here are the a few of the warning signs of trouble ahead: military overstretch, a widening gulf between rich and poor, a hollowed-out economy, citizens using debt to live beyond their means, and once-effective policies no longer working. The high levels of violent crime, epidemic of obesity, addiction to pornography and excessive use of energy may be telling us something: the US is in an advanced state of cultural decadence.

Empires decline for many different reasons but certain factors recur. There is an initial reluctance to admit that there is much to fret about, and there is the arrival of a challenger (or several challengers) to the settled international order. In Spain's case, the rival was Britain. In Britain's case, it was America. In America's case, the threat comes from China."

For the last forty years America has shifted from a society that created goods into a society that created debt. Displays of affluence like McMansions, Mercedes, BMWs, Rolexes, summer mansions in the Hamptons, designer clothes, granite and stainless steel kitchens, and 85 inch HDTVs, all purchased with debt provided like candy by the Wall Street banks and their sugar daddy -- the Federal Reserve, have trumped true wealth building. The result is a nation with $52.6 trillion of debt outstanding, or 350% of GDP. The basic rule for maintaining a healthy economic system requires the population to spend less than they earn and save the difference. The savings can then be invested in domestic companies, plants and equipment which keep the country growing. Americans bought into the lie that purchasing cheap foreign goods with cheap credit was as valid as actually building wealth. The national savings rate, which exceeded 10% in the 1970s and early 1980s, dropped to less than 1% by 2005. Why save when you could whip out one of your 13 credit cards.

America's obsession with sex and perversion of sex makes Caligula look like a Boy Scout. There are 4.2 million pornographic websites serving 72 million visitors per month and generating $5 billion of revenue for these fine capitalists. More than 40% of internet users view porn. What passes for art today is a crucifix in the artist's urine. The true art of the American empire consists of reality TV shows like Jersey Shore and Housewives of NY, OC, NJ, Miami, and Atlanta. America has taken shallow, mindless, and superficial to an empire crushing low.

The disparity in wealth between the super rich and the working class has never been greater. The working middle class that built this country has been systematically destroyed as the super rich have used inflation and debt to lure them into servitude, while the unproductive parasites have learned it is easier to feed off their middle class host than work for a living. It is clear to anyone, except a Republican ideologue, that when the top 10% richest Americans abscond with 50% of the income in the nation through their control of politicians, Wall Street and the few mega-corporations that set the economic agenda, a convulsive change is necessary. It is not a coincidence the heyday of the American Empire was from 1946 until 1971 when the working middle class was able to advance their station in life through education, hard work and a level playing field.

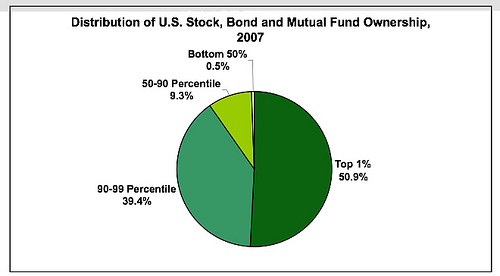

The playing field got tilted against the working middle class in the late 1960 --s with LBJ's Great Society welfare state and got turned upside down in 1971 when Nixon closed the gold window and allowed bankers and politicians unfettered access to money printing with no immediate consequences. The result has been a slow steady descent into hell as politicians have made $100 trillion of unfunded promises of bread to the masses and bankers have gorged themselves with riches from peddling debt to the same masses, so they could enjoy the circuses. We are now left with the top 1% hoarding 33.8% of the wealth and the top 10% clinging to 71.5% of the wealth in the country. The bottom feeders are thrown scraps of bread in the form of food stamps, welfare, disability payments, and unemployment compensation. They have grown dependent and no longer participate in productive society. With more than 50% of adults paying no income tax, they vote for politicians that promise to not "cut" their social benefits.

When you see your leaders take actions that clearly are not in the long term best interests of the American people, you need to ask why. Since September 2008 your leaders have funneled trillions of dollars to the Wall Street bankers that nearly destroyed the worldwide economic system. They have funneled billions into the coffers of the mega-corporations that outsourced your jobs to Asia. They ramped up their wars in the Middle East to reward their friends in the military industrial complex. And lastly, they handed out a few hundred billion more to the masses to keep them from rioting in the streets.

We know for a fact QE2 was designed to prop up the stock market because Ben Bernanke told us so. And it worked. From the day he announced he was going to do it at the annual meeting of the ruling moneyed classes at Jackson Hole until it ended on July 1, 2011, the market went up 30%. The average American dealt with the 30% to 50% increases in food and energy costs, while the richest 1% partied like it was 1999. Considering they own 50.9% of all the stocks in the country, the last couple years of free money and stock appreciation created by the Federal Reserve have been a windfall for the privileged moneyed class. The bottom 50% who own 0.5% of the stocks in the country haven't fared so well.

(Note: You can view every article as one long page if you sign up as an Advocate Member, or higher).